Opportunities in Down Markets and Recessions

Recessions and down markets are scary, but they can also offer lots of opportunities too! If you’re wondering what to do with your money, you’re not alone. When markets get sideways, folks tend to look to make moves to protect their assets.

Depending on what your financial life looks like, you can employ a number of tax saving strategies and other methods to boost your financial stability. There are some particularly useful strategies for down markets.

More of the Same, Keep Investing

Although it might not seem like a “strategy” in the typical sense, continuing to invest in a well-diversified portfolio through a down market or recession can yield amazing results. Although we don’t have a guarantee when or if the markets will go back up, history shows we always see a recovery.

As the stock market rebounds, the shares you purchased at a “discount” will yield even better results. The markets typically drop way faster than they recover. If you’re continually buying throughout, you’ll be buying more at lower prices than at higher prices overall. The big advantage of regularly contributing is you’ll never miss out on a good month to buy!

Even though you’re making the decision not to change anything, you’re still making a conscious choice. Sticking to your guns (and investment strategy) will pay off in the long run.

Roth Conversions

If you’ll benefit from Roth conversions, then down markets can help you out. Essentially, you’ll be able to convert more shares of stock or mutual funds for less money to taxes. This means you can get more “bang for your buck” when you convert in a down market.

Think about it like compressing air. When markets are down, you can get more shares per dollar (compressing the air into a bottle) into your Roth IRA. As the market heats back up (and the air expands), your share prices increase, and your compressed air can expand to fill the “tank” with tax-free funds. Essentially, you’re “shrinking” price you pay in taxes on the same number of shares.

