How The One Big Beautiful Bill Affects Social Security

Social Security changes from the 'One, Big, Beautiful Bill' could have the longest-lasting impacts on your retirement. Healthcare and tax reforms have dominated headlines, but they also have numerous secondary effects.

The impact largely depends on how effectively you utilize temporary rules and tax reductions. We’ll explore short-term and long-term effects, who’s most affected, and what you can do now to stay prepared.

Table of Contents

- Immediate Impacts on Social Security

- Negative Effects on Social Security

- How You Can Take Advantage of Opportunities

- Example: Increased Roth Conversions for Long-term Tax Savings

- Getting Assistance with Tax Changes

- Nailing Your Social Security Strategy

- NextGen Wealth Helps Guide You Through Tax Law Changes

- Final Thoughts on the One Big Beautiful Bill Act

Immediate Impacts on Social Security

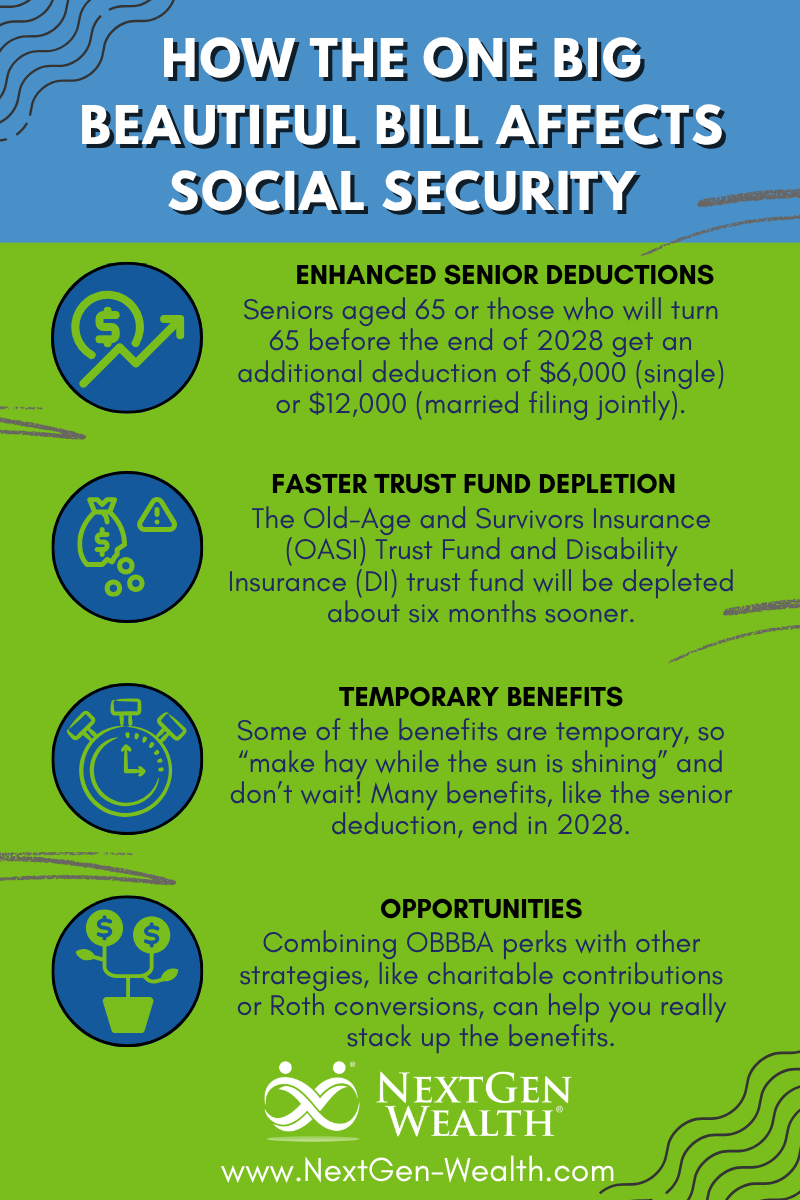

Headlines touted the law as “no tax on Social Security,” but it’s a little more complicated. In reality, the way the One Big Beautiful Bill reduces, or even eliminates, Social Security taxation is through an additional “enhanced” or “bonus” deduction for taxpayers age 65 or older.

As a result, many more seniors will see a reduction in their taxable income. This may drop their income below the threshold for having their Social Security taxed or below the standard deduction. In effect, this means an estimated 88%, up from 64%, of Social Security beneficiaries will owe no taxes on their Social Security benefits.

Senior Deduction Eligibility and Income Limits

To be eligible for the new deduction of up to $6,000, you must turn age 65 sometime during the tax year or before. In other words, to claim the additional deduction, you must be age 65 or older as of December 31st. For couples filing jointly, the deduction can be combined if you and your spouse are both age 65 or older by the end of the year.

The deduction phases out for individuals starting at $75,000 and for couples filing jointly starting at $150,000. The deduction is reduced by 6% of your income above the applicable threshold. Once you reach $175,000 for individuals or $250,000 filing jointly, your additional deduction is eliminated.

Temporary Relief from Taxes

The additional senior deduction is only effective for tax years 2025 through 2028. Unless Congress passes further legislation, the deduction will not be available starting January 1st, 2029. In other words, take advantage while you can.

