How NextGen Wealth Prepares Your Social Security Strategy

Deciding on when to draw Social Security based on only one or two factors could be a huge mistake. As you approach retirement, your financial life doesn’t necessarily become less complicated. In some ways it gets even more complex.

It may seem like making the right decision is pretty straightforward. However, once you include all the different income, tax, and lifestyle variables, it isn’t that easy. At NextGen Wealth, we help guide you through these decisions in a deliberate and methodical approach.

Science and Mathematics

NextGen Wealth helps take the burden of knowing what the “right” mathematical answer might be. This is based on your income before and during retirement, tax planning strategies, and anticipated Social Security benefits.

We can pick a set of parameters using the most current studies on aging, health, and current Social Security rules. Then we can “math” our way to the best theoretical answer. However, there’s one major piece of data that we’ll never know – how long you’re going to live.

Guessing How Long You’ll Live

Sorry to turn the conversation morbid, but it’s true that we can’t know what the perfect answer is without knowing exactly how long you’ll live. We can use statistical data as a starting point, but you aren’t just a number on a chart or graph. You are a real person with unique personal history and habits.

We get to know you, your family, and your history. You may want to prioritize different times in your life. There may be personal details that affect how you want to plan for the future.

We take all of this into consideration and work with you to tailor what we use to assume what life will look like in the future. Of course, this is going to change and adjust over time. That’s why we engage in a continual process of reevaluation. We adjust for changes in your life and the rules and strategies around the things that are most important to you.

Your Input and Wishes are the Biggest Factor

You are the expert in your own life, so getting your input is the single biggest factor in determining what we recommend. Without collaboration between your hopes, dreams, and wishes, the math and science of financial planning is useless. You are our most important data point.

Important life goals such as travel, upgrading or downsizing your home, moving to a dream retirement location, or other big purchases and experiences need to be addressed first. You put in the hard work to get to retirement. We work to solve for how to make it what you’ve always dreamed of.

Blend the Math with Human Aspects

Once we understand you on a more personal level, we can get to work. To be clear, we’re working from our best estimates using the current information we have. There are several different strategies for tax, insurance, retirement income, and estate planning that need to be reconciled.

Nobody has completely unlimited resources, so often we may need to look at making adjustments. Your goals are not where we want to adjust. However, there’s no magic wand to make the cash appear if there’s not going to be enough to fund your goals.

We’ll present what we can accomplish with what you have and develop strategies to make it work. You’ll get detailed recommendations to make an informed decision no matter what the data shows. This is where financial planning really helps make informed decisions to achieve the most of what you want in life.

