Are Roth IRA Conversions a Good Idea in Retirement?

This post was last updated on January 08, 2025, to reflect all updated information and best serve your needs.

This post was last updated on January 08, 2025, to reflect all updated information and best serve your needs.

It seems like Roth conversions are all the rage, but are they really the right thing for you? There are many potential benefits, but there are some trade-offs to consider as well. The decision to use a Roth conversion incorporates a much longer timeline than many other tax-saving strategies.

If you’re comfortable with the idea of paying taxes today to save on your total lifetime taxes, then you should really consider a Roth conversion. Not everyone will benefit from a Roth conversion though. However, there’s a reason why this is such a popular and powerful strategy for many retirees.

What Are Roth Conversions?

A Roth conversion is exactly what it sounds like – you convert or transfer money from a “traditional” IRA to a Roth IRA. You pay the taxes in the year of the conversion as earned income which is included in your adjusted gross income (AGI).

Roth vs Traditional

Let’s discuss the basic differences between Roth and “traditional” IRAs.

With a “traditional” IRA, as well as other qualified accounts, you deduct your contributions from current earnings. You pay taxes as earned income when you withdraw those funds in retirement. In other words, you deduct contributions now, and pay taxes later when you withdraw the funds.

With a Roth account, you pay the taxes now and then withdraw the funds tax free in retirement. Technically, these withdrawals are excluded from your AGI completely. This is an important distinction.

Eligible to Contribute to a Roth IRA

There are limitations on who can contribute to a Roth IRA. The phaseout for single taxpayers is currently $150,000 to $165,000 (Single) and $236,000 to $246,000 if you are married filing jointly. If you make too much money, this might not be an option. This is where Roth conversions come in handy.

Back Door Roth Conversion

You may have also heard of the term back door Roth conversion. This is almost identical to the “plain” Roth conversion. The real difference is when and why you’re converting. A back door Roth conversion is completed in the same year as the contribution.

This is used when your income is above the applicable thresholds for contributing to a Roth IRA. You’ll contribute to a traditional IRA (non-deductible) and then convert that to a Roth IRA soon after.

Mega Back Door Roth Conversion

Have you heard of a “mega back door Roth conversion” before? This sounds even cooler than a “normal” or “back door” Roth conversion. This might apply in certain circumstances, but you must be able to take in-service withdrawals and make after-tax contributions into your qualified retirement plan like a 401(k).

Who is Eligible to Complete a Roth Conversion?

Technically, anyone can complete a Roth conversion. There was legislation introduced (but not passed) to limit Roth conversions, but conversions are allowed broadly for now.

Why do a Roth Conversion in Retirement?

The main reason for completing a Roth conversion is to save on taxes. Roth IRAs aren’t subject to required minimum distributions (RMDs) which gives you a lot more flexibility. This also allows for continued tax-free growth to be passed to your heirs.

Tax Benefits (Short Version)

