How the GATT Rate Changes Your Pension Lump Sum

This post was last updated on June 30, 2025, to reflect all updated information and best serve your needs.

This post was last updated on June 30, 2025, to reflect all updated information and best serve your needs.

Although defined benefit plans (pensions) are less common today, many people still rely on them for retirement income. There are specific rules governing the calculation of pension plan payouts, whether in the form of monthly payments or as a lump sum.

If you’re going to be eligible for a pension, then you need to be familiar with the role the Federal General Agreement on Tariffs and Trade (GATT) rate plays in your benefits. This is particularly important when deciding whether to take a lump sum payout.

Table of Contents

Federal General Agreement on Tariffs and Trade (GATT)

The General Agreement on Tariffs and Trade (GATT) was originally an agreement on trade quotas and tariffs after World War II (hence the name). Over the years, the GATT has evolved and influenced global policy. One of those laws changed how pension lump sums are calculated.

What the “GATT Rate” Is

Long story short, when people say the “GATT Rate,” what they actually mean is the 30-Year Treasury Rate.

Technically, the term “GATT Rate” (sometimes misspelled as "GAT Rate") is a bit misleading. This refers to a change to the Employee Retirement Income Security Act of 1974 (ERISA) made by the “Uruguay Round Agreements Act” (Public Law 103-465, 103d Congress). There were two key changes relating to lump sum pensions: the use of the 30-year Treasury Rate and the Secretary of the Treasury’s mortality tables.

Why GATT Rate and Mortality Tables Are Important

Previously, pensions were based on different mortality tables and interest rates. This meant the assumed life expectancy and rates of return used by pension funds were sometimes very different than the new standard. In other words, the GATT altered the calculation of all pensions and lump sums, which is a significant change.

Example of How Much Rate Changes Affect Lump Sums

If you increase the rate of return by one percent (1%) on $500,000 over 20 years, the ending sum increases by $231,087. In 1994, when this change was introduced, there was a 1.75% difference, representing a change of $649,551!

For companies using the earlier mortality tables and interest rates, this meant they had to invest significantly more in their pension plans to ensure they were adequately funded. At the time, many plans were underfunded.

To keep the plans funded, employers needed to put substantially more into their retirement funds. By some estimates, plan costs doubled from 1980 to 1996.

What This Means for Your Pension Lump Sum

Without getting too far down this math equation, the lower the interest rate assumptions are, the larger the lump sum should be. The opposite is also true. When interest rates are higher, lump sum payments will decrease.

Therefore, if the 30-year treasury rate is low, you’ll get a bigger lump sum. If rates are higher, you’ll get a smaller lump sum. The smaller your lump sum payout is, the harder it is to create the same level of income your pension would have provided.

This can significantly impact your decision to take a lump sum or not.

Risk in Taking a Lump Sum

If you opt for a lump sum distribution, you have to create your own stream of income. Normally, this involves building an investment portfolio (stocks, bonds, etc.) or an insurance product such as an annuity. There are other options, such as investing in real estate for income as well.

There are risks involved in all of these. Even “safe” investments aren’t bulletproof. In general, the higher the expected rate of return, the higher the risk you take on.

If your lump sum is lower due to higher 30-year treasury rates, then you’ll need to earn more on your investments. The 30-year Treasury rate also affects other investments, so rate changes may impact other investment products you choose.

