How to Retire with Confidence and Peace of Mind

This post was last updated on January 19, 2026, to reflect all updated information and best serve your needs.

You may have spent your whole life working towards retirement. However, as you get closer to retirement, there are so many feelings and doubts that can creep in and cause you stress. There’s no need to worry – as long as you have a plan.

As long as you’ve been smart with your money and saved up a reasonable amount for retirement, you should be just fine. NextGen Wealth specializes in the transition into retirement for this very reason. Here are the main things we see to help you retire with confidence and peace of mind.

Table of Contents

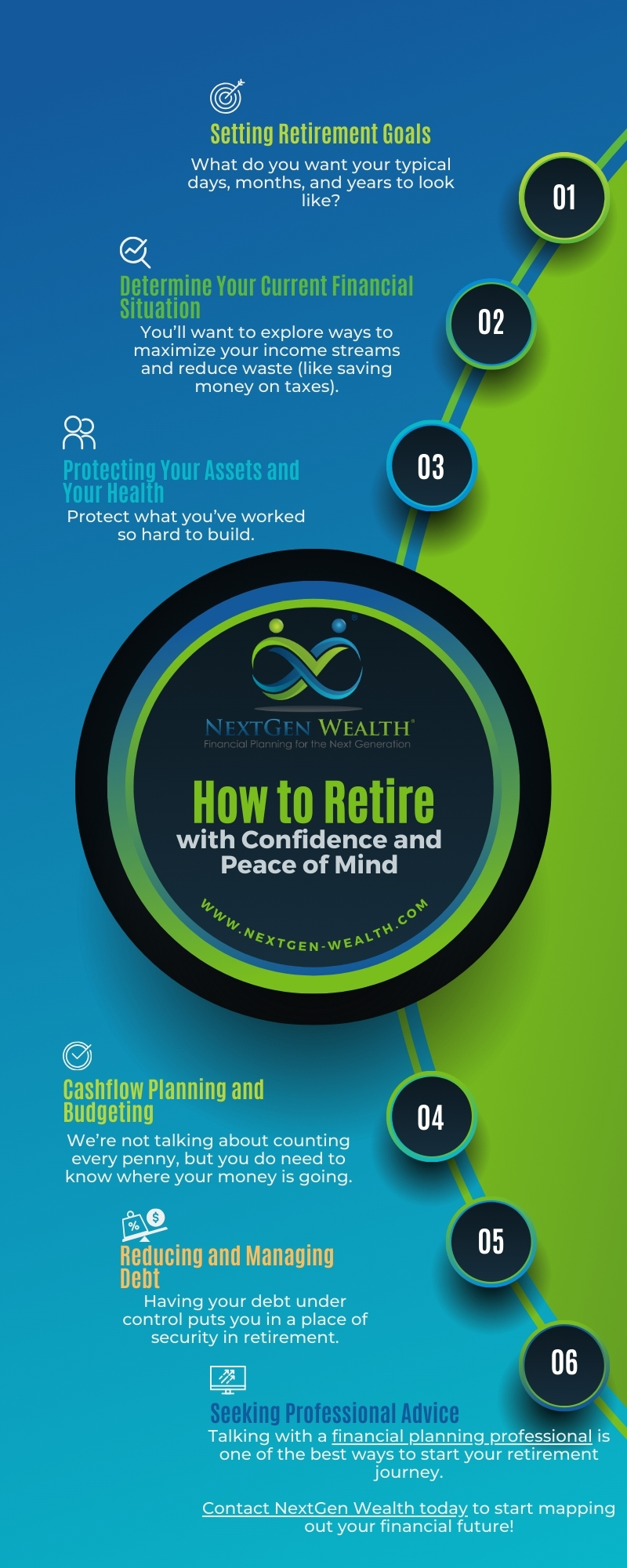

Uncovering and Setting Retirement Goals

As with any long-term commitment, you’ll need to consider what you want life to look like. This is a major piece of our COLLAB Financial Planning Process™, which we walk clients through. Everything in your plan must support your deepest desires and diminish your biggest fears.

Choose Your Own Adventure

What do you want your typical days, months, and years to look like? Do you want a quiet retirement in a small house surrounded by friends and family? Do you want to spend your golden years traveling the world?

Whether you see yourself behind the wheel of an RV as you drive from state to state or don’t really want to retire at all, you can make a plan to make your dreams a reality. These are important questions you’ll need to consider as you begin your journey into retirement.

