Calculating the Right Amount of Roth Conversions

This post was last updated on December 23, 2025, to reflect all updated information and best serve your needs.

Roth conversions are among the most powerful long-term tax-saving strategies. If a Roth conversion might benefit you, the next question is how much you should convert. The right amount will vary based on your situation.

Once you’ve decided to implement a Roth conversion strategy, you’ll want to identify the best opportunities. We usually analyze projected cash flows throughout retirement and identify dips in income to complete Roth conversions at lower tax rates.

Table of Contents

Why Roth Conversions are Helpful

In the simplest terms, Roth conversions let you pay taxes now and then have your money continue to grow tax-free. Then, you can avoid issues with required minimum distributions (RMDs), limit your tax burden later in life, and pass money tax-free to your heirs. Roth conversions can be an effective tool to maximize your tax savings over your lifetime.

Reduce Overall Tax Bill

Your income from traditional retirement accounts, such as your 401(k) or IRA, will be taxed at some point. By completing Roth conversions, you pay the taxes upon conversion now, but then you can enjoy tax-free growth and tax-free income later.

Switching to tax-free growth earlier in retirement can lead to substantially lower taxes over your total lifetime. You can avoid paying higher taxes when you’re forced to pull money out for required minimum distributions. It’s a long-term strategy, but it can really pay off.

Avoid RMDs

Required Minimum Distributions (RMDs) force you to withdraw money from your traditional retirement accounts or face a 25% penalty from the IRS. This can force you to withdraw more than you want. Technically, you can reinvest this amount, but you’ll still have to recognize the income on your taxes.

Roth IRAs are not subject to RMDs, so you can avoid taking RMDs completely if your money is in a Roth IRA.

Tax Efficiency for Surviving Spouse and Heirs

Another benefit to converting your IRA or 401k to a Roth IRA is the beneficial tax treatment for your surviving spouse or other heirs.

Surviving Spouse

If your spouse inherits a qualified retirement account like a 401k or a traditional IRA, withdrawals will still be taxed as ordinary income. Most retirees will not qualify to file as a surviving spouse, and even if they do, it’s only for two years. Your surviving spouse will eventually have to file as single (unless they remarry).

This means they would have a smaller standard deduction and be subject to lower thresholds in the higher tax brackets – everything is basically cut in half. Your surviving spouse could also be forced to take much larger RMDs and end up paying significantly more in taxes. This is often referred to as the “widow’s penalty.”

Heirs

Your children may be doing okay financially and have their own RMDs to contend with. Additional taxable income, coming from the IRA they inherit from you, may cause a tax burden you didn’t intend to give them.

The rules on RMDs for inherited accounts are complicated and annoying at best. If your children inherit a Roth IRA instead, those withdrawals would be tax-free. Roth conversions can help you avoid passing a tax headache on to your spouse or heirs.

