How to Maximize Your Pension Final Average Earnings (FAE) Calculation

For many retirees with a pension, maximizing your payout options is vital. Many pension plans use what’s called a Final Average Earnings (FAE) calculation. There are several factors that might affect your retirement pay.

You might not be able to control all the variables in your FAE calculation, but certain things, like deciding when to retire, are generally within your control. You don’t want to make the mistake of retiring too early and missing a benefit or working longer with minimal or no benefit to you.

Understanding Your Final Average Earnings Calculation

Each plan is going to have a different way they arrive at your FAE number. There may even be several different plans with the same employer. For example, we’ve recently been working with clients from Evergy and there are several different pension plan types – all with slightly different FAE calculations.

Here are the main metrics you want to consider carefully:

- What counts toward years of service (credited service)?

- Does the plan cap credited years of service (e.g., 30, 35, or 40 years)?

- What wages are counted as earnings?

- Are there any penalties for drawing early, etc.?

There may be some other important variables for your pension plan, like if you were part of a merger or started before or after a certain change in the pension plan. You really want to look at what you can control first and then worry about the rest. For instance, if you work an additional 6 months, you might be able to get an entire year’s worth of credited service (more on this later).

Need help navigating your retirement income options? Get your retirement income plan today!

The Role of Final Average Earnings in Pension and Retirement Calculations

The final average earnings (FAE) calculation is only one metric in your pension payout, but it is very foundational. Almost every pension payout formula will take some version of this into effect. There are other plans to consider, such as a Cash Balance (CB) plan, which doesn’t use FAE. We won’t discuss CB plans here.

Formulas for Calculating FAE in Various Retirement Systems

One of the most widely known and utilized pension plans, Social Security, uses a form of FAE calculation. For Social Security, your retirement benefits are based on the highest 35 years of your working life. This can greatly affect how much your monthly check will be.

Many private pension plans use a similar range. Actually, some plans will even base benefits on the same earnings calculation as Social Security does. There are several nuances in each plan, so it’s really important you read all your plan documents thoroughly.

Salary and Income Components Included in FAE Calculations

A final average earnings calculation may state it’s based on the average of the highest 36, 48, or 60 months of earnings. Then, this may be multiplied by a specific percentage based on your age and years of service. For instance, you may only get 75% of your monthly salary if you decide to retire early or haven’t reached a certain age (age 55, 62, 65, etc.).

It’s not uncommon for a single years’ difference to be 3-5%. Although 3% doesn’t seem like a huge difference, once you compound it over the next 20-30 years of your retirement, it can be a meaningful amount of money.

Factors Influencing FAE

As mentioned, staying longer could have a significant impact on your FAE calculation. This is generally one area where you have some control. Sometimes, we don’t have a choice and are forced to retire due to health or family issues.

However, if your job offers the ability to reduce your hours or take some unpaid vacation, this might be a good way to keep “running the clock,” so to speak, while not reducing your pension payout. For instance, you may only need to work 6 months and 1,000 hours for a year to be counted as credited service.

Impact of Raises, Bonuses, and Overtime on FAE

Another major consideration is what pay actually counts toward your final average earnings calculation. In many instances, your bonuses and overtime may not be included. This can lead to being off in your personal estimates of your potential pension payments.

You’ll want to look at plan documentation very carefully to see what is and is not included in your pay calculations. Your pension payout might not match what your normal paychecks would be with overtime and bonuses.

Need help navigating your retirement income options? Get your retirement income plan today!