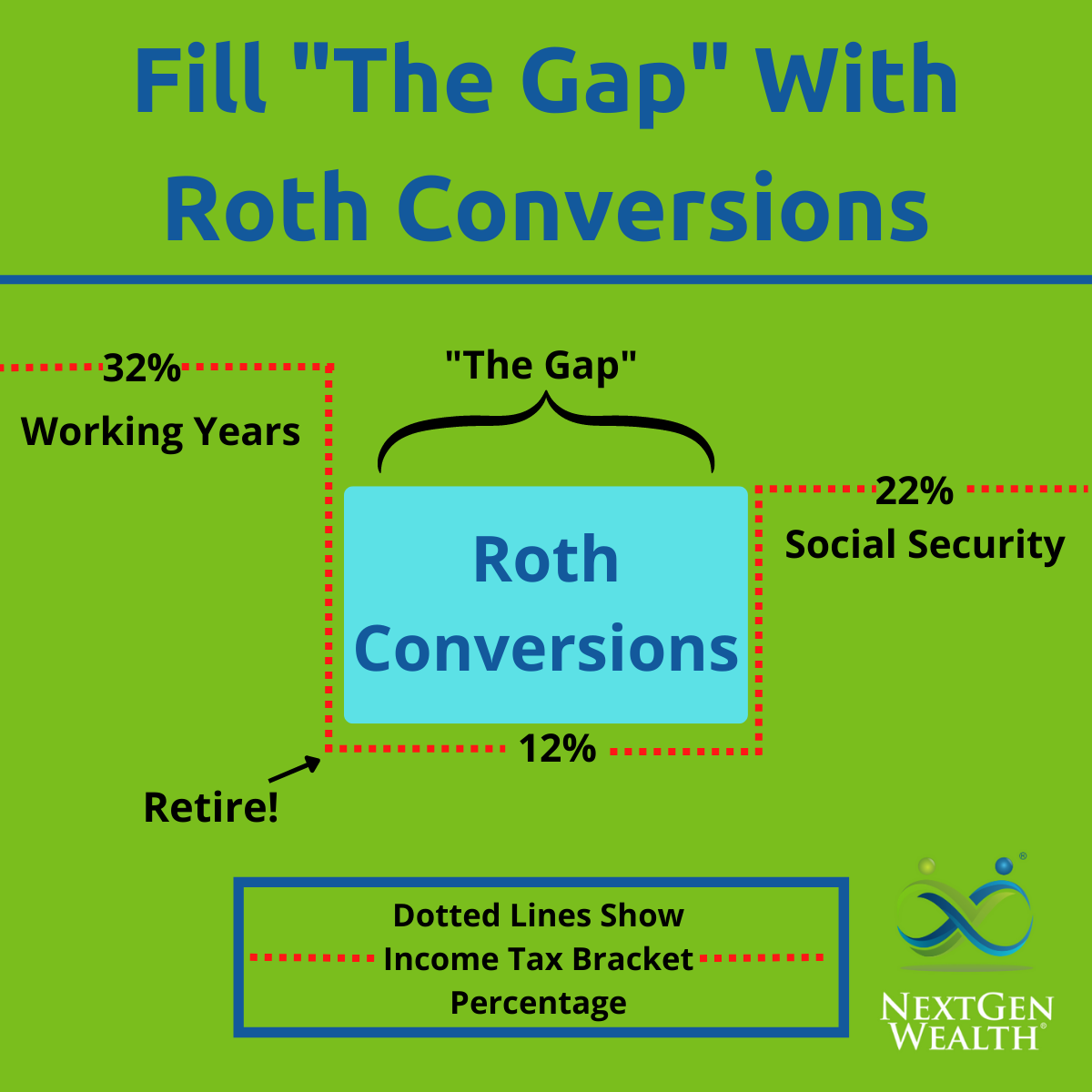

In short, we can look for (or create) dips in your taxable income. Then we can “fill up” the lower tax brackets with Roth conversions. This ensures you have some control over how much you’re paying in taxes.

We don’t have a crystal ball, but if your anticipated retirement income creeps higher, you could run into issues. If RMDs force your income above AGI thresholds for Medicare Part B premiums or capital gains rates, you’ll lose money to higher costs and taxes. No thank you!

The Conversion Process

The conversion process is relatively simple, but you must be careful about how and when you transfer the funds. Direct rollovers are the safest method.

Otherwise, you can take a distribution and then deposit the money into a Roth IRA within 60-days. This works but isn’t really the best option. Otherwise, you need to be 59-1/2 to ensure you don’t get hit with a 10% penalty.

Regardless, you’ll want some cash on hand to pay the taxes. This puts more into the Roth account and avoids penalties. The full amount you withdraw must be deposited into the roth account (institutions automatically withhold 20% for taxes).

Determine if a Roth Conversion is Right for You

There are many considerations to determine if Roth conversions make sense for your situation. Factors such as projected retirement dates, retirement account balances, pension income, and expenses all play a role.

