How Inflation Affects Planning Your Retirement

Inflation can really eat into your retirement if you’re not careful. However, with proactive planning, you can effectively combat inflation. You don’t have to let inflation slowly erode your lifestyle over time.

To be clear, there’s little we can do to eliminate inflation completely. However, you can avoid losing purchasing power over time. A properly constructed portfolio can withstand the damage of inflation.

What is Inflation Anyway?

The term inflation itself is broad and can be measured in many ways. Inflation is an increase in prices which causes purchasing power to decrease. However, when the headlines talk about inflation, they’re usually referring to the indices the government uses.

The Consumer Price Index (CPI), more specifically, the CPI for All Urban Consumers (CPI-U) is the most common measure of inflation. The CPI-U is the average cost of products such as food, electricity, gas, vehicles, and more which are tracked over time.

Long story short, more inflation (price of things you buy) equals less ability to purchase goods and services. When you are on a fixed budget or retired, this can be a real problem.

Worried if you're going to have enough income to retire? Learn more here.

Inflation Causes Issues

If inflation rises too much, then it can really eat into your nest egg (and your plans)! We can all agree a dollar just doesn’t go as far as it used to. No matter how bad it gets, there’s no scenario where you can’t adjust to get back on track.

Worst Case Scenario [So Far]

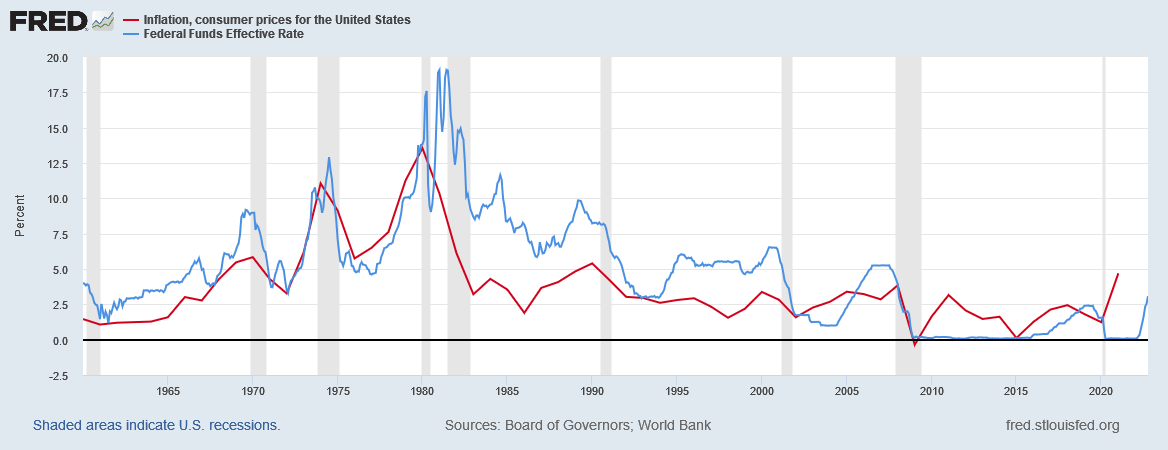

If we look at the worst-case scenario, at least since 1960, we’ll see the highest levels of inflation occurred between 1973 and 1982. The average inflation rate during that period ranged from 5.7% to 13.5% and averaged 8.75%. Since 1983, the average inflation has been 2.7%. With all of that said, we use 3.7% as our baseline assumption for inflation, the average inflation rate since 1960.

How to Plan for Inflation

Even if inflation is at all-time highs, there’s no need to panic. You can make some changes to help alleviate your concerns about inflation. Why don’t we walk through a scenario?

Scenario

Our pal Max Benny and his wife, Minny, are very concerned about inflation. The current inflation rate is 9.1% and they’re afraid they’ll run out of money in retirement. Let’s look at how bad it really is.