Effect of Career Progression on FAE

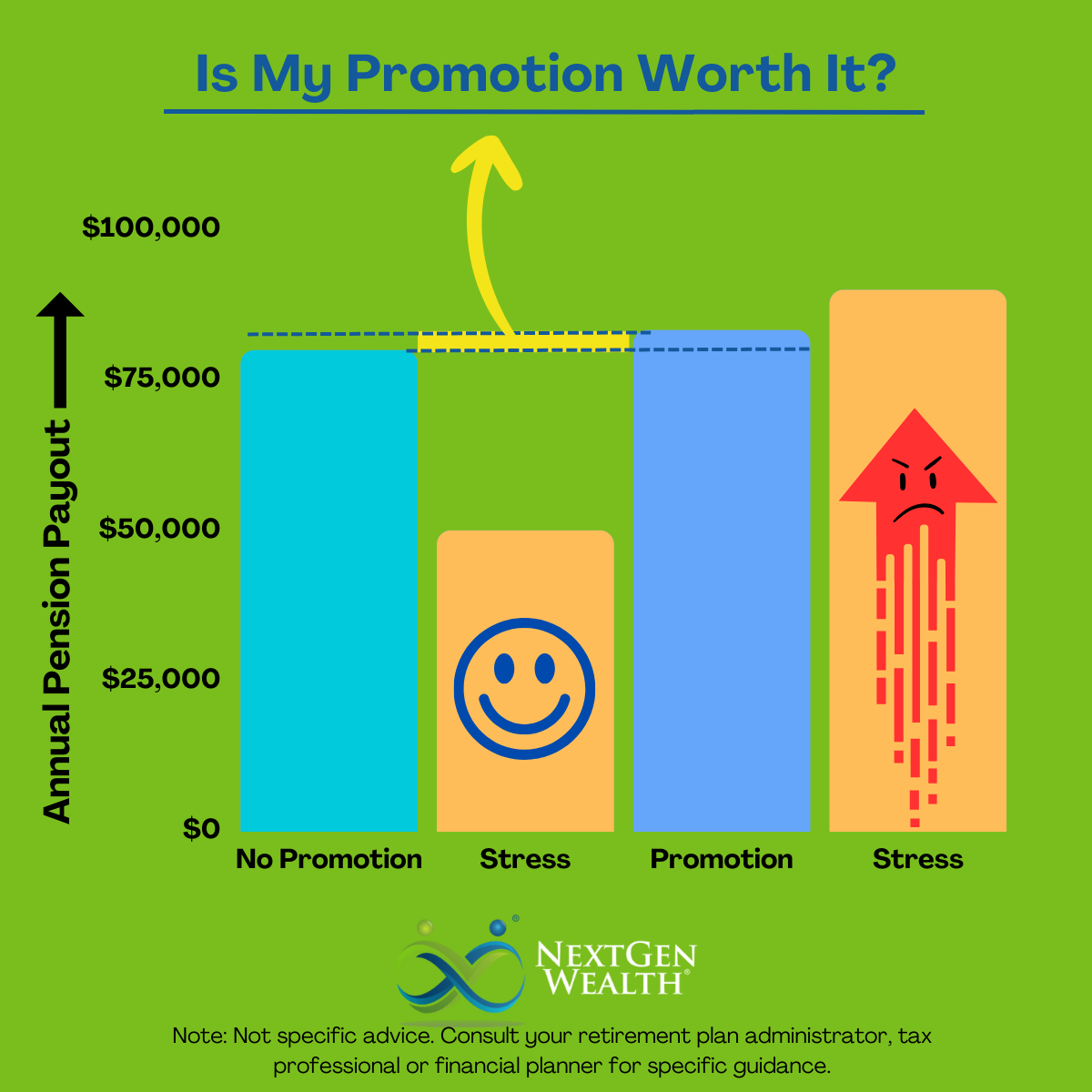

Another thing to consider is how moving up in a company might affect your pension. If you move into a position where you’re making more, but only for the last couple years before retirement, it might not make as big of a difference to your pension.

On the other hand, you may like what you’re doing, but the pay isn’t as high. In this case, staying an extra year in a job you enjoy may be way more impactful than taking a higher salary and a less fulfilling position. If the higher salary/high stress job causes you to retire sooner, it might not be worth it in the end.

For example, let’s assume your FAE is based on the highest 60 months of your pay. If your salary was $80,000 in a role you knew and loved, but you got a chance to move to a different shift for an extra $10,000 a year, would it be worth it?

If it’s only for the last two years, you’d only change your final average earnings per year by $3,333 – per year. However, if you’re stretching this over your lifetime, say 20-30 years, this could be significant ($67k to $100k). The other thing to consider is whether you actually need the extra $3k a year (~$278/month).

Common Misconceptions About Final Average Earnings

One of the most overlooked pieces to final earnings calculations is what constitutes years of work that actually count. Often, this is called “credited” service. Just because you worked somewhere for 20 years doesn’t mean you have 20 years of actual credited service.

