Critical Ages to Keep Track of in Retirement

This post was last updated on January 10, 2025, to reflect all updated information and best serve your needs.

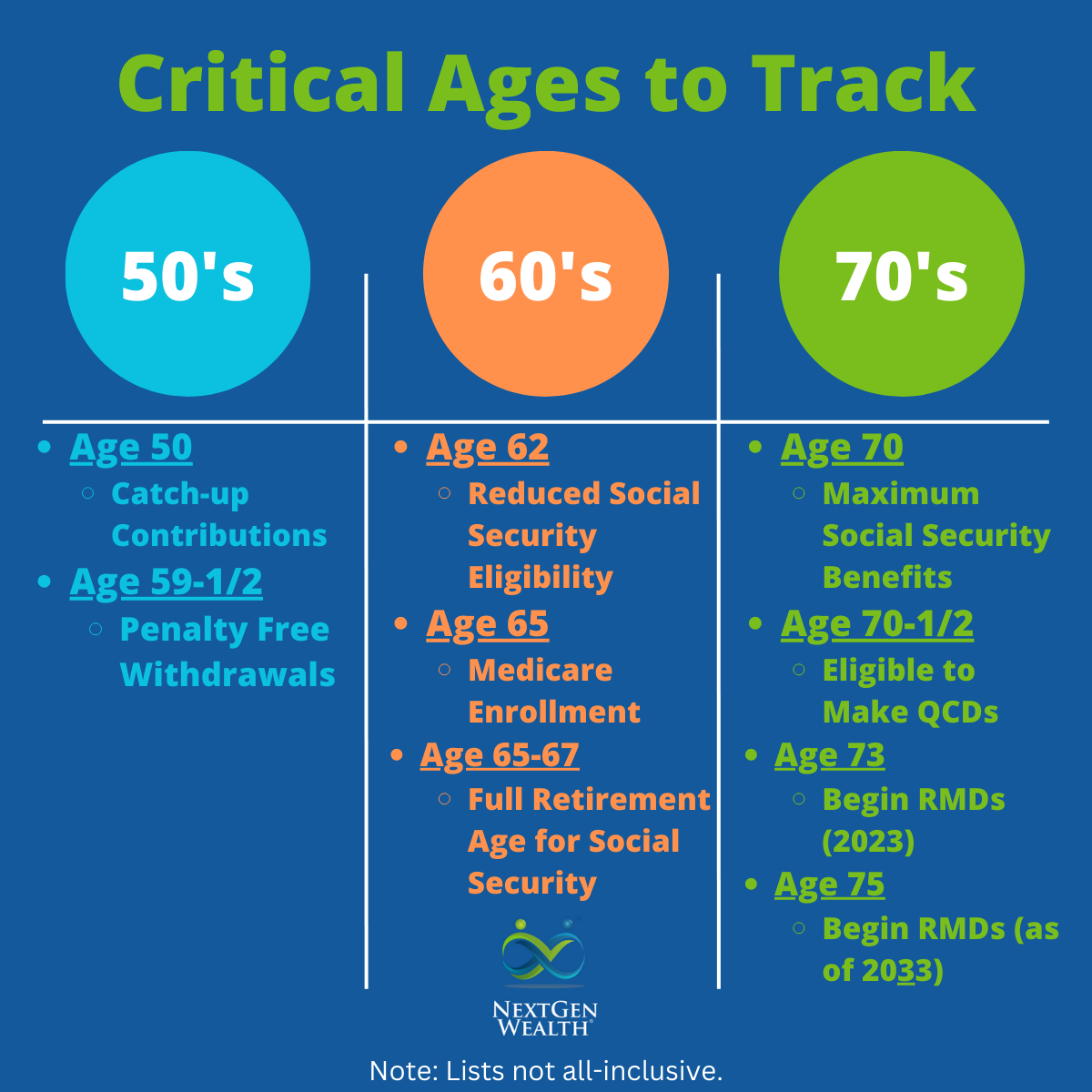

Although you might not care much about what age you are, the government does. It’s very important you keep track of key age-related milestones in retirement. If you fail to properly plan around these, you may be missing out on some opportunities – or even face penalties.