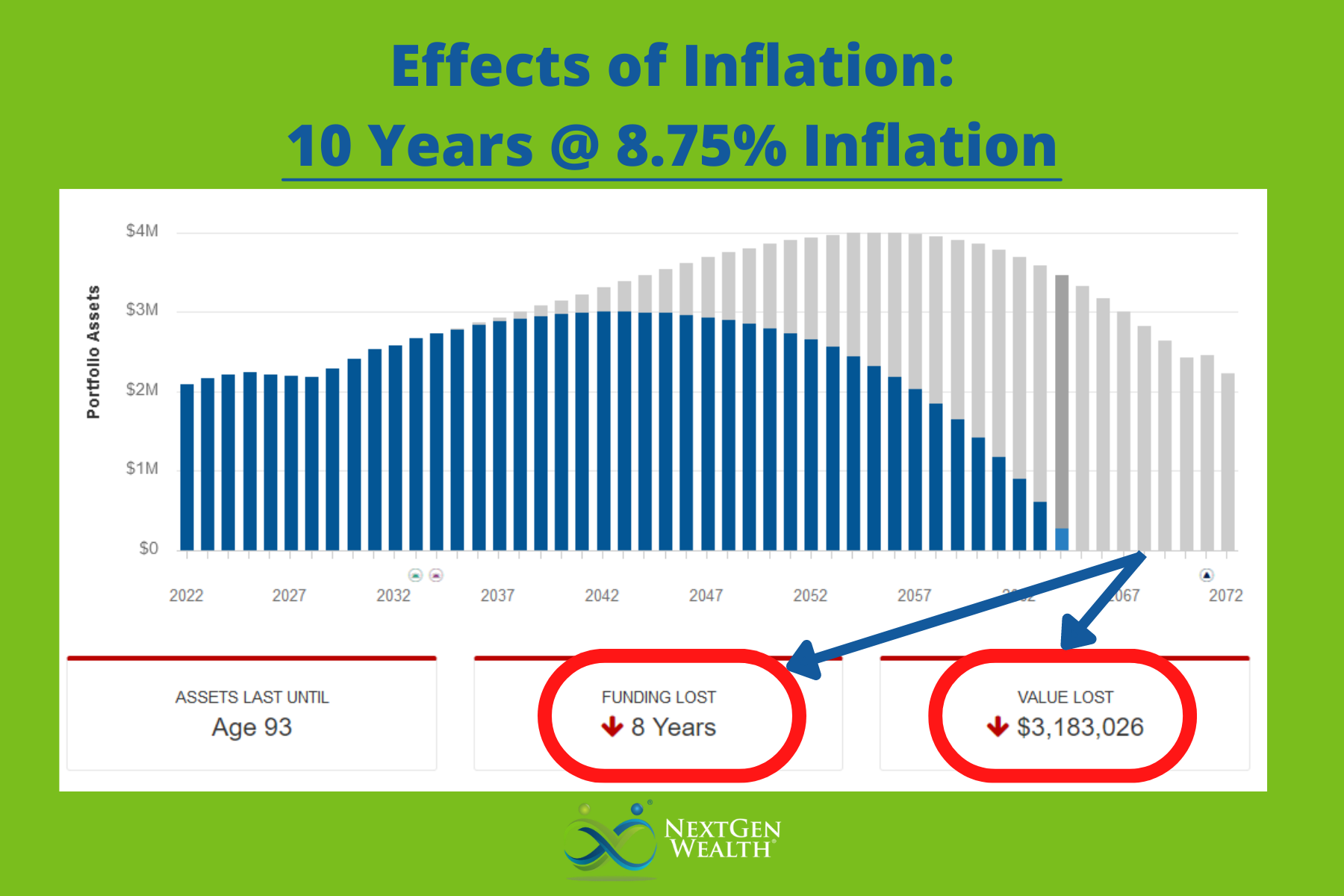

First, we’ll look at Max and Minny’s retirement projection to see what things look like with inflation at 8.75% for the next 10 years (the longest surge for inflation we’ve seen). It does look pretty rough at first!

We’re assuming Max and Minny (unknowingly) retired at the very beginning of the worst period of inflation in the last 80 years. His projected total lifetime portfolio value hypothetically drops by $3,183,026 - yikes! What options do they have?

Do Nothing

Keep in mind, that’s a hypothetical loss over Max and Minny’s entire retirement until they’re 100 years of age. They would not run out of money until they were roughly 93. Running out of money might seem okay since they’ll still have Social Security and likely won’t be spending much money past 93 years of age, but, let’s face it, nobody wants to see themselves running out of money.

