Planning Your Pension in Concert with Social Security

Coordinating your pension and Social Security benefits are some of the most important decisions you’ll make as you retire. It’s very important you don’t plan either one without looking at your whole financial picture. In other words, we want you to think about your overall retirement income – not just your pension or Social Security.

Your pension income, retirement accounts (401k, 403b, TSP, IRA, etc.), Social Security, and other income (rental property, inheritance, etc.) all factor into how much you need in retirement. Each one of them comes with their own risks and benefits to consider in relation to your other retirement income sources.

Table of Contents

- Understanding Social Security

- The Role of Your Pension

- Coordinating Social Security and Your Pension

- Potential Challenges and Pitfalls to Avoid

- Potential to Prioritize Both Your Pension and Your Social Security

- Tax Efficiency and Planning

- The Effect of Taxes on Social Security and Pension Income

- Tax-efficient Withdrawal Strategies

- Advanced Strategies

- How NextGen Wealth Can Help

Understanding Social Security

We’ll do a quick overview of the Social Security system, but you can check out our articles on determining your Social Security withdrawal strategy and how we prepare a Social Security withdrawal strategy for people like you. In short, Social Security is a government run pension program.

In order to be eligible for Social Security, you have to earn 40 Social Security Credits. You will earn one Social Security and Medicare credit for each $1,640 you earn (not all earnings count) each year. You have to earn $6,560 to get a maximum of four credits for the year (based on 2023 numbers).

Your Social Security benefits are based on the highest 35 years of taxable earnings in your lifetime. You generally can’t start drawing Social Security until you’re age 62 (reduced payout) unless you’re disabled, or an eligible spouse or dependent. For more information, check out our other articles on Social Security.

The Role of Your Pension

Your pension and other retirement income is important whether you have a “traditional” defined benefit pension (monthly check to you), or you have a defined contribution plan like a 401k, 403b, 457, etc. In many cases, your pension might be your main source of income.

It’s really important for you to have a solid understanding of your pension plan's features and benefits. What payout options are there? How do you maximize the amount you receive?

Overall, we look at your pension as a solid foundation to build additional retirement income sources around. There are also some key factors regarding taxation of pension benefits and Social Security as well. We want to make sure your pension is working with your pension – not against it.

Coordinating Social Security and Your Pension

There are many benefits to aligning your pension with Social Security. One of the biggest factors is when you should retire and when to draw Social Security. If you can live off your pension for a while before drawing Social Security, then you may be able to maximize your Social Security payments.

