SECURE Act 2.0 Changes Going into Effect in 2023

This post was last updated on January 08, 2024, to reflect all updated information and best serve your needs.

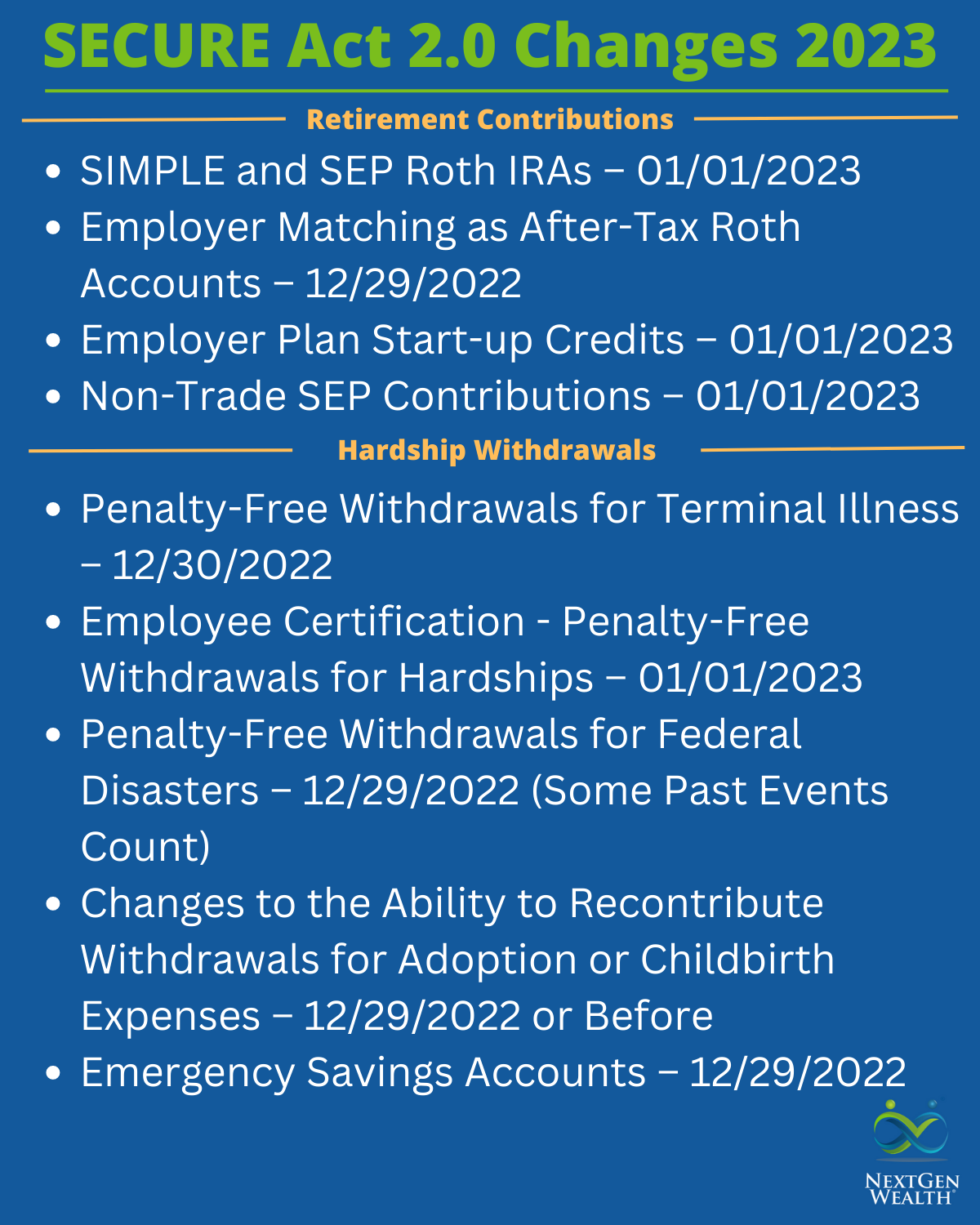

Many SECURE Act 2.0 changes were set to go into effect later, but 2023 was an important year when many changes took effect. We’ve made a list of these changes so you can more easily track them.

We’ll work through all the changes going into effect for 2023 year by “like items” instead of chronological order. This just helps keep things grouped together mentally. No need to add any more confusion, right?