Max and Minny could do nothing, move on as usual, or wait to adjust later if needed. However, we talked with Benny and Minny. They’re not okay with running out of money – ever…and I’m guessing most of you aren’t either!

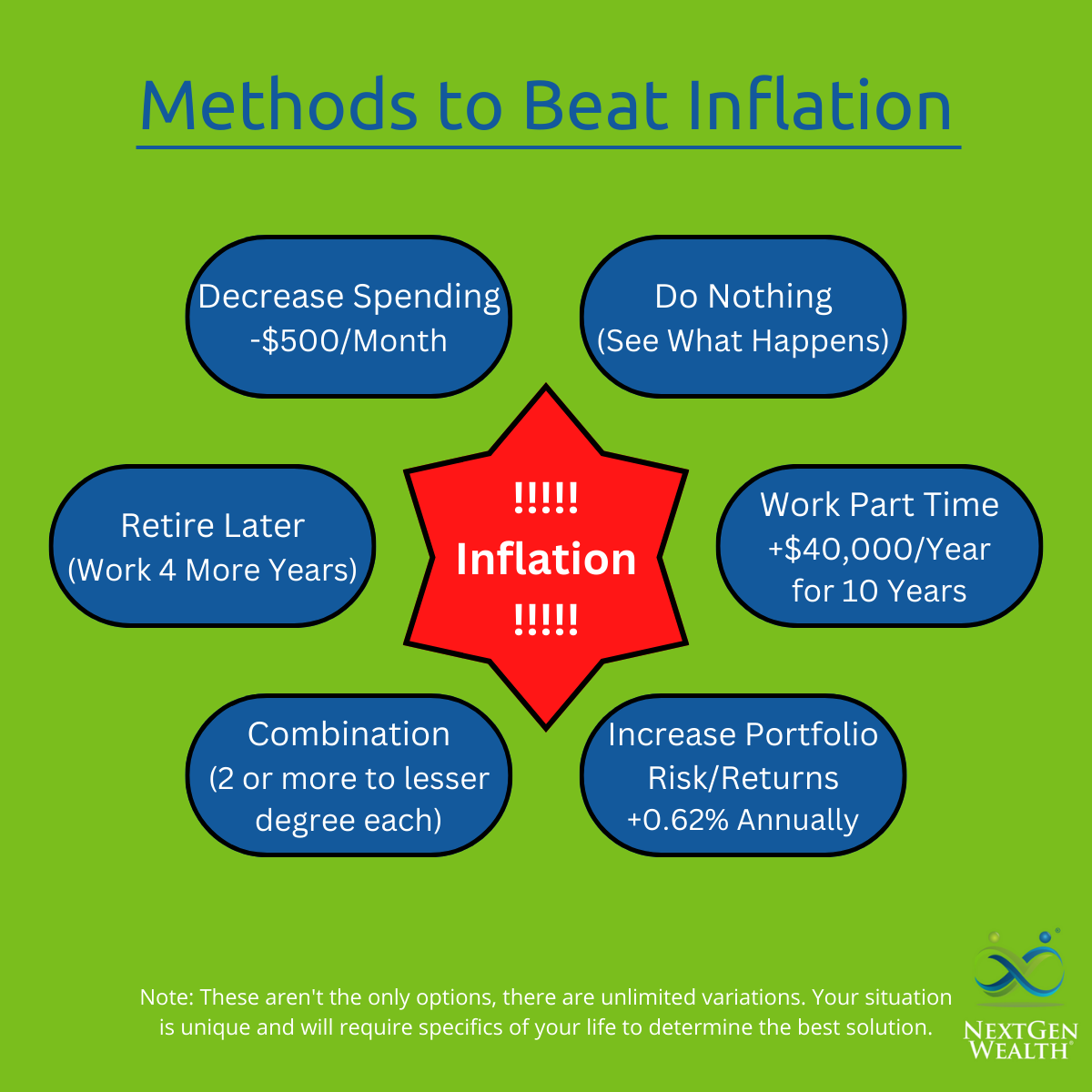

Decreasing Spending

Max’s initial thoughts are cancelling vacations, selling the Corvette, and skipping extra gifts for grandkids this Christmas. However, these one-time purchases will not make as big of a difference as Max thinks.