Once you figure out what you want in life, we can start working out the financial details.

Determine Your Current Financial Situation

Like building a house, you must know which resources (income streams) are available to make it happen. Furthermore, you want to make sure you’re not wasting anything either. Ever heard the phrase “measure twice, cut once”?

Planning for retirement is no different. You’ll want to explore ways to maximize your income streams and reduce waste (like saving money on taxes). You’ll want to optimize your benefits, like your pension and Social Security income.

This is why having a second set of eyes is so important. NextGen Wealth offers a no-obligation financial assessment for this very reason.

Understand Social Security

There are two mistakes people often make when it comes to Social Security: forgetting to account for it or assuming it will cover more than it does. Social Security won’t come close to matching your income during your working years. However, it can make a significant difference.

You also need to be aware of how Social Security is taxed. This can make a significant difference in how you make other plans. Developing the right Social Security withdrawal strategy takes time and in-depth analysis.

At the end of the day, it’s impossible to know the exact answer, but we can make a great choice based on the most likely scenarios. Then we can plan for problems that could derail your plans.

Protecting Your Assets and Your Health

One of the most important things you’ll need to do is protect what you’ve worked so hard to build. This may be diversifying your portfolio or determining your insurance needs. You may also need to review important estate planning techniques and ways to avoid probate.

Once you reach retirement, your need for life insurance may be lower. You may also need to check whether your current insurance coverage is enough. It’s also possible you’re carrying some unnecessary insurance as well.

As you enter retirement, you’ll want to strike a balance between preserving assets and keeping up with inflation. You don’t want to become too safe, but you don’t want to risk your well-being either.

Protecting Your Health

You’ll also need to make important decisions about Medicare and other health insurance. Maintaining access to quality healthcare is essential to a happy and healthy retirement. All the money in the world is useless if you’re not healthy enough to enjoy it.

Maintaining an active lifestyle and making healthy choices can go a long way. As they say, an ounce of prevention is worth a pound of cure.

Cashflow Planning and Budgeting

If you’ve been paying attention to your money, you may not need to budget in the typical sense. You probably know how much you spend and whether you have extra money at the end of the month. We’re not talking about counting every penny, but you do need to know where your money is going.

Consider Priorities and Goals

As we mentioned earlier, your goals and vision for the future drive your spending. It's okay to spend money. It's important to remember your retirement funds are meant to be spent, just not all at once.

We help our clients build a cash flow plan and take a reasonable amount of income from their portfolio. We help develop an investment policy statement and specific parameters around spending. This gives you the freedom to spend on things you want without worrying about running out of money.

Having a budget or cash flow plan doesn’t mean you can’t enjoy life. Quite the opposite. A proper spending plan will support your goals – not hinder them.

Track Spending with Technology

If you haven’t explored the world of budget apps and programs, then you might want to check some out. There are hundreds of websites, programs, and apps you can use. Many banks now offer a spending tracker in their own apps.

Technology can help you stay on track and spend less time worrying.

Reducing and Managing Debt

Having your debt under control puts you in a place of security in retirement. You don’t want debt payments cramping your style. It’s unnecessary to be completely debt-free, but you definitely don’t want to carry any high-interest debt either.

If you’re unable to pay off your credit cards every month, you might need to make some changes. High-interest debt, like credit cards or store charge cards, eats away at your ability to build and maintain wealth.

On the other hand, a low-interest mortgage isn't something to stress over. In most cases, keeping your money invested is the financially optimal choice.

Consolidate Bills to Lower Payments

If you're dealing with a lot of high-interest bills with monthly minimum payments, you can consolidate these bills. You may be able to get a personal loan or some other low-interest loan.

This only works if you stop accumulating debt. Otherwise, this can just make the problem bigger. Reducing high-interest debt is one of the most important steps you can take to retire with confidence and peace of mind.

Adjust as Needed

Your financial plan is a living document. It’s going to need updates and adjustments as things change. Tax laws seem to change every year, and things get confusing.

One of the hallmarks of a solid financial plan is its ability to adapt to the times. Regardless of how circumstances are now, things will change in the future. This is why we call it a planning process, not just a one-time plan.

Seeking Professional Advice

There’s no need to try sorting through all this alone. Talking with a financial planning professional is one of the best ways to start your retirement journey. Retiring with confidence and peace of mind doesn’t have to be hard. Contact NextGen Wealth today to start mapping out your financial future!