Roth conversions are not the first thing we look at, but they are always considered. Once you set a date for retirement and set your anticipated Social Security withdrawal strategy, then we can layer on Roth conversions.

Preferences

Your personal preference may be to have all your money in Roth accounts regardless. We suggest looking at the benefits and drawbacks. What’s mathematically optimal may not be emotionally optimal for you – you need to know the effects regardless.

Avoiding RMDs

If RMDs will push your income over important AGI thresholds, then converting to a Roth may be a real cost savings to you. We can gauge the likelihood of RMDs becoming an issue through detailed projections.

Existing Opportunities

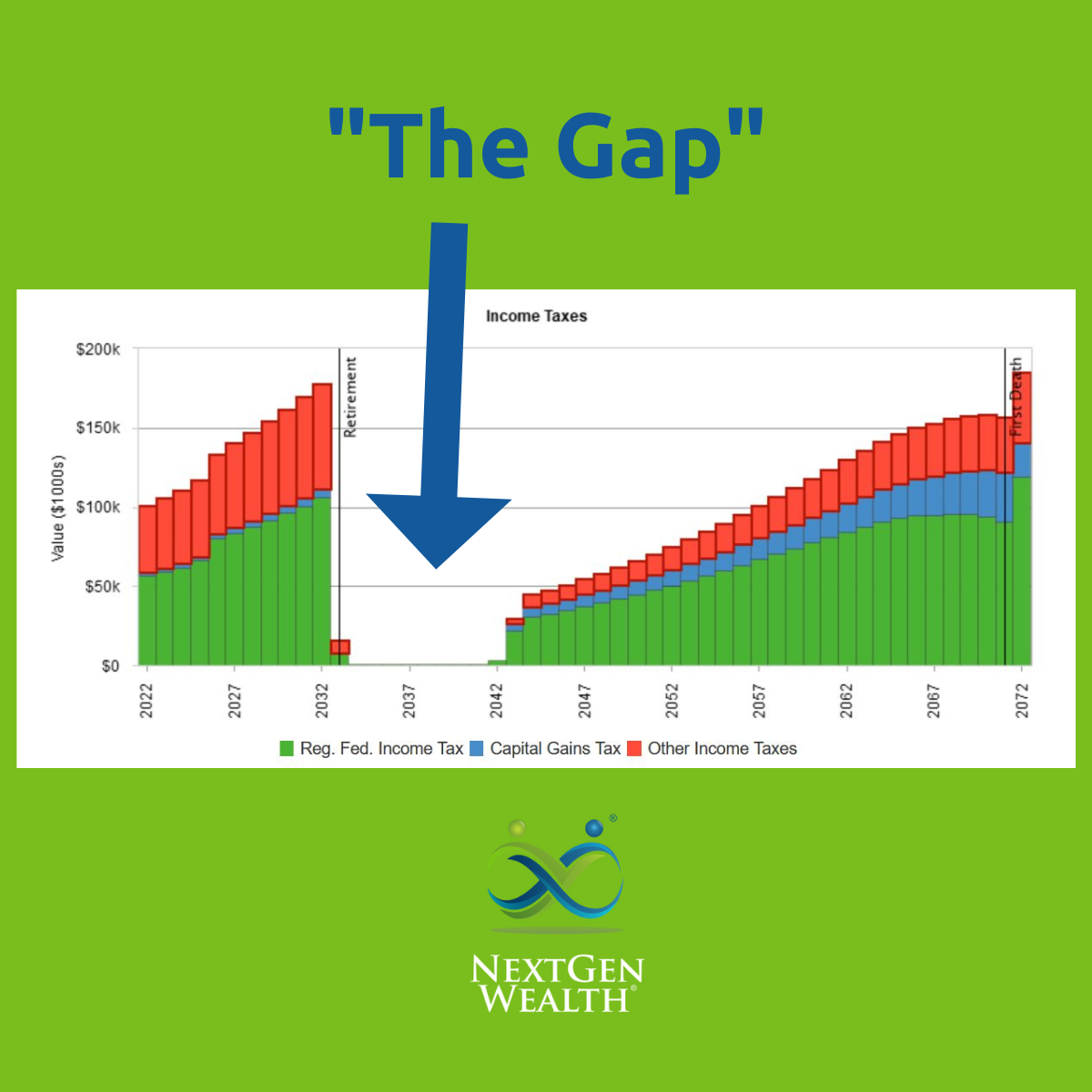

We want to look at existing opportunities to utilize Roth conversions. Most often there’s an opportunity between your retirement date and when you begin to draw Social Security benefits. We call this “the gap.”

Taking Advantage of “Gaps”

To illustrate “the gap,” we’ll look at our pal Max Benny and his wife, Minny. In the chart below you can see where there’s a dip in income taxes paid right after retirement.