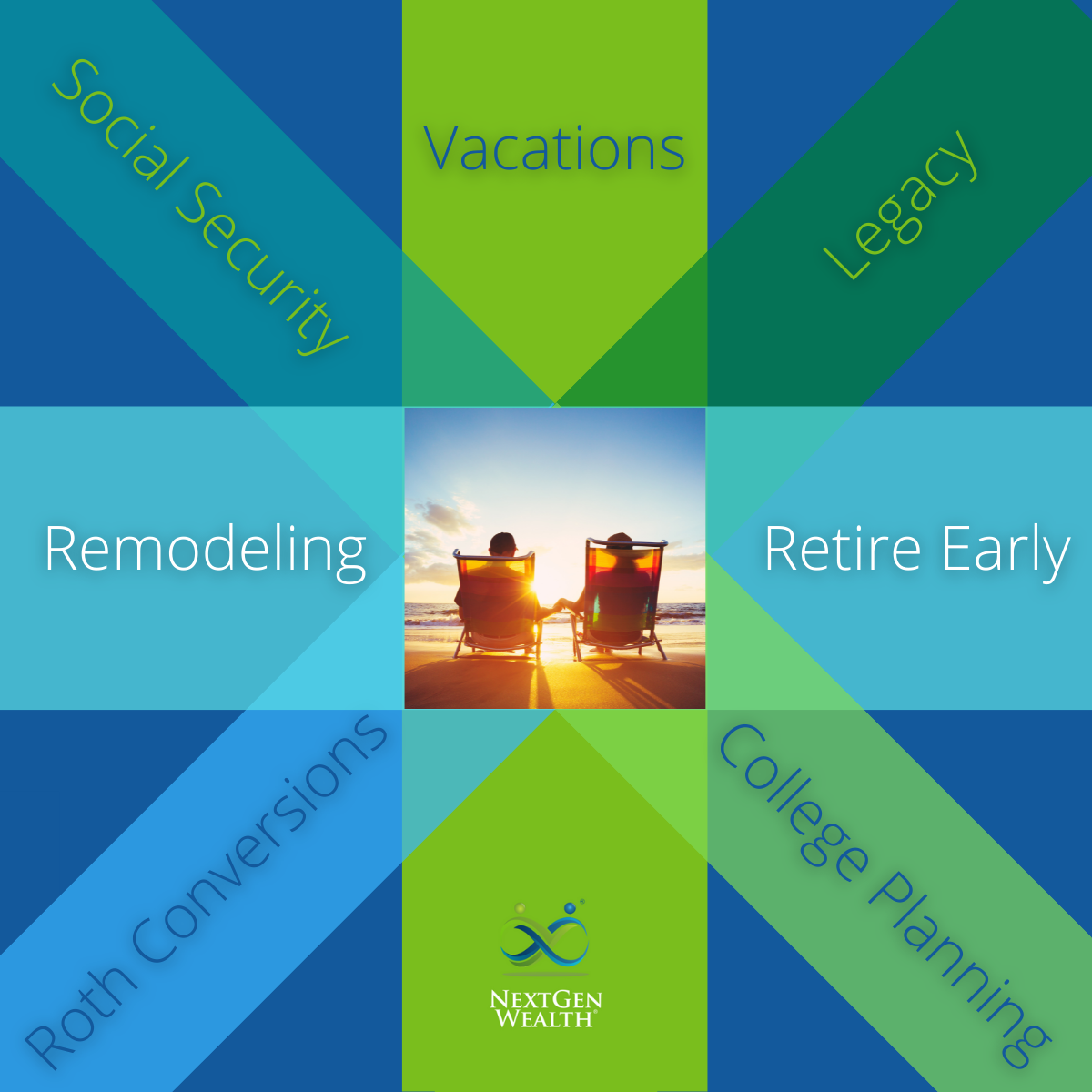

The Short List of Variables

When we start to look at how to best tackle your Social Security strategy, we look at what we know first. This process includes looking at all the different variables that may impact your personal Social Security benefit decision.

Retirement Income Timing

Part of our job is to ensure that you have money available to do what you want in retirement when you want to do it. This is why we focus on goals early on. We look to align income sources with your goals first, then layer on additional income like Social Security.

There are fewer variables we can play with when it comes to Social Security. Regardless of when you draw, we want to time everything to minimize the effects your income will have on Medicare Part B premiums, total tax burden, and other factors. Also, if you plan to move to a different state in retirement, this could factor in as well.

Roth Conversions

Roth conversion strategies are a very useful way to save on taxes long-term. However, the decision to implement a tax strategy like this can significantly impact when it would be best to draw Social Security benefits. We wouldn’t want to save you taxes just to lose out on your Social Security benefits.

There is always a little bit of give and take in such a strategy. We use specialized software to help analyze different scenarios. This also helps us weigh the total benefits of when to draw and whether or not Roth conversions make sense.

Estate and Charitable Giving Planning

Gift and charitable giving are important for us to know if you want to include these in your goals. Not only do these often require long-term planning, but there are a multitude of strategies in this area to be aware of. Having these integrated into every part of the plan is important.

If your giving is tied to a specific cause or event, then that will affect some of the other pieces of your financial plan as well. Also, as tax laws change, we may be able to offset some of your other goals and tax strategies with charitable giving.

Best Guess on When to Draw

As we mentioned earlier, NextGen Wealth uses advanced financial planning software to help model and compare. We take all the variables of your life and recommend what is as close to perfect as possible. Honestly, we’ll always be giving our best guess, but we continually look to improve that “guess” to give you the most optimal outcome.

There can be a major difference over the course of your lifetime depending on when you draw Social Security benefits. For our good pal Max Benny and his wife Minny, there was a total difference in lifetime income of $1,066,968 just by having him wait until 70 to draw Social Security while she started drawing at age 62. That’s a pretty big difference!

Common Retirement Variables Scenario

Let’s take a quick look at some of the scenarios and changes that we can consider in order to arrive at our “best guess” for Max and Minny Benny. In our examples, let’s say they’ve accumulated just over $1 million in investment assets for retirement.

Social Security Only

If Max and Minny were going to rely solely on Social Security, their optimal withdrawal ages would be to start taking Social Security benefits at 65. As a comparison, we will compare all the scenarios to both drawing at the earliest eligibility age of 62.