Employer Contribution Plan Changes

Employer sponsored retirement plans and retirement plans for small businesses saw the most changes. We’ll touch on each briefly. We talk about some of these changes more in depth in some of our other articles.

SIMPLE and SEP Roth IRAs – 01/01/2023

SECURE 2.0 changed the rules to allow for SIMPLE and SEP IRAs to have all contributions designated as Roth contributions. This will allow small businesses to increase their ability to contribute to a Roth account.

Employer Matching as After-Tax Roth Accounts – 12/29/2022

Previously, employer matching contributions could only be on a pre-tax or “traditional” basis. With the passing of SECURE Act 2.0, employers now have the option to contribute matching contributions on an after-tax basis to a Roth account.

It’s important to note this is an option and not a requirement. There may be some time before you’ll actually see this offered as a part of your 401k, 457, or 403b plan.

Employer Plan Start-up Credits – 01/01/2023

This credit is somewhat confusing, but it is a much larger credit than the previous one. The previous credit was limited to 50% up to $5,000. The limitation is now changed to 100% up to $1,000 per employee per year.

However, this is capped at $1,000 per employee per year and then reduced to 75% the next year, 50% the next 2 years, 25% the following year, and then no credit afterward. See, we said it was confusing.

The key takeaway is there’s now more incentive for small businesses (50 employees and fewer) to establish and contribute to employer sponsored retirement plans.

Non-Trade SEP Contributions – 01/01/2023

Once again, this provision is a little confusing. However, this change removes the restriction on employer plans covering employees who are not employed in the same trade as the employer. Nannies were the example given in the law.

This change is very limited in scope but may be useful to some people.

Hardship Withdrawals

There were many additions and changes made to when hardship withdrawals can be taken. More importantly, the law adds the ability to recontribute money taken as a hardship withdrawal. Overall, these modifications to hardship withdrawal rules could prove useful for bona fide hardships.

Penalty-Free Withdrawals for Terminal Illness – 12/30/2022

Normally, early withdrawals from retirement accounts incur a 10% early withdrawal penalty. This new exception allows early withdrawals if a physician certifies the person as terminally ill.

Employee Certification - Penalty-Free Withdrawals for Hardships – 01/01/2023

This provision allows the employee (the owner of the retirement account) to write a statement to certify a hardship is an “immediate and heavy financial need.” This might make it easier for people to access their retirement accounts in the case of hardship by removing some red tape.

You would also have to certify the withdrawal was not more than what’s needed, and no other means were available. Hence the name hardship. This is only if you really can’t meet your needs otherwise.

Penalty-Free Withdrawals for Federal Disasters – 12/29/2022 (Some Past Events Count)

There are a lot of additional details and options for withdrawals if you’ve been affected by a federally declared disaster. Your “abode” or place of residence must be within the federally declared disaster area. You can withdraw up to $22,000 penalty free.

There are other interesting features to this section such as the ability to stretch out the taxes for 3 years and pay the balance back over the course of 3 years. This could be useful for many people.

This section may be retroactive in some cases. The term “qualified disaster” includes any major disaster as defined by the Stafford Act after December 27th, 2020.

This could give people, who have previously taken a hardship withdrawal due to a federally declared disaster, the opportunity to recontribute those funds.

Changes to the Ability to Recontribute Withdrawals for Adoption or Childbirth Expenses – 12/29/2022 or Before

This is another section allowing for recontribution of qualified withdrawals and is retroactive. For qualifying births or adoptions, there is an allowed $5,000 withdrawal.

Now, the ability to recontribute these withdrawals from retirement accounts is extended to 3 years. The time starts on the date of birth or date of legal adoption – even if it was prior to the enactment of SECIURE 2.0 (up to 3 years afterward).

Emergency Savings Accounts – 12/29/2022

This is another addition which is an option, not a mandate. Section 127 allows employers to create an emergency savings account separate from your main retirement account. These funds would be treated like Roth contributions and could accumulate up to $2,500 in the account.

The employer can designate automatic contributions of up to 3%. They can also make matching contributions. The account balance would be distributed to the employee upon leaving the employer.

We’ll likely see some additional rules to keep people from abusing the matching. Otherwise, this could be a nice additional benefit which employers can offer their employees.

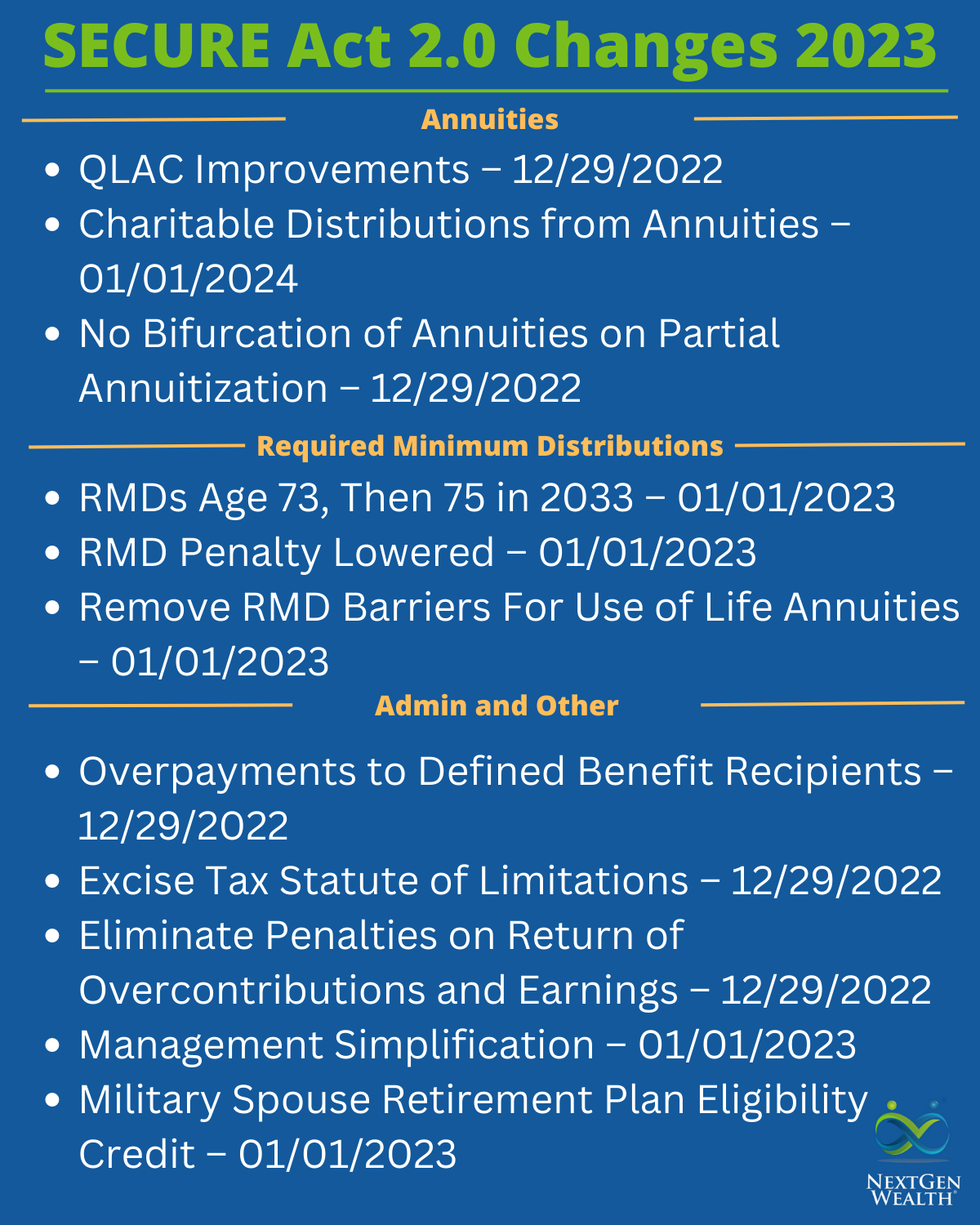

Annuity Changes and Improvements

Many annuities are expensive and have lots of fees and rules around them. However, some people choose to use annuities to cover their basic living expenses with regular income. Regardless, SECURE 2.0 has several provisions to improve the use of annuities in some cases.

QLAC Improvements – 12/29/2022

A qualifying longevity annuity contract (QLAC) is a special annuity intended to protect against the risk of outliving your life savings. Annuity payments from a QLAC don’t start until you reach your life expectancy. In other words, if your life expectancy is 84 years of age, you would not receive payments until then.

The new provision removes the old restriction on annuity payments being limited to 25% of the account balance. It also raises the dollar amount of retirement account funds used to purchase annuities to $200,000. This amount will be indexed for inflation.

For what it’s worth, we’ve never sold one of these contracts and they’re not on our list of preferred methods to insure against longevity risk. Speak with a fiduciary financial planner before seeking out limited use tools and products like QLACs.

Charitable Distributions from Annuities – 01/01/2024

There is now an ability to make a $50,000 distribution to charities through charitable gift annuities, charitable remainder unitrusts, and charitable remainder annuity trusts. If you’re charitably inclined, this might be a great option.

Also, if you have an old annuity and no longer need it, this could be an option to consider.

No Bifurcation of Annuities on Partial Annuitization – 12/29/2022

Yes, this sounds complicated, but it’s really not. If you have a retirement account with an annuity and regular investments in stocks and mutual funds, this will apply. For RMDs, you would have been forced take an RMD based on the entire balance from the regular retirement savings portion.

Now, any distributions from the annuity portion also count as the RMDs for the account the annuity is in. This is a limited use case but may be helpful to you if you have an annuity in your retirement account and are subject to RMDs.

Changes for RMDs

We have already written about required minimum distributions (RMDs) elsewhere, so we’ll be brief here.

RMDs Age 73, Then 75 in 2033 – 01/01/2023

Starting in 2023, the RMD age increased to 73 years old. This will eventually increase to age 75 in 2033. If you turned 73 in 2023, you’ll have to make your first RMD by April 1st, 2024.

RMD Penalty Lowered – 01/01/2023

The excise tax on amounts not withdrawn as RMDs is now 25% (used to be 50%). The excise tax may be lowered to 10% if the error is fixed within the “correction window” which varies depending on when notice is given and what time of year the “error” occurs.

Remove RMD Barriers For Use of Life Annuities – 01/01/2023

As we’ve mentioned, annuities can be confusing. The new law removes restrictions on annuities and allows larger increases in benefits (up to 5% per year) or lump sum payments. This allows some life annuities to meet actuarial tests moving forward.

Mistakes, Overpayments, Administrative, and Other

Mistakes happen. However, if the mistakes are on your taxes, the IRS could fine you. However, they’re not (completely) cold-blooded. There are ways to fix honest mistakes, but SECURE 2.0 makes some improvements here too.

Overpayments to Defined Benefit Recipients – 12/29/2022

In some instances, retirees are actually overpaid from their pension plans. When these mistakes are caught, plan administrators will try to recoup this money and even charge interest (doesn’t seem fair, right?). In the new law, there’s an allowance for plan fiduciaries to choose not to recoup the overpayments to avoid creating a hardship for the retiree.

Statute of Limitations for Excise Taxes – 12/29/2022

The law adds a statute of limitations for excise taxes for overcontributions or failure to take RMDs. The current law starts accruing penalties and interest starting when the violation occurred and carries indefinitely. Now the penalties and interest are limited to 3 years after the filed 1040 in the year of the violation for RMDs and 6 years for excess contributions.

Eliminate Penalties on Return of Overcontributions and Earnings – 12/29/2022

Another helpful piece of the SECURE Act 2.0 is the elimination of the 10% penalty on overcontributions to IRAs. Currently, the 10% penalty would apply to the return of excess and earnings. Removing this extra excise tax can help take a little bit of the sting out of an accidental overcontribution.

Management Simplification – 01/01/2023

When an employee elects not to participate in a retirement plan, the employer is still required to send them a lot of additional paperwork and notices which don’t really pertain to them. Instead, companies are only required to send employees a notice stating they are eligible for the plan annually. They are also required to provide other key information about the plan such as contribution deadlines.

In other words, employees who are saving for retirement in other ways than their employer plan won’t get as much spam for a service they’re not using.

Military Spouse Retirement Plan Eligibility Credit – 01/01/2023

This provision encourages employers to accelerate retirement plan matching and vesting for military spouses. The law established a credit of up to $500 per year for 3 years. Employers must allow retirement plan participation and offer 100% vested matching benefits within 2 months of the military spouse’s employment.

Lots to Keep Track of with SECURE 2.0

As we mentioned previously, there’s a lot to keep track of for SECURE Act 2.0. Many changes might not apply to your personal situation, but some things definitely will. The value of having a financial planner is we know the changes and, more importantly, we know you so we can determine what’s actually important.

We’re doing regular reviews with our clients to ensure we’re covering all our bases. Laws and rules are always changing, but our commitment to keeping up with them doesn’t. We’re always here if you need some assistance on your continuing retirement journey.