Should I Roll My Pension Lump Sum into My 401(k) or IRA?

This post was last updated on December 01, 2025, to reflect all updated information and best serve your needs.

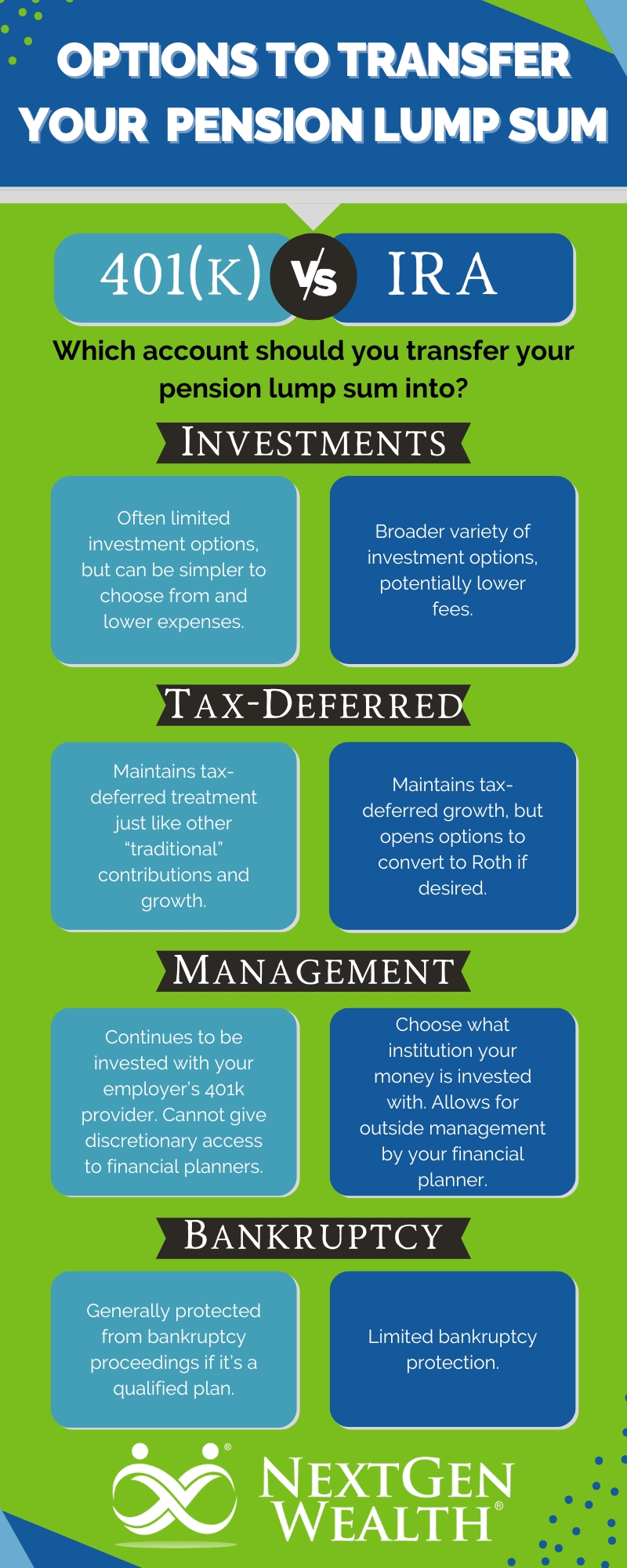

Taking a pension lump sum takes careful consideration. And if you decide to take a lump sum, you’ll have to decide whether to transfer your lump sum pension payout into your 401(k) or your IRA. The decision to take a lump sum can’t be reversed, so take it seriously.

Many different factors come into play when we’re sorting through this decision. Pension payout calculations, tax considerations, and personal goals all matter. Also, your investment style and money habits are particularly important.

Table of Contents

Understanding Your Pension Lump Sum

A pension lump sum is exactly what it sounds like – a single payment in one “lump” of money. Instead of having your pension spread out into even payments or annuitized payments, you get everything at once. Then you take responsibility for creating your own retirement income from the lump sum you received.

Many different factors influence the size of your lump sum. To start, you have to understand what the lump sum is based on. Your lump sum payment is the estimated value of the total payments you would have received from your pension. The calculation usually starts with your final average earnings (FAE) to determine your estimated annual or monthly payments.

Then the plan sponsor or actuary (or software created by one) will complete a net present value calculation using your estimated payments and the current GATT segmentation rates to determine your lump sum payment. There’s a little more to the calculation, but this is the basic process. Make sure to check your employer’s retirement plan provider to make sure you understand how your retirement benefits are calculated.

Tax Considerations and Implications

Many plans give you the option to roll your lump sum into a retirement account such as a 401k or an IRA. You can usually take some, or even all, of your lump sum in cash – we generally advise against taking money out without careful consideration. If you take a cash payment, you’ll be taxed on the amount distributed to you.

Another thing to consider is the type of account. For instance, if you’re trying to transfer into a Roth IRA, this would be considered a Roth IRA conversion. Once again, you’d have to pay all the taxes on the money converted. In both cases, you might end up paying way more taxes than you need to.

The Benefits of Rolling Over into a 401(k)

Most employers will also offer a 401k along with your pension plan. There are some unique considerations for a 401k. Often, these plans offer limited fund choices but typically have low fees.