Adding Retirement Accounts

Once Max and Minny consider their retirement accounts in deciding their Social Security decision, their income and withdrawal strategy shows that they would be better off if Max and Minny both start drawing Social Security at age 70. This is why we need to look at all factors. Just this one added factor makes a significant difference on their Social Security strategy.

Timing With Your Partner

One interesting thing to note is that the decision for one spouse to wait to draw at full retirement age at 67 and the other draw early at 62 is drastically different depending on which spouse draws first. For example, if Max begins drawing Social Security at 62 and Minny draws at 67, this increases their lifetime portfolio value (total money available for them to spend in their lifetime) by $ 392,158. However, if Max waits until 67 to draw Social Security and Minny draws at 62, their total portfolio value increases by $808,378. That’s a difference of $416,220!

As you can see, there can be a substantial difference depending on when you draw Social Security. To arrive at this conclusion, we ran 16 different scenarios using different combinations of ages for Max and Minny to start drawing Social Security. This is a pretty basic scenario – real life tends to be more complex.

Adjusting for Life Expectancy

Another variable to consider is your life expectancy. The scenarios above are using an estimate of each person living to be 100 years of age. If we drop that age down to 80 for Max and age 90 for Minny, the optimum ages to withdraw are age 70 for Max and 65 for Minny.

We have no idea how long each of us will live, but we can try to make another best guess based on statistics. The average life expectancy for Americans at age 65 is 19.6 years. Therefore, you might assume that you may live to be 84.6. When we adjust your Social Security withdrawal for that, things change again.

The new optimal ages for Max and Minny to draw Social Security are 67 and 70 respectively. One other interesting thing to note is that the difference between drawing at 67 and 70 and both drawing at 65 is $109,941 which in this case is roughly 3% of their total retirement assets.

The other interesting thing to note (at least to a financial planner) is that after both reach age 65, there’s minimal increases in benefits for waiting when factoring in the lifetime income values. For example, if Max waits to draw at age 67, there’s only a $1,921 difference between Minny drawing at 67 and 70 years of age. Looking at all these possibilities is important to understand the impact they make on decisions you make to optimize your retirement elsewhere.

Going back to the first example where Max and Minny only have Social Security, their ideal ages to draw would be for both to draw at age 65. Keep in mind that we don’t have a crystal ball and there’s no way to know for sure how long you’ll live.

To close this discussion on guessing life expectancy, if we look at the numbers for Max and Minny’s situation, there’s a $111,611 total lifetime difference between the optimum Social Security strategy for a life expectancy of 100 and 84. However, we’re going to be solving for not running out of money. We would rather plan on you living longer with money to spare than try to fit you into a statistical box so-to-speak.

Social Security and Roth Conversions

Now let’s also consider when to take Social Security if you would benefit from doing Roth conversions. This adds an additional layer of complexity. Readjusting for this common tax strategy may change the plan for Social Security significantly.

Ultimately, we want to optimize for whatever the biggest benefit is first and then adjust the other details around it. When federal income tax rates start at 10%, this is always going to be a significant factor. Once again, getting to know the details of your situation is the biggest input into our process.

We use financial planning software to help analyze any gaps in income or opportunities to utilize tax saving strategies like this. Once again, this is after we’ve set the data around your goals and aspirations.

Only the Tip of the Iceberg

This only shows the tip of the iceberg and there’s already a massive difference in the Benny’s financial future. Once we start layering on all the other details of your financial life, this difference could be even greater. That’s why planning early and planning often is so critical!

Even if you don’t feel like you have a “complex” financial life, there are variables that will affect what your optimum is. Many of these things are small by themselves but add up to be a big deal in the long run.

Once we start factoring in timing income for travel, gifting, and estate planning, we can better optimize. We still can’t predict the future, but we can help you make informed decisions about the financial implications of your lifestyle in retirement.

Not A Black and White Decision

As you can see, there are many layers to any decision regarding your retirement and when to draw Social Security. However, once everything is aligned, it can be a really beautiful thing.

NextGen Wealth understands that this isn’t a simple black and white decision to make. That’s the whole reason why we do what we do. You deserve to have someone really get to know you and help guide you through the complexities of retirement and optimize for what matters most – your happiness.

If you’re interested in seeing what working with NextGen Wealth looks like, please check out our client onboarding process and feel free to schedule a call for more information.