To gain all the portfolio value back, the Benny’s are required to cut spending in retirement by $500/month or $6,000 per year. However, taking a $500/month pay cut isn’t that fun either, but they could certainly manage it.

Higher Returns

Another method for overcoming inflation is to change the portfolio allocation to help overcome inflation. Adding more “risk” when things are “bad” already might seem counterintuitive, but it’s not as scary as it sounds. A few tweaks to the portfolio allocation can go a long way.

It only takes an additional 0.62 % return over the Benny’s retirement to completely recover what was “lost” to inflation. This can be as simple as moving from what we’d characterize as an “income” portfolio to an “enhanced income” portfolio.

In fact, investing in the stock market is a very common method of fighting inflation…and probably the best way. A properly allocated and diversified portfolio will do the trick. Big caveat – investment returns are not guaranteed, and more volatility will be incurred.

Retire Later

Minny’s reaction was maybe they just shouldn’t retire yet. They are stable in their jobs and can just work an extra 1 or 2 years. In reality, it would require both Max and Minny to work an additional 4 years to make up the difference.

They were planning to retire at 62. If they need to, they can work longer. They might not be happy about it though, but running out of money would be worse.

Worried that you might run of money in retirement? Learn more here.

Working Part Time in Retirement

Max isn’t a fan of working an extra 4 years, but he really enjoys doing part-time consulting work. He suggests maybe they each work about 20 hours a week to supplement their income until things get back on track.

Making an additional $40,000 per year until the worst inflation is over (10 years) does the trick. However, Max will be 72 and Minny will be 71 by then. They’re still not excited about working longer than they planned.