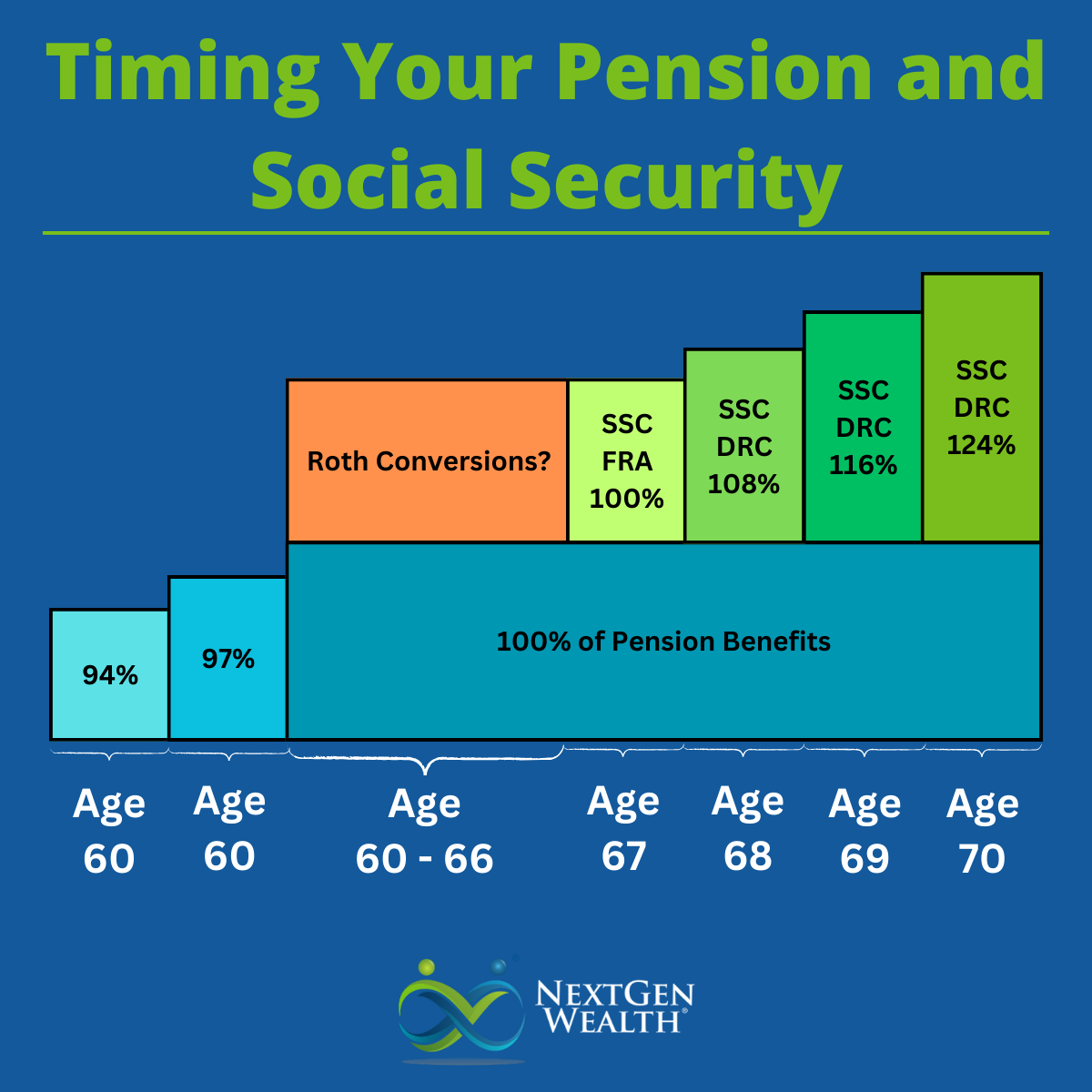

You get an additional delayed retirement credit (DRC) of 8% for Social Security every year you wait to draw up to age 70. If you can live on your pension and maybe some of your 401k, you could delay and get up to an additional 24% of your benefit at the full retirement age (FRA) – for life.

There are some strategies to optimize both your pension and your Social Security. For instance, waiting to draw Social Security may give you a window to implement some tax-saving strategies such as Roth conversions. If you have other income sources like a 401k, you’ll need to factor those in as well.

Potential Challenges and Pitfalls to Avoid

What you don’t want to happen is getting too much income at the wrong times. Also, getting the taxes dialed in makes a huge impact on your overall financial life. In both cases of your pension and Social Security, you don’t want to retire too early or think about either one of them in a vacuum.

You don’t want to end up having too much taxable income and be subject to Income Related Monthly Adjustment Amounts (IRMAA). These will make your Medicare premiums increase which isn’t fun for anyone.

Potential to Prioritize Both Your Pension and Your Social Security

In both cases, how long you work and how much you make will affect your retirement benefits. Both your Social Security benefits and your pension payments are based on some type of salary calculation and the number of years you’ve worked. Often, this is called your Final Average Earnings (FAE) calculation.

If you look at what types of pay are counted toward your Social Security benefits as well as your pension, you may be able to find a way to squeeze a little more from both. Obviously, you want to get the most from these, but it’s important to prioritize your overall financial health and wellbeing – not just the dollars and cents.

One way to do this is to look at your tax strategy and make sure you’re getting to keep, and use, more of the money you make. You want to pay all the taxes you owe, but you don’t get an award for giving Uncle Sam a tip on your tax bill.

Tax Efficiency and Planning

Overall, you’ll want to fill any gaps in income between your pension and your expenses with other sources of income. If your pension covers all your needs, that’s fantastic! Now you’ve got to figure out how to use the “extra” money efficiently.

However, for most of us, we’re not going to run out of ways to spend money. However, it can be somewhat stressful to spend money if you’re concerned about having enough money to retire on. You want to have a spending plan to cover your expenses but leave a little buffer just in case.

You may need to use sources like your 401k or Roth IRA to fill any income gaps. Keep in mind, the final layer of all this is how your money will be taxed. Your 401k, Roth IRA, pension, and Social Security are all taxed (or sometimes exempt from tax) at different times, rates, and income levels.

The Effect of Taxes on Social Security and Pension Income

You’ll need to plan on income taxes for your pension and probably Social Security too. With a few exceptions, if you’re receiving an annuity-style pension (monthly payments), those payments are taxable at the federal level.

Once your income increases enough, your Social Security benefits are taxed too. This may seem a bit unfair, but if you’re interested in the why and the history of Social Security taxation, you can check out this article on the Social Security Administration website. Regardless, once your Adjusted Gross Income (AGI) reaches $25,000 (single) or $32,000 (Married Filing Jointly), your Social Security benefits begin to be taxed.

Don’t Forget About State Taxes

Many states have some form of taxation for pension benefits. However, some states limit this or even exclude pension income. Missouri and Kansas both have different rules for this. Also, keep in mind there may be exemptions on city taxes like the 1% Kansas City E-Tax.

Tax-efficient Withdrawal Strategies

As you can see, you can’t escape taxes. As a matter of fact, it probably feels like you’re getting hit with taxes at every turn. Taxes and inflation are some of the biggest threats to your retirement income.

The name of the game is to reduce the overall lifetime tax burden for you and your family – not just today. If we can keep your taxable income low enough, you may be able to keep your overall tax rate lower throughout retirement and beyond.

Advanced Strategies

This is why retirement tax-saving strategies become so important. It can get a little confusing on how to get everything to work together. We regularly analyze, simplify, and educate on these topics because of how important they are.

Roth Conversions are one of the most common strategies we use. This involves transferring some of your 401k or traditional IRA money into a Roth IRA. You’ll pay taxes now, but you’ll save more on taxes overall.

We can also help walk through issues like required minimum distributions (RMDs), qualified charitable distributions (QCDs), and many other important financial tools. We’re constantly reevaluating our processes, technology, and changes to tax laws to keep your retirement on track and worry free.

How NextGen Wealth Can Help

NextGen Wealth dives deep into how a pension fits into your financial plan. We work with you to develop an overall retirement income plan with tax-saving and risk reduction strategies throughout. Your situation is unique to you, but we’ve spent over 20 years analyzing Social Security, pension, and other retirement income options and how they fit into our clients’ situations.

We’d love the opportunity to do the same for you. If you’re wondering how to coordinate your pension with your Social Security and how to navigate all the other retirement questions you have, contact us today for your retirement checkup.