As you enter the end of your working years and transition into retirement, these key dates are critical. You really need to start paying attention to these in your 50’s and 60’s. Once you’ve reached your 70’s, the actions tied to your age start to taper off, but there are other important factors to consider.

Table of Contents

Critical Ages by Decades

The easiest way to keep these straight is to split things up by decades. This also helps tie these age-related checkpoints to the three main phases of retirement planning: accumulation, transition, and decumulation.

Catching Up in Your 50's

Starting the day you turn 50, you’ve got a few different things you need to consider. You’ll be eligible for catch-up contributions and, at the very end of your 50’s, penalty free withdrawals. You’re likely making more money than ever and you may be thinking about what the right age to retire is for you.

Catch-up Contributions

It’s highly likely you’ll be in your peak earning years in your 50’s. It also just so happens you’ll be able to contribute more money into your retirement accounts via catch-up contributions. The catch-up contributions change, but for 2025 you can contribute up to an additional $7,500 in your 401k or an extra $1,000 in your IRA.

Actually, there's even more you can contribute once you reach age 60. For those aged 60 to 63, you can contribute an additional $11,250 instead of $7,500.

Instead of the normal maximum contribution of $23,500, you could put up to $31,000 per year into your 401k, 403b (maybe more), 457, or Thrift Savings Plan (TSP). On top of your retirement account through work, you can also contribute extra money into an IRA or Roth IRA.

For IRAs, you can contribute $7,000 per year as well as an additional $1,000 catch-up contribution for a total of $8,000. You might not be eligible to contribute to a Roth IRA, but you can still contribute to a regular or traditional IRA. Catch-up contributions for SIMPLE IRAs are limited to an additional $3,500 or $5,250 if you're age 60-63. You might also be eligible for an additional 10% contribution increase.

403(b) plans also have an additional 15-years of service catch-up contribution limit. We won’t go into detail here, but there is also a lifetime limit for the 15-year catch-up. Depending on your years of service and previous contributions, you will eventually exhaust the ability to make these additional 15-year catch-up contributions.

Open a Roth IRA and Start Thinking About Roth Conversions

Although there isn’t a specific year/age you need to have a Roth IRA, by the time you’re in your 50’s you probably need to open one. You want to start the clock on the 5-year rule and to have the ability to complete Roth conversions which are also subject to the 5-year rules.

The 5-year rules say distributions from a Roth IRA are not considered “qualified” unless 5 taxable years have passed. Simply put, if you contributed to a Roth IRA for tax year 2025, you cannot take earnings out without penalty until 2030. You can still withdraw your contributions, not conversions, without penalty or tax before age 59-1/2.

Return of Roth IRA Contributions are Tax-Free

It’s important to know the return of your contributions (not rollovers) to a Roth IRA are not subject to the 5-year rules and are not penalized for early withdrawal. Because of the Roth IRA distribution ordering rules, your contributions will always be taken out first.

Roth IRA Rollovers Are Subject to the 5-Year Rule

Roth conversions are subject to a slightly different 5-year rule. Unlike your direct contributions to a Roth IRA, any amount you convert to Roth will be subject to the 5-year rules and the 10% early withdrawal penalty. You’ll also have to pay taxes on the earnings. This can get a little complicated because amounts from rollovers are distributed from your Roth IRA second – after your contributions.

Each Roth conversion has its own “clock” for the 5-year rule. For instance, if you complete Roth conversions for 5 years from 2025-2029, you have 5 separate 5-year rule time periods with the last one starting in 2029.

Ability to Withdraw Penalty Free

As you close out your 50’s, you’ll be able to make withdrawals from most retirement accounts penalty free. Once you reach age 59-1/2, you don’t have to worry about the 10% early withdrawal penalty. Now you’ll be able to use the money you’ve been saving for retirement – which will be here before you know it.