The main advantages of rolling your pension lump sum into a 401k are bankruptcy protection (limited protection for IRAs as well), continued deferred taxation, and simplicity.

Tax Deferred Growth

One of the main advantages of a 401k is the potential for tax-deferred growth. In other words, you get a deduction from your income in the year you contributed funds and then pay the taxes when you withdraw later. Essentially, you get to “kick the tax can down the road” until retirement or until you hit required minimum distributions (RMDs).

Simplicity

The other added benefit of rolling your lump sum into your 401k is the simplicity of investment options. However, this can also be accomplished with an IRA. Investment options vary by employer (plan sponsor), but you’ll generally have a limited number of lower-cost funds to invest in.

Disadvantages to Your 401(k)

There are some disadvantages to rolling your pension lump sum into a 401(k). The biggest one is the number of investment options. Although fees may be lower than some places, expense ratios might be slightly higher than at some larger fund providers. For most individual investors, this isn’t a major issue.

The Advantages of Transferring into an IRA

An individual retirement account (IRA), also referred to as an individual retirement arrangement, is a different type of retirement account. The biggest reasons for transferring to an IRA versus a 401k are for broader investment choices, more control over your investments, and the potential for lower fees. Also, if you have more than one retirement account from several employers, it might be easier to transfer them all into the IRA versus your 401k.

Roth Versus Traditional IRA

It’s important to note the difference between a Roth IRA and a traditional IRA. As mentioned earlier, you have to make sure you’re transferring between the same types of accounts (e.g., Roth to Roth, Traditional to Traditional), or you could end up creating a taxable event. Your lump sum pension has not been taxed yet, so if you transfer to a Roth account or anything other than a “traditional,” tax-deferred retirement plan like a 401 (k) or IRA, you’ll have to pay taxes on it.

Simplifying Your Financial Life

If you transfer your pension lump sum into your IRA, it can be at any number of financial institutions – not just whichever financial institution your employer chooses. This allows you to keep everything in one place, simplifying your financial life. Instead of having a 401k and an IRA, you can consolidate both into your IRA.

Additional Options for Tax Optimization

If your money is in an IRA, you can easily complete strategies like Roth conversions or qualified charitable contributions (QCDs). You also only have to complete required minimum distribution (RMD) calculations for one account each year. If you have a 401k and an IRA, you must complete the RMD calculations for both and take distributions from both accounts.

Lower Bankruptcy Protection

Just like a 401k, there are bankruptcy protections, but there’s a limit (currently $1,512,350 as of April 1st, 2025). This topic is beyond the scope of this article, but it’s nice to know you have some protection.

Getting Assistance

Transferring to an IRA allows your financial planner to help you manage your account more easily. You can give them what’s called “discretionary” access so they can make trades, but they can’t just take all your money either.

Comparing the Two Options

At the end of the day, there’s minimal difference between rolling your pension lump sum into your 401k or an IRA. Your personal situation and preferences carry the most weight. The bigger decision is whether you choose a lump sum over other pension payout options.

Pros and Cons of 401(k) Rollovers

The biggest pro for your 401k is familiarity. If you’re planning to keep your 401k with the company it’s currently invested with, it might make sense to roll into the 401k. Also, if you’re already familiar with and like how your 401k is set up, this can potentially cut down on paperwork and the learning curve of a new company or system.

Cons of Rolling to a 401(k)

As for cons, some 401k’s have different rules when it comes to withdrawals, partial transfers, etc. Also, if you’re working with a financial planner, it might prove difficult or impossible for them to help you manage the funds inside your 401k.

You might not want your funds in your 401k if you want your financial planner to be able to make trades on your behalf or rebalance your portfolio. If they’re not able to get access, you might have to make the trades yourself or sit on the phone to complete other account maintenance.

Pros and Cons of Rollovers to an IRA

One of the biggest benefits of moving your money into an IRA is the flexibility you’ll gain. You can invest in virtually anything inside your IRA. Also, you may find the fees to be lower too.

You can allow your financial planner discretionary access to place trades and other account maintenance on your behalf. It’s simpler to implement a Roth conversion strategy with your funds in an IRA as well.

The downsides of rolling over to an IRA are minimal. If you’re not planning to also roll your 401k over to the IRA, this could add some unnecessary complexity.

Other Factors to Consider

There are many other factors to consider. These may include:

- Your current and future tax situation

- Investment preferences and risk tolerance

- Estate planning and beneficiary considerations

- Assessing the need for ongoing financial advice and management

There’s no one-size-fits-all solution. Your individual circumstances will be the most crucial factor.

Making an Informed Decision

So how do you decide what to do? We’re maybe a little biased, but seeking advice from financial professionals on your retirement team is always best. We’ve seen the peace of mind from knowing you made an informed decision.

Nobody wants to worry or wonder if they made the right decision. And unfortunately, there’s no way to go back after the fact. This is why getting a second set of eyes from a financial professional can be so impactful.

How NextGen Wealth Can Help

At NextGen Wealth, we walk you through our COLLAB Financial Planning Process™ to understand your whole financial picture and help you fit all the pieces into place. We plan around the most important variable – you.

The importance of a comprehensive retirement plan can’t be overstated. Simply put, people who have a plan and stick to it do far better. As a matter of fact, your increased financial well-being could help you live longer too.

If you want to learn more about how you can optimize your retirement savings and pension options, schedule your no-obligation retirement checkup today.