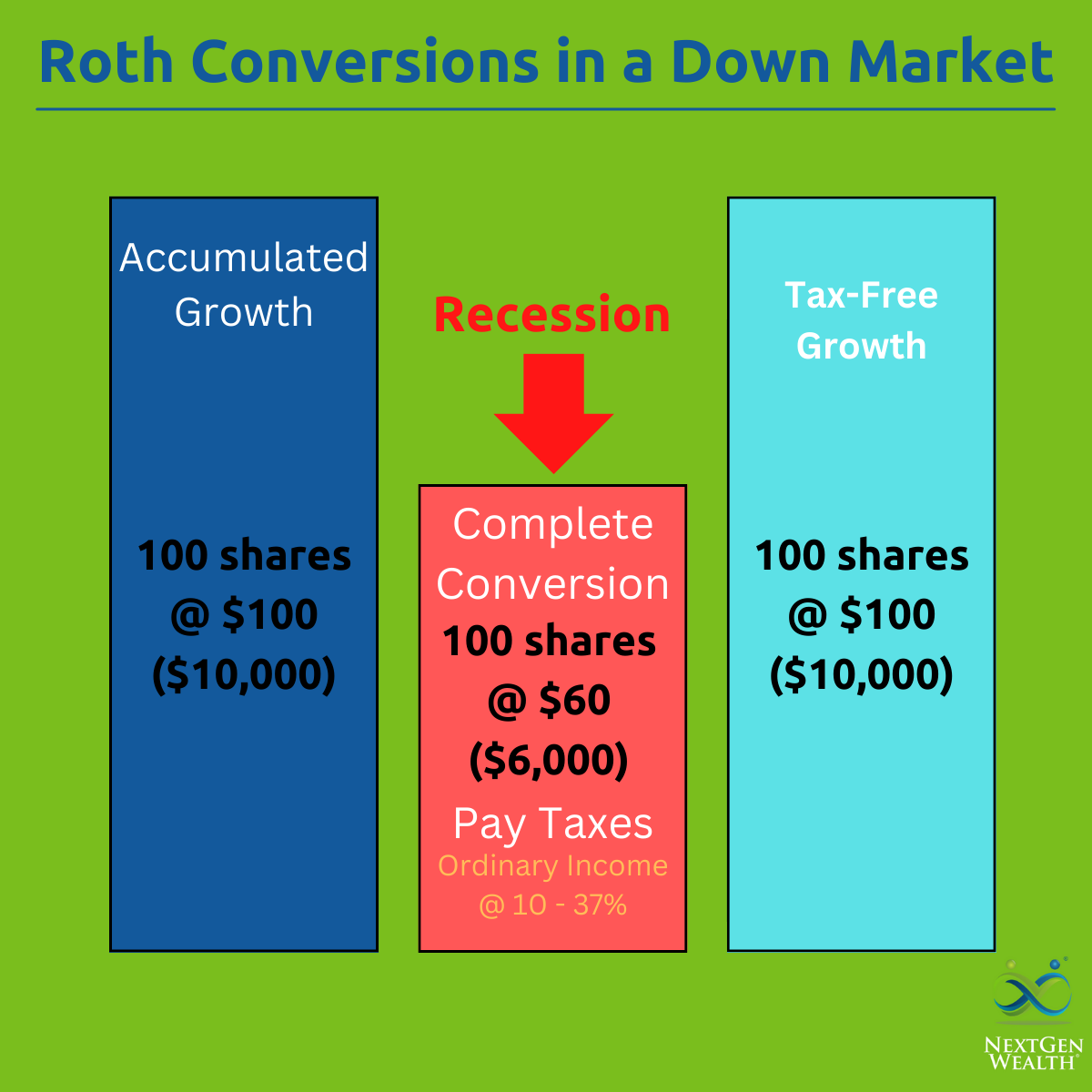

As an example, assume you have 100 shares of a mutual fund at $100 per share in your 401k for a total value of $10,000. The market “tanks” and your mutual fund shares drop to $60 per share for a current value of $6,000. If you complete the Roth conversion when the market is down, you’ll pay taxes on the market value of the shares you transfer into your Roth IRA.

When the market recovers (as it always has in the past), your shares will eventually be worth the same $100 per share or more. The difference is now you can withdraw those funds (sell the shares) and you won’t have to pay any taxes. In essence, you paid 60% of the taxes on your 100 shares versus 100% later – same shares, less taxes.

Loss Harvesting

Like converting “traditional” funds when markets are down, you can also sell them outright. This applies to funds in a taxable brokerage account. If you have shares you’ve purchased which are now in a loss position (worth less than you paid), you can sell them and purchase something else.

This allows you to claim the loss to offset some of your gains. It’s important to note that if you don’t have gains to apply the losses to, then you can only claim up to $3,000 of capital losses toward your ordinary income. You can carry the losses forward and zero out gains in the future, but this might not be much help now.

You’ll have to consider whether it’s actually worth it to take the losses now or just wait it out.

Wash Sale Rules

Keep in mind wash sale rules apply, so you have to purchase something “substantially” different. The wash sale rules basically state you can’t sell an asset (stocks) and repurchase the same asset or something “substantially identical” to arbitrarily reset your basis (amount you paid) and claim the loss. If this occurs, then you’ll still have the same original basis.

To avoid wash sale issues, you’ll need to purchase something substantially different or wait 31 days. For instance, if you sold a share of a large cap index fund, you can’t buy another large cap index fund with nearly identical holdings. You would have to purchase something completely different like a small cap or emerging markets fund.

Another thing to be on the lookout for is any dividend reinvesting in the account. If you are reinvesting dividends, those purchases still count toward wash sales as well.

Rebalancing

Although this is a normal occurrence for investors, this might be the only action needed to take advantage of a market downturn. Rebalancing is simply selling and buying assets to balance out the holdings back to your desired investment allocation for each. In essence, this takes profits from one holding and offsets the losses from another asset.

Another way to think about rebalancing is thinking about it as “volatility arbitrage.” Meaning you’ll use the steadier or unaffected value of one asset to be a counterweight for an asset with more volatility or losses. Both might be down (or up) but at different rates.

By rebalancing, you’re kind of “spring loading” the lower weighted asset for a potentially stronger rebound. When markets are up, you’ll take gains from some assets and move those to other assets to “store” value for later. When markets go down again, you repeat the cycle and slowly build up the incremental efficiency of selling high, buying low, selling high, and buying low again.