Permanent Tax Relief

The extension of the TCJA's higher standard deductions and beneficial tax brackets could permanently reduce the amount of Social Security subject to tax. Until there is another major change to tax law, the TCJA tax brackets are permanent with slight modifications to inflation adjustments. For many retirees, this is a significant benefit because you’re no longer incurring business or other deductions.

Negative Effects on Social Security

Overall, there’s a slight negative effect on overall Social Security revenue. This is partly because of the extension of the TCJA tax cuts we just mentioned. Additionally, there will be lower tax revenue due to fewer Social Security benefits being taxed.

Many headlines suggest that the OBBBA is a death blow to the Social Security trust funds. However, it’s not as severe as some make it sound. Overall, the Old-Age and Survivors Insurance (OASI) Trust Fund, which pays retirement benefits, and the Disability Insurance (DI) trust fund will be depleted about six months (two quarters) sooner than expected.

The eventual depletion of the Social Security trust funds has been known for years. Social Security will still exist after the trust funds run out, but benefits will be reduced.

How You Can Take Advantage of Opportunities

If you’re age 65 or will turn 65 before the end of 2028, pay special attention to tax-saving opportunities. With an additional $6,000 or $12,000 deduction, strategies like Roth conversions could make even more sense. A married couple filing jointly with both spouses age 65 or older now has a total standard deduction of $46,700.

Couple this with other benefits like increased charitable deductions for taxpayers who don’t itemize, and you can start to stack up the benefits. Of course, some of the benefits are temporary, so “make hay while the sun is shining” and don’t wait.

Example: Increased Roth Conversions for Long-term Tax Savings

Our friends Max and Minny Benny are very fond of this new deduction. They are both 67 years old and receive Social Security benefits, totaling $50,000. They need to pull an additional $22,000 a year to cover their living expenses of $6,000 per month.

With the new standard deduction, age-based additional deduction, and new “enhanced” senior deduction, their total tax bill is $0 for the year. In reality, $8,550 of their Social Security is still taxable, but the additional standard deductions completely eliminate their tax bill.

Regardless, because of the way Social Security is taxed and all their deductions, they can have a total of about $80,000 of income for the year before paying any federal income tax!

Without OBBBA Deductions

The estimated increase in their taxes without the new deductions would have been $605 at the federal level. It also makes $18,750 of their Social Security taxable – even though they’re not actually paying taxes on all of it.

Roth Conversions

Each year, Max and Minny usually try to convert a portion of their IRAs into their Roth IRAs. Most years, it’s around $50,000. If they were to convert $50,000 without the additional $12,000 standard deduction, they would have paid an estimated $8,494 or roughly $170 per $1,000 converted to Roth.

After factoring in the new $12,000 standard deduction, their costs to complete Roth conversions drop to an estimated $7,659 or about $153 per thousand of their IRA converted to Roth. Another way to look at this is they can convert an additional $7,000 to a Roth IRA for the same price. Roth conversions will permanently reduce their lifetime taxes and the taxes on their remaining IRA balance when passing it to their children.

Getting Assistance with Tax Changes

We highly recommend consulting your financial planner and tax professional to adjust your personal strategy. If you don’t already have a financial planner, consider our no-obligation financial assessment to see if we’re a good fit to work together.

Regardless, this is not the year to wait until spring to think about taxes. It’s pretty rare to have such major tax changes in the middle of the tax year. You don’t want to miss out on tax savings.

Nailing Your Social Security Strategy

If you haven’t already started drawing Social Security, now is a great time to start planning. It’s one of the biggest decisions you’ll make in retirement. Make sure you’re prepared. You might enjoy one of these articles we’ve written on Social Security:

- What is the Best Social Security Withdrawal Strategy for Me?

- How NextGen Wealth Prepares Your Social Security Strategy

- Planning Your Pension in Concert with Social Security

- Will My Pension Reduce My Social Security Benefits?

- Surprising Social Security Calculation Facts

NextGen Wealth Helps Guide You Through Tax Law Changes

As part of our standard process, we review tax returns, identify tax-saving opportunities, and analyze your entire financial picture. Once you become a client at NextGen Wealth, we guide you through our COLLAB™ Financial Planning Process and continue to guide you throughout retirement.

In fact, the analysis above is a simplified version of what we do for clients every year. We complete an in-depth Roth conversion analysis and provide a detailed summary with personalized recommendations. We believe in ongoing planning because you never know what new changes and opportunities will come.

We help you navigate new tax laws and stay on track for a confident retirement.

Final Thoughts on the One Big Beautiful Bill Act

The One Big Beautiful Bill is a significant change to the broader retirement landscape and Social Security. Headlines vary from best to worst, but the reality is often somewhere in between. Regardless, this new law won’t prevent you from living a prosperous retirement.

Stay informed and regularly review your plan to help ensure your benefits work best for you. To learn more about the OBBBA, read our related articles: How The One, Big, Beautiful Bill Affects Retirees as well as How The One, Big, Beautiful Bill Affects Medicare. If you’re nearing retirement, contact us today to schedule your no-obligation financial assessment and see if we’re a good fit.