Different Methods to Implement Roth Conversions

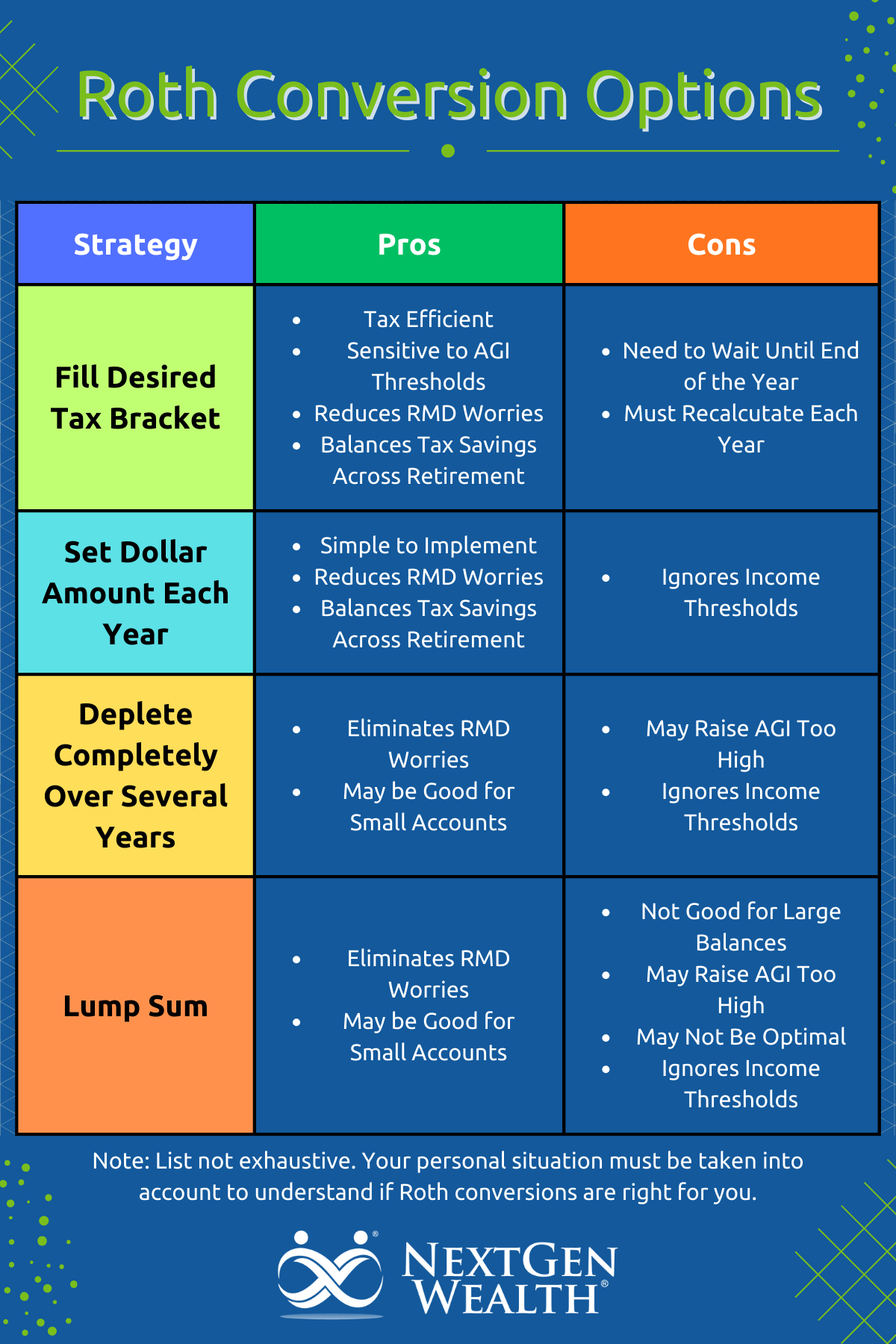

If you’ve decided a Roth conversion strategy is right for your situation, you still need to determine how much to convert and when. There are several different options, including:

- Lump Sum

- Deplete Completely Over Several Years

- Set Amount per Year

- Fill a Particular Tax Bracket

Let’s discuss how these work and the pros and cons of each. We’ll use our good friends Max and Minny Benny to see how effective each strategy would be. Max and Minny have $1.5 million in their retirement accounts, which they can convert to a Roth IRA.

Lump Sum

Technically, you could convert your entire account balance to Roth. Taking a lump sum is almost always the least favorable option. Unless you have a relatively small balance to convert, you’ll lose way too much to taxes. We’re not saying to dismiss this option entirely, but you shouldn’t overpay on taxes either.

If Max and Minny implemented this strategy, they’d end up with $3,347,569 less over their lifetime while paying $280,158 less in taxes– not exactly what we were hoping for. This will be different for smaller account balances and may be better for some individuals.

Deplete Completely Over Several Years

You could convert the entire account balance over several years. Max and Minny have a targeted window of 8 years to complete the conversions between the start of their retirement and when they plan to start Social Security benefits at age 70.

If they convert the entire 401k balance over 8 years, they’ll end up with $402,160 more in total lifetime assets. Their total tax savings would be an estimated $602,628. Nice!

Set Amount per Year

After reviewing their financial plan and discussing everything with Max and Minny, they don’t really want to convert everything to Roth. They can convert a good portion now and then utilize the remaining balance to fund retirement. Plus, they really can’t stand the idea of paying all those taxes up front; they don’t need to either.

They’re comfortable with converting about $50,000 per year until it’s time to start drawing Social Security. If they do this, they’ll convert $400,000 to Roth in 8 years. This increases their final projected assets by $2,641,234 and saves them $235,999 in taxes - now we’re starting to get somewhere!

Completing Roth Conversions Until the Start of RMDs

If they convert $50,000 each year for a total of 13 years, until their RMDs start, they achieve a much better result, with a lifetime portfolio value gain of $2,996,164 and additional tax savings of $274,639.

If Max and Minny continue $50,000 of Roth conversions after the 13-year mark, when they start RMDs, they’ll get a worse outcome. They probably wouldn’t want to continue conversions after this point.

Fill a Particular Tax Bracket

The final option we’ll discuss is “filling” a particular tax bracket each year. In other words, we look at the income for the year and then convert as much as we can without raising your income above higher tax bracket thresholds.

This strategy is specific to your needs and focuses on tax efficiency. We’re not going to raise your annual income too much, but we’ll make meaningful progress toward converting traditional accounts to Roth accounts.