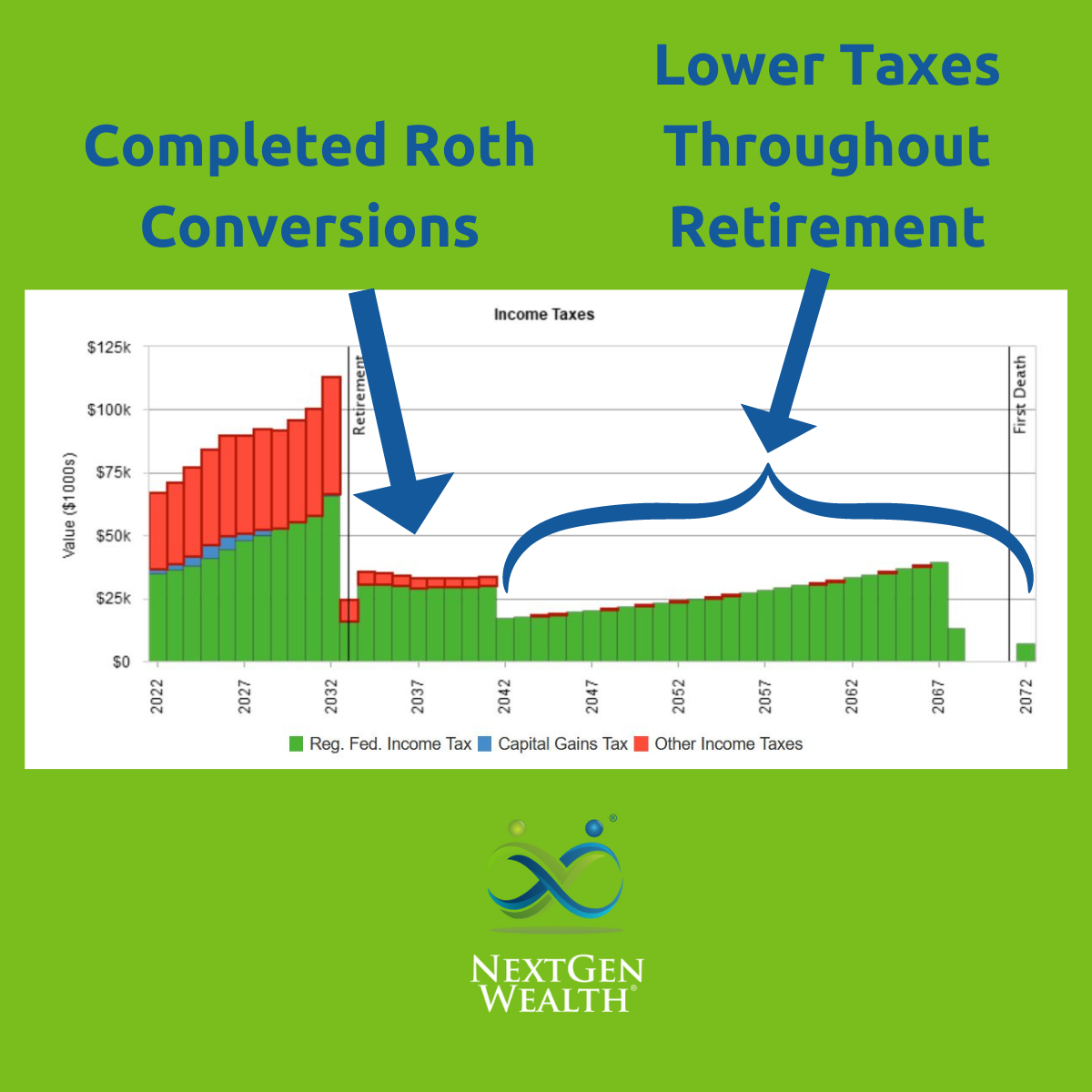

In those dips, we can complete some Roth conversions. These conversions in this scenario may seem “aggressive” because we hypothetically converted Max’s entire 401(k) balance in 8 years. However, this better highlights the difference (and makes the graph look prettier).

Although it may hurt a little adding to Max and Minny’s tax bill for 8 years, you can see a lower tax bill over the remainder of their life. The name of the game here is a little short-term pain for long-term gains.

If we complete the Roth conversions for Max and Minny, they will avoid $194,412 in income taxes! Even more interesting is their overall lifetime portfolio increases by $1,725,134. Not too shabby!

Keep in mind, your situation is going to be different. By the end of Max’s life, he and Minny will have amassed over $2 Million in their retirement accounts before the Roth conversions. Also, this is a hypothetical scenario to demonstrate the possible benefits of a Roth conversion strategy.

Creating Opportunities for Roth Conversions

You might also be able to create opportunities to take advantage of Roth conversions. This could be from delaying Social Security, charitable contributions, or other similar tax and income changes. These changes are considered only if you were likely to do these anyway – we don’t want to alter your life too much just to save on taxes.

Delaying Social Security

You might be in a situation where you can delay drawing Social Security benefits. This can artificially create a dip in retirement income to complete Roth conversions. You’ll still need some money to live on, so this may be easier said than done.

Charitable Giving

You can coordinate charitable giving to help offset the taxes from Roth conversions. Additional tools like donor advised funds (DAFs) can be utilized here as well.

Bunching Expenses