Setting Plans in Your 60's

Your decisions in your 60’s are probably the most important to your retirement success. The decisions you make immediately before and during the transition into retirement are absolutely critical. This is why NextGen Wealth puts so much emphasis on the transition phase of retirement planning.

At this point, you’ll probably be putting a lot of thought into exactly when you want to retire – or when you can retire. You’re going to be reaching many important milestones during this major time of transition.

Social Security Eligibility

Beginning when you turn 62 years old, you can start drawing reduced Social Security benefits. However, you want to have a solid Social Security withdrawal strategy so you can maximize your benefits. For the most part, once you start drawing Social Security, there’s no changing it.

Depending on when you were born, you’ll reach the normal or “full retirement age” between 65 and 67 years old. Most retirees should wait to draw Social Security until full retirement age. As a matter of fact, for many people, waiting to draw Social Security even later is the most beneficial option.

Medicare Eligibility

Being ready to enroll in Medicare is very critical. Not only is it a benefit you earned, but if you sign up too late, there could be penalties you’ll have to pay. You can use the questions on the Medicare.gov website or ask your financial advisor to determine when you are eligible.

For most people, Medicare eligibility starts at age 65. You have a 7-month enrollment period to sign up for Medicare without a penalty. The initial enrollment period is the 3 months prior to the month you turn 65, the month you turn 65, and the 3 months after the month you turn 65.

In other words, if your birthday is on July 4th, your enrollment period is from April 1st all the way through October 31st. If you get enrolled in Medicare during those 7 months, you’ll have one less thing to be scared of for Halloween!

If you’re continuing to work past 65, then you may not need to enroll in Medicare yet. However, for many people, gaining Medicare eligibility is the last piece of the puzzle to get their retirement started. Healthcare is always important – especially for retirees.

Settling Down in Your 70’s and Beyond

Things may slow down a bit in your 70’s, but there’s plenty to keep track of still. For most of us, we’ll already be retired or retiring soon. However, even if you choose not to retire yet (or ever), there are still some critical ages you need to keep track of.

Maximum Social Security

If you turn age 70, and you still haven’t started drawing Social Security, it’s probably time to start. There is no increase in monthly payments to you by waiting beyond age 70. Unless there is a very unique circumstance, it’s time to go ahead and start drawing your maximum Social Security benefits.

Qualified Charitable Contributions

Qualified charitable contributions (QCDs) might not be a huge deal for you. However, for folks who have charitable giving as part of their financial plan, it could be. At age 70-1/2, you are eligible to take distributions from your retirement accounts as QCDs.

Required Minimum Distributions

Once you reach your mid-70’s, you’ll have to take required minimum distributions (RMDs). These have changed significantly over the years. However, with the changes from SECURE 2.0, almost everyone will have to start taking RMDs starting when they’re 73 or 75 (starting in 2033).

You definitely want to pay attention because if you don’t take the required distributions, you’ll be subject to penalties. You’ll have to pay a penalty of 25% of the amount not taken out. For example, if you failed to take your RMD of $10,000, you’d have a penalty of $2,500. However, if you correct this in a “timely manner,” the penalty is lowered to 10%.

Keep Track and Plan Ahead

As you can see, there are many different milestones tied to your age as you get closer to retirement. Many actions you take will affect others. For example, Roth conversions in your 50’s and 60’s may prevent issues with RMDs later.

If you fail to plan for all these different pieces of your finances, you could be unknowingly setting yourself up for heartache in the future. Fortunately, you can prevent a lot of problems down the road through proper planning and timely financial planning strategies.

This is why NextGen Wealth specializes in the transition period covering the 5 years prior to retirement and beyond. If done correctly, everything will line up and go smoothly. Our goal is for you to enter retirement knowing you crossed all the t’s and dotted all the i’s so you can enjoy a worry-free retirement.