Direct Indexing

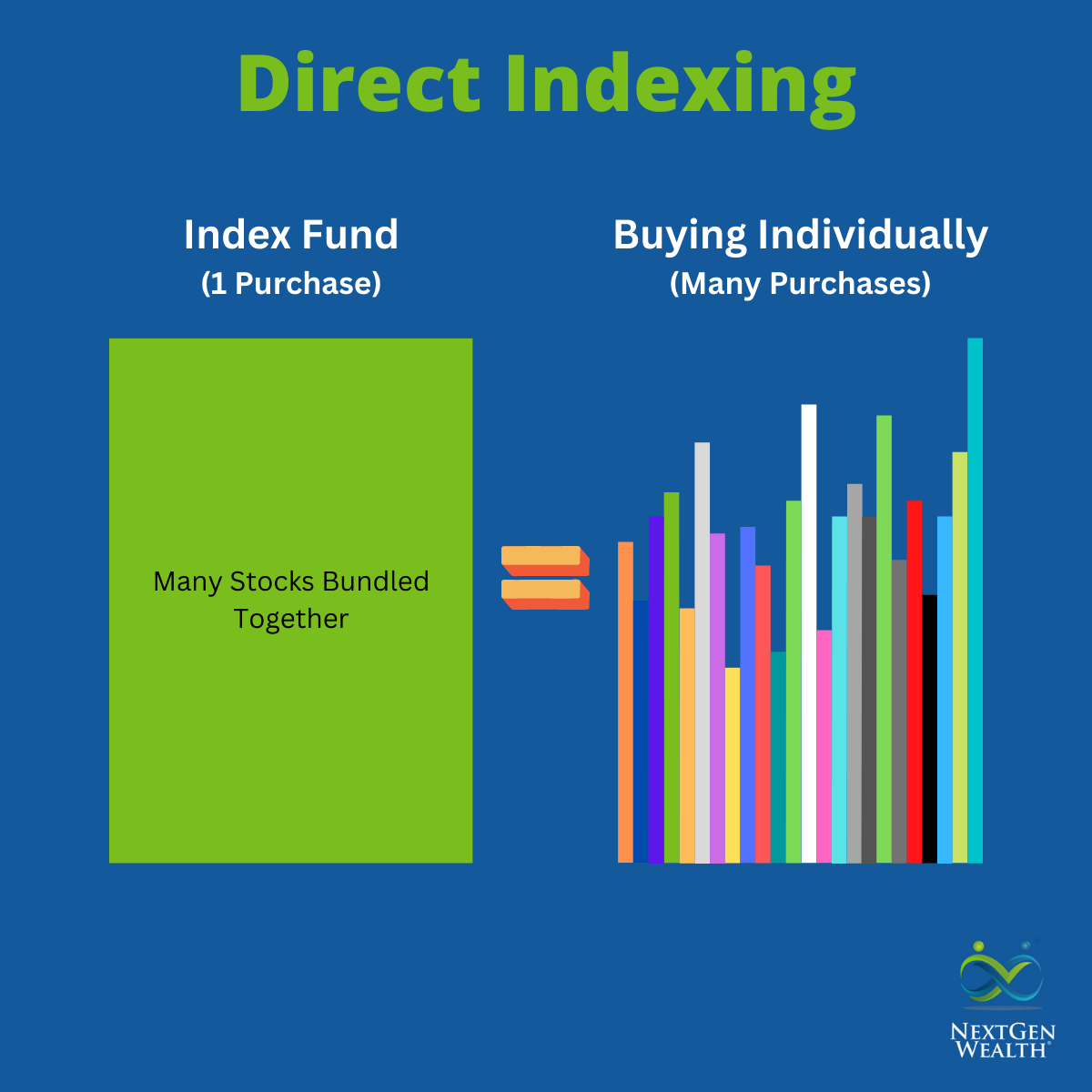

Direct indexing is another strategy for large taxable brokerage accounts. This strategy relies on capital loss harvesting and rebalancing. With direct indexing, you would still purchase the same underlying securities of a popular index like the S&P 500 or Russell 1000.

Instead of being “packaged” together like an index fund, you’re buying each separately. Over time, the individual holdings grow in value at different rates.

This does take a sizeable amount of money to implement. To buy even one share of all 503 stocks in the Standard and Poor’s 500 (S&P 500) index, you would need $86,504.98 (as of 23 January 2023). If you don’t have $500,000 or more in a taxable account, you probably don’t need to worry about direct indexing at all.

When markets or individual stocks are down, you can sell individual securities, harvest the loss, and then purchase a stock with similar characteristics. For example, if you had purchased two separate technology companies in an index, you could sell shares of Tech Stock #1 and invest in Tech Stock #2.

Then over time, you could sell shares of Tech Stock #2 and invest in Tech Stock #3. You can later sell other depreciated securities within the index, Energy Stock #1 for instance, and repurchase Tech Stock #1 and #2.

Over time, you’ll keep the same “weighting” or ratio of each stock in the overall index, but you’ll slowly harvest losses to reduce your taxable income. The overall basis (amount of money you initially paid) of the portfolio will also creep up over time. This means you’ll have less gains to realize when you sell shares for income later.

Direct Indexing Sounds Complicated

If you’re thinking direct indexing sounds complicated, you’re not wrong. Financial planners and investment advisors use sophisticated software to help implement more complex strategies like direct indexing. It’s not impossible to do this without software, just a lot more cumbersome and time consuming.

It’s also worth noting, direct indexing isn’t a silver bullet to solve all your investing problems. It can increase tax efficiency, but there’s no price performance advantage to be had. You’re going to match the performance of the market because you’re buying the same stocks in the market indices.

Should I Get Excited About Down Markets and Recessions?

Nope! A down market or recession is nothing to get excited about – good or bad. You should still be aware of what’s happening and keep an eye out for opportunities. If your portfolio is deflated, you might as well make the most of it, right?

The main thing is to have a solid investing strategy and stick to it. If you have an investment policy statement with your financial planner or investment advisor, this would tell you what you should be doing in a depressed market.

Even if you’re a DIYer, it’s a good idea to have your own order of operations for when markets go haywire. If you’re not sure what to do, feel free to contact us for additional help.