Combination

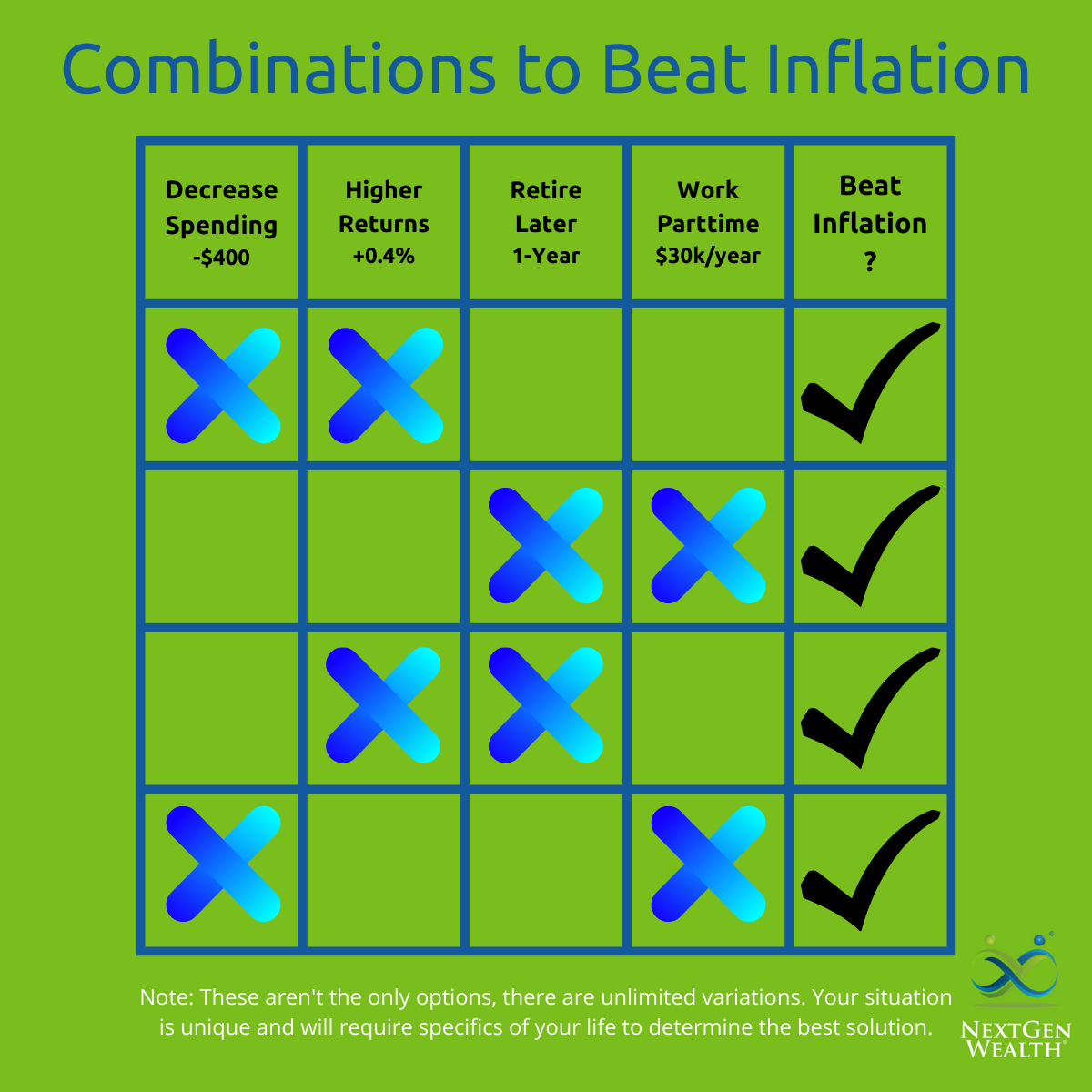

After discussing options with Max and Minny, we understood they were willing to try each method, but maybe not to the extent required to “beat” inflation. The good thing is they can do a little bit of each and still meet all their goals.

Max and Minny were both willing to work an extra year, so they only needed to add in one of the following: reduce spending by $400/month, add $30,000 of income per year for 10 years, or take on additional portfolio risk to earn an additional 0.4% on their investments.

What’s even cooler is combining any of the other three methods would also effectively erase the effects of inflation. In fact, some combinations yield a significantly better outcome than the original plan!

The great thing here is Max and Minny have an almost infinite number of combinations to get after inflation. We worked with Max and Minny to strike a balance and prioritize what was most important to them.

Areas of Opportunity Amid Inflation

Even though media outlets make it seem like inflation is all bad, there are some opportunities during inflation as well. Typically, inflation is met with adjustments from the Federal Reserve (The Fed) to help keep things in check. This usually comes in the form of The Fed raising the federal funds rate – the rate at which banks can borrow money from each other.

If you look at the graph below, you can see The Fed keeps the federal funds rate higher or lower depending on inflation.

This means “safe” investments will have a higher yield due to the higher interest rates. It also means stocks will have a corresponding slump (read that as going on sale) because the costs of working capital (often borrowed via bond issuances or short-term loans) become more expensive. This drives operating costs up, profits down, and corresponding drops in valuations and stock prices.

That’s an oversimplified explanation. Don’t get too wrapped up in the details, but stock prices often fall due to raises in interest rates. Market downturns are great opportunities to invest in quality funds (and underlying companies), complete Roth conversions, and employ other strategies like tax-loss harvesting.

Change, Change Again: It’s What We Do

Just because we might have dialed things up or down to adjust for inflation doesn’t mean we can’t change them again. At NextGen Wealth we plan for change on a regular basis. There’s a reason why we call it financial planning.

If conditions improve considerably (they probably will), then we can ease up a little. Regardless, we’re always going to take the long view and help you make sound decisions. We’ve been dealing with inflation for quite some time. It doesn’t have to be too scary.

Bottom Line on Inflation and Retirement

There will always be curveballs thrown at us in life. However, don’t always believe the gloom and doom on the news. Human beings are resilient – we always find a way to make it work.

If you’re getting closer to retirement or just entered retirement, very likely things will work out just fine. Even if you are unlucky enough to retire at the beginning of the worst period of inflation since 1960, you can still live a full, happy retirement. If you need help seeing the light at the end of the inflation tunnel, reach out and we’ll help you find the bright side.