Current GATT (30-Year Treasury Rate) and What It Means

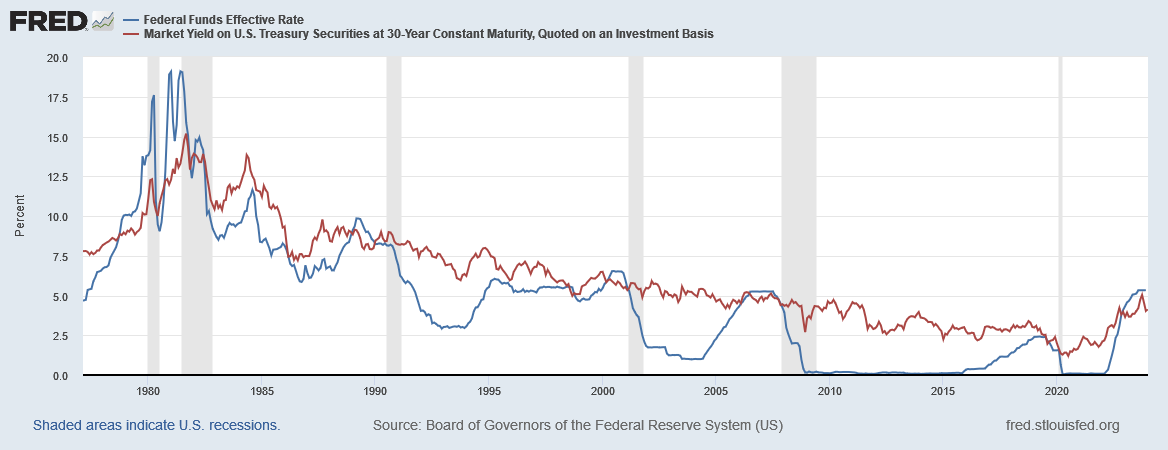

When this article was initially written, the “GATT Rate” was 3.18% on July 11, 2022. The 30-Year Treasury rate was rising and now, in June 2025, it’s risen to 4.85%, which is slightly higher than the historical average of 4.73%. This means your pension lump sum would be about "average” right now, but vastly lower than it has been over the last few years in our extremely low-interest rate environment.

Historical Relevance to Your Lump Sum

Pension lump sum calculations will change over time. If you’re nearing retirement, you need to analyze the potential impact this could have. Keeping track of changing rates is crucial if you plan to take a lump sum payout.

Current Trends in the 30-Year Treasury Rate

The 30-Year Treasury Rate is set by auction and influenced by many factors. In general, the 30-Year Treasury Rate will change closely with the Federal Funds Effective Rate (FEDFUNDS) set by the Federal Reserve Bank.

To better illustrate this, refer to the chart below, which displays the 30-Year Treasury Rate in red and the Federal Funds rate in blue. Notice how closely they move together?

What This Means for Your Pension Lump Sum

We can’t predict the future, but the Federal Rate is highly unlikely to be lower than it has been in recent history. The Federal Reserve had committed to fighting inflation by raising interest rates when this article was originally written. As inflation continued to rise, interest rates were raised accordingly.

When this happens, it means there may be smaller lump sum pension calculations. As of June 2025, the Federal Reserve chose to maintain the federal funds rate, meaning pension calculations should remain steady as well.

Right now, there isn’t anything to be concerned about, per se, but you need to know the impact on your pension. Keep in mind that this is only one part of the overall equation. There are many other factors to consider for your retirement.

Market Conditions

Market conditions can change rapidly. However, not everything is bad. If you can stand the emotional rollercoaster of investing your lump sum in the stock market, market downturns are less concerning.

The overwhelming evidence shows the stock market will recover and continue to grow. We don’t know what the future holds, but we can anticipate continued long-term growth.

Segmentation Rates and Pension Plan Common Practices

Your pension plan may not follow the GATT rate exactly, though. That's because laws are changing constantly. In practice, many pension plans use "segmentation" rates to calculate your pension lump sum.

Segmentation Rates for Pensions

The IRS sets these segmentation rates. For more information, see the current segmentation rates here. There is a slightly higher rate for later segments, resulting in a lower credited lump sum value for later years in your pension.

These "segments" correspond to the number of years between your retirement or "commencement" date and your life expectancy. As an example, a local company here in Kansas City has segmentation dates split by the first segment of the first five years of retirement (highest crediting), a second segment of years 6 through 20, and a third segment rate is used to discount payments in years 21 and beyond (lowest crediting).

Retiring Early Could Affect Your Lump Sum

In theory, retiring early means you would get a slightly lower lump sum because your payout period would extend beyond 20 years and have the lowest crediting (highest interest rate). Bottom line, it's complicated. However, most pension plans now offer online calculators, allowing you to check your potential pension payout regularly.

Always check your plan documents for your specific situation.

Conclusion and Closing Thoughts

If the decision whether to take a lump sum in lieu of your pension seems complex, it can be. The GATT Rate (30-Year Treasury Rate) and segmentation rates are only some of the factors you want to consider. There are many other variables in your situation.

Given the current 30-Year Treasury rate, lump sums may trend higher or lower into the future. If you’ve been putting off deciding whether to take a lump sum payout instead of regular pension payments, now is the time to get serious. You may be surprised at how your pension lump sum could impact you.

You’ll want to weigh all the risks and benefits of your decision carefully. Check your plan documents and use your pension's online tools to help you decipher what your pension payout might be.

Getting Expert Advice from a Fee-Only, Fiduciary Financial Planner

Deciding between pension payout options might be the most significant financial decision you’ll ever make. It’s best to get as much guidance and information as possible. We recommend consulting with a fee-only, fiduciary financial planner and other financial professionals on your retirement team before making this decision.

A fee-only fiduciary financial planner is bound to always act in your best interests. It’s a great way to get objective, data-based advice.

Working with NextGen Wealth

At NextGen Wealth, we consider your entire financial picture, not just this one decision. We guide you through our COLLAB Financial Planning Process™ to understand your goals first, then help you make informed retirement decisions. Contact us today to schedule your no-obligation Retirement Checkup and receive thoughtful, no-pressure advice.