A Note on Recent Tax Law Changes

The One Big Beautiful Bill Act makes Roth conversions a little more appealing. The law makes the tax brackets from the Tax Cuts and Jobs Act (TCJA) permanent, widens the 10% and 12% tax brackets, and gives a temporary “enhanced” senior deduction for those age 65 and older.

With these changes, Roth conversions may be even more beneficial. Don’t wait, though. The “enhanced” senior deduction of $6,000 is only available through 2028.

Filling the 12% Bracket for Max and Minny

When looking at Max and Minny’s situation, we can plan to fill the 12% tax bracket starting at retirement and continuing until they start drawing Social Security at age 70. This results in an additional $3,204,077 in their lifetime – even better! They’ll also save an estimated $269,015 in taxes overall!

You might be wondering why Max and Minny would fill the 12% tax bracket and not the 22% or 24% brackets. The answer is simple: converting more at higher tax brackets is a lot less effective. Converting within the 12% bracket is like getting a tax discount compared to converting at the 22% bracket or paying the “widow’s penalty” later on.

Comparison to Filling the 22% Bracket

Just for comparison, simply changing the strategy to fill to 22% bracket results in $858,075 more portfolio value (versus $3,204,077 for the 12%). Interestingly, this results in $590,678 less in taxes over Max and Minny’s lifetime. Would the extra tax savings be worth losing out on $2,346,002? Probably not.

The best result for Max and Minny is to fill the 12% tax bracket with Roth conversions until the year before their RMDs start.

How Much Do You Really Need to Convert?

Even after looking at all these different methods to implement a Roth conversion strategy, you might not need to convert a ton. A good goal is to convert enough to Roth to reduce your RMDs to your normal withdrawal level. If you’re not going to have an RMD problem, it doesn’t make sense to complete an aggressive Roth conversion strategy.

There’s a balance between paying taxes now and paying taxes later. Just like a healthy diet, we want balance and moderation.

Risks of Roth Conversions

It’s not always best to complete Roth conversions. There are several reasons why skipping Roth conversions for a year or two, or limiting how much you convert, could be beneficial.

Converting Too Late in Life

Roth conversion advantages diminish over time. If you convert too late, you’ll pay the taxes, but you won’t break even on taxes paid through the growth of your Roth IRA. Depending on your circumstances, it might still make sense to complete some Roth conversions throughout retirement.

However, for many people, completing additional Roth conversions after they start drawing Social Security can be more costly. Conversions might still be worth it, but you’ll need to decide before continuing your conversion strategy.

Making AGI or MAGI Too High

You’ll want to be careful not to convert too much in any given year. Roth conversions are counted as taxable income in the year you convert, so your Adjusted Gross Income (AGI) and Modified Adjusted Gross Income (MAGI) will increase. This can push you into higher tax brackets and over other important thresholds.

The most noticeable threshold you need to be considerate of is the Income Related Monthly Adjustment Amounts (IRMAA) for your Medicare premiums. If your MAGI is too high, you’ll be charged higher Part B and Part D Medicare premiums. These adjustments start for income above $106,000 (Filing Single) or $212,000 (Married filing Jointly) for 2025 and income above $109,000 (Single) or $218,000 (MFJ) for 2026.

IRMAAs are calculated based on your MAGI from two years ago. This means any conversions you complete starting when you’re 63 could affect your Medicare premiums at age 65. These are “cliff” thresholds, so even one dollar over triggers the next higher Medicare premiums.

College Planning

If you still have children in college, Roth conversions could also affect your child’s eligibility for student aid. Higher income levels affect the Student Aid Index (SAI), formerly known as the Expected Family Contribution (EFC), used for student aid applications. The higher your income, the lower the amount of student aid your children might qualify for.

Private institutions have their own rules and calculations for student aid, so be aware of how your assets and income are considered.

Proper Timing of Roth Conversions

Proper timing of Roth conversions is essential. There’s usually a prime window of opportunity between when you retire and when you start drawing Social Security or your RMDs start to complete Roth conversions. If you begin drawing Social Security earlier or delay Roth conversions, you might miss this opportunity.

This makes planning your transition into retirement even more critical. There are already a lot of changes happening, so adding additional work isn’t always what you want. Plus, making a mistake with your nest egg can be painful.

How NextGen Wealth Helps with Roth Conversions

At NextGen Wealth, we specialize in the transition into retirement. We work extensively with clients who are 5 years from retirement and throughout retirement. Roth conversions are something we handle regularly.

When we take clients through our COLLAB™ Financial Planning Process, we use software to create a detailed Roth conversion strategy. Every year afterward, we use additional software to calculate how much to convert each year before completing conversions. We take great care to make sure we’re deliberate and precise when implementing a Roth conversion strategy.

Think of us as your guide on a tax-saving journey through retirement. If you’re near retirement (or want to be), contact us today to schedule your financial assessment and see if we’re a good fit.