If you have business or personal expenses you can deduct in the same year as a Roth conversion, this could help as well. With deductions that allow carryover, you can bunch expenses and carry that to later tax years for future Roth conversions.

Coordinating With A Spouse

Coordinating retirement income and tax strategies with a spouse is a must. However, if one of you is delaying drawing Social Security while the other is converting their IRA or 401(k) balance to a Roth IRA, you may be able to accomplish more together. It may seem logical to start drawing benefits at the same time, but this could be a mistake.

Why Not to Convert to Roth

To be clear, Roth IRA conversions are not for everyone. Let’s talk about when a Roth conversion is not right for you.

Income Not High Enough

It’s possible your retirement income won’t be high enough to worry about RMDs or higher tax brackets. If you paid off your house and have other tax-free income, then your income tax may not be high enough to benefit much from Roth conversions.

Loss of Protection

Although it’s not likely to be an issue, you may lose some legal protection from creditors in case of a bankruptcy. Qualified plans like 401(k) accounts have higher protection limits in cases of bankruptcy. IRAs have lower limits on protection from bankruptcy than “qualified” accounts.

How to Decide for You

If you have a large balance in qualified retirement accounts, then you need to take a serious look at Roth conversions. There are some significant long-term tax benefits. However, you have to pay taxes regardless – it’s just a matter of when and how much.

The whole idea is to pay everything you owe in taxes and nothing more. We don’t know if Roth conversions will always be an option but using this strategy while it still exists can save you money on taxes. Contact us to get your free financial assessment and learn how NextGen Wealth can help you navigate your retirement journey.