In some cases, your initial “probationary” period might not count as credited service even though you actually were working there. Also, a partial year of working may be worth a full year of service even though you only worked there for six months out of the year.

You’ll want to read plan documents carefully to make sure you know exactly what counts and what doesn’t.

Does Working Longer Always Equal More Pension?

Another misconception is thinking working longer always equals a higher pension payout. This is generally true, but maybe only up to a certain point. Many plans cap your credited service at a certain point, like 30 or 35 years.

Therefore, if you work an extra year, your pay hasn’t increased, and you’re already at the 100% multiplier, then you’re not adding anything to your pension. Granted, there are more reasons to stay than just the pay, such as healthcare or if you just enjoy what you’re doing.

Need help navigating your retirement income options? Get your retirement income plan today!

Strategies to Maximize FAE

It’s in your best interest to get a higher pension payout. There’s nothing wrong with wanting to maximize your benefits – you earned it. There are a few things to consider in getting the most out of your benefits.

The biggest thing is understanding exactly how your benefits are calculated. You also need to get really detailed about your exact timelines from when you started accruing credit toward your pension and when you end your employment. It’s not a bad idea to create an employment timeline to help ensure you know exactly what day you can retire and still get the most benefits.

Salary Negotiation and Advancement Tactics

When negotiating salary, consider what pay counts toward your pension payout and what doesn’t. For instance, if you have the ability to negotiate a higher salary and lower bonuses, this may help give your pension a boost.

On the other hand, if you’re already close to maximizing your pension payout, maybe you can negotiate bonuses or overtime and put the extra money into your 401k to beef up your retirement savings. It’s really going to come down to your individual needs.

Working Part-Time to Help Maximize Benefits

If you know you’ve already got the maximum earnings you need to sustain your lifestyle, you may be able to slow down at work a bit. In other words, you might want to “run the clock” a little longer for a better percentage while only working the minimum hours to make it count as a fully credited year.

Obviously, there’s risks involved in such a strategy, so keep in mind you may get sick or injured and be out of work. You’ll want to know the rules on how missed work due to illness or injury comes into play.

Timing Income for FAE Optimization

As we mentioned earlier, you may need to work a little longer to hit certain dates to maximize your benefits. You wouldn’t want to retire right at your first eligibility date if you could work an extra two months and get an extra 3-5% of your pension for life. You also wouldn’t want to work an extra six months to a year with no benefit to you either.

You want to make sure you are clear on exactly when the key dates are for you to get extra bumps in your final pay calculations. Once you retire, you can’t go back and change these things.

Potential Pitfalls and Common Mistakes

Getting your timing wrong is one of the most common mistakes. This is also one of the easiest to avoid. Most pension plans now have online calculator tools to help you estimate retirement.

Pay close attention to when you’ll hit certain age benchmarks versus when you’ll hit certain years of employment or service milestones. For instance, your percentage for your pay calculation may increase when you turn 65, but you get an additional year of employment a month later. You’d probably want to work the extra month.

You might even consider making a visual timeline to help you see when you’ll hit certain checkpoints. We don’t suggest hanging this above your desk – unless you want to send your boss a not-so-subtle hint.

How a Higher FAE Translates into Greater Retirement Benefits

The obvious benefit of a higher final average earnings calculation is a higher salary to base your pension payments on. One thing which may not be apparent is the correlation between your FAE and your potential lump sum payout option amount. We talk about lump sum payments in other articles, but the main takeaway is your lump sum is an up-front payment of the value of your pension over your retirement.

Depending on interest rates, more specifically the “GATT Rate” used for calculating pensions, your lump sum offer may be larger or smaller. Regardless, the higher your estimated pension from your FAE, the larger your lump sum would be.

How NextGen Wealth Can Help

NextGen Wealth works with several clients where a pension is part of their financial plan. For example, we work with clients with pensions from Evergy and elsewhere in the Kansas City area. Each person’s situation is different, but we’ve spent hours analyzing different pension options and how they fit into our clients’ situation.

We’d love the opportunity to help do the same for you. If you’re wondering how to maximize your pension and how to navigate all the other retirement questions you have, contact us today for your retirement checkup.