The IRS Hardship Rules Do Not Care About Your Boat

This post was last updated on April 29th, 2023, to reflect all updated information and best serve your needs.

If times are tough, a hardship withdrawal from your 401k might sound like a good solution. Hold your thoughts and do lots of research first. There are irreversible consequences to taking a hardship withdrawal for emergency situations.

To be clear, the IRS and your retirement plan sponsor will only allow hardship withdrawals for an “immediate and heavy” financial need. The IRS specifically states purchases “such as a boat or television” are not covered. In other words, the IRS doesn’t care about your boat when it comes to hardship withdrawals.

What Hardship Withdrawals Are

As the name suggests, hardship withdrawals are when you take a withdrawal from your 401(k), 403(b), or other qualified retirement account during a hardship. The IRS specifies you must prove an “immediate and heavy” need exists. You also need approval from your retirement plan as well.

Just because the IRS allows for hardship withdrawals doesn’t mean your retirement plan allows it. There may also be other limits and stipulations your plan sponsor requires too. The hardship withdrawal is different than a loan from your retirement plan.

The withdrawal may also be subject to a 10% penalty if you make the withdrawal before age 59-1/2. The distribution is also subject to ordinary income tax as well.

The only thing a hardship withdrawal allows you to do is make the withdrawal. There’s no other special treatment. Normally, you can only access funds if you terminate employment, complete a rollover (if allowed), or actually retire.

Additional Hardship Withdrawal Changes from SECURE Act 2.0

SECURE Act 2.0 added some events which qualify as a hardship withdrawal. These changes also allow for the ability to recontribute withdrawals.

Penalty-Free Withdrawals for Terminal Illness

This new exception to the 10% early withdrawal penalty allows penalty free early withdrawals if a physician certifies the person as terminally ill. The distribution must happen on the day the physician deems them terminally ill or later.

Employee Certification - Penalty-Free Withdrawals for Hardships

Now, an employee (the owner of the retirement account) can write a statement to certify a hardship is an “immediate and heavy financial need.” You also need to certify the withdrawal amount is enough to cover the hardship only and no other means to pay were available.

Being able to self-certify may remove some red tape in the process of taking a hardship withdrawal.

Penalty-Free Withdrawals for Federal Disasters

If your home (abode) was damaged due to a federally declared disaster, you can now withdraw up to $22,000 penalty free. With this provision, you can stretch out the taxes for 3 years and pay the balance back over the course of 3 years.

In some cases, you may be able to take a hardship withdrawal for past disasters. The term “qualified disaster” includes any major disaster as defined by the Stafford Act after December 27th, 2020. If you took a withdrawal due to a qualifying disaster, you might have an opportunity to recontribute those funds.

Reasons to Utilize a Hardship Withdrawal

There are some legitimate reasons someone might feel a need to take a hardship withdrawal. The most common are for the purchase or repair of a home after a natural disaster, to avoid foreclosure, or for burial costs.

Regardless, taking a hardship withdrawal only provides a solution right now and can really set you back in retirement. There are many more reasons why not to take a hardship withdrawal you should consider first.

Reasons Why You Shouldn't Take a Hardship Withdrawal

It’s best to avoid taking an early withdrawal from your retirement accounts at all costs. It’s a permanent decision.

You must prove you “couldn't reasonably obtain the funds from another source.” A written statement from you may be enough to meet this requirement. The bottom line is the IRS and 401k plan sponsor want you to be sure this is the only option left – it’s in your best interest.

Economic Downturn

If you’re scared of an economic downturn and are looking for a reason to get your money out, a hardship withdrawal isn’t it. You’ll incur taxes and penalties and miss out on all the gains when the market returns. Even if you can meet the criteria for a hardship withdrawal, taking the withdrawal when you don’t have to is not a good decision.

Other Options Available

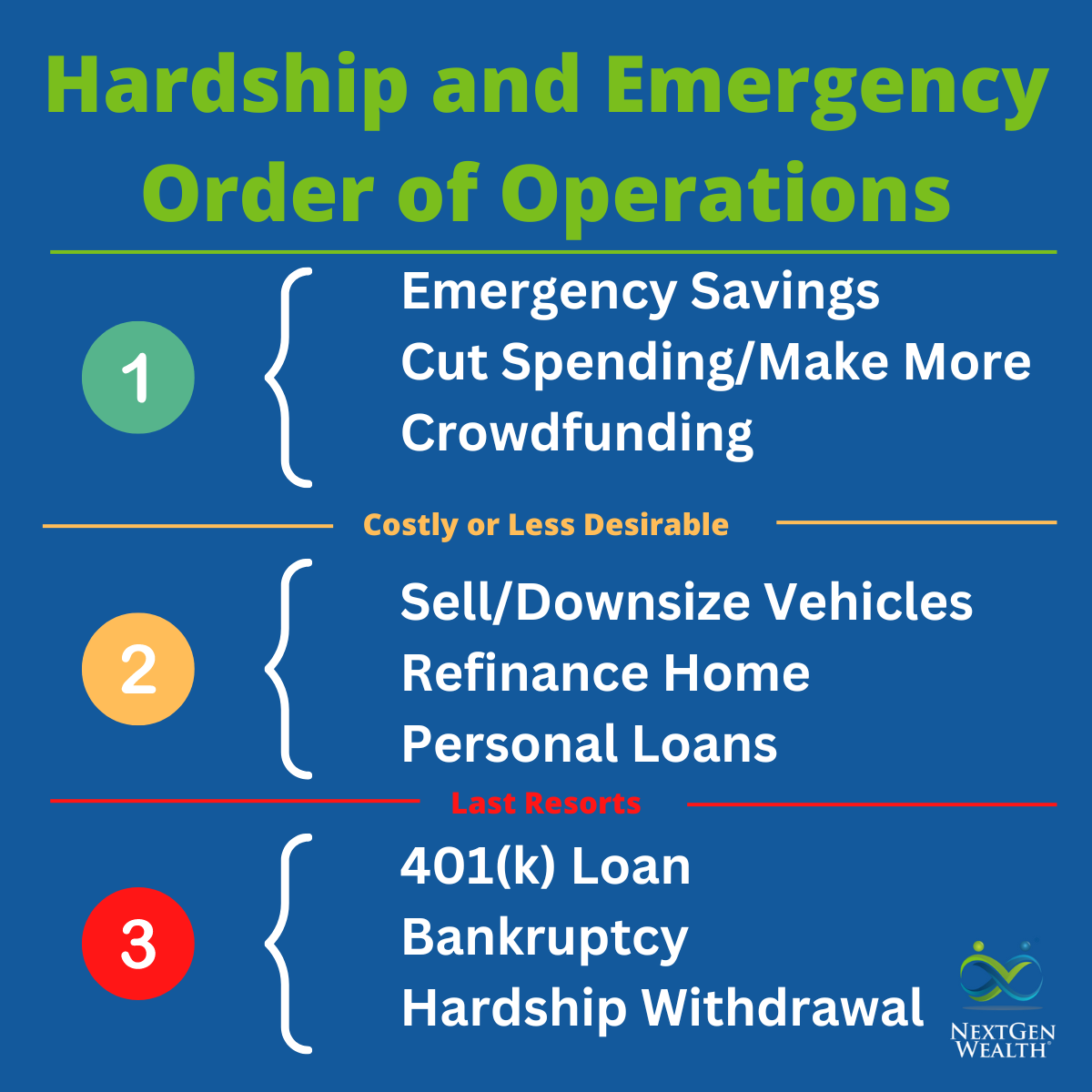

A hardship withdrawal from your 401k is not a good option if you still have other means to cover your hardship. Ideally, you’d pull from emergency savings or other sources before you took a withdrawal from your retirement accounts. However, you might have already burned through your emergency savings.

If your retirement account allows you to take out a loan, this could be a better option than an outright withdrawal. Keep in mind you must pay the money back or you may be subject to penalties and taxes if you terminate employment before it is paid back. The IRS doesn’t want you to take money out of retirement accounts except for emergencies or other special circumstances.

Alternatives to a Hardship Withdrawal

Once again, a hardship withdrawal is a last resort. There are several other options you should consider first. The circumstances surrounding your immediate need are personal to you and not all these ideas will apply to your situation.

Emergency Fund

If you have an emergency fund, this is what it’s there for. If you’re looking at taking a hardship withdrawal, you’re probably having an emergency of some sort. Use the cash on hand and keep your retirement funds growing.

Cut Spending

We know this might sound obvious, but you really want to look at where you can trim expenses to cover things. If the need is great enough, this might not be enough to make a big difference. No matter what, you need to explore this as an option so you can explain you looked here before trying to justify the hardship withdrawal to your retirement plan sponsor.

Work Extra Hours or Make More

Are you able to take on some extra shifts or overtime to help make things work? Once again, this might not be enough, and it might not even be an option. We can’t usually just decide to make more money suddenly.

There might be an opportunity for you to make a pivot or give yourself a little extra wiggle room. This might be enough to let you gain more time to research and make the best decision moving forward without being rushed.

Crowdfunding

It might seem somewhat embarrassing to ask for help, but options like GoFundMe can be a real lifesaver. We’ve all had bad days and most people would be more upset if you didn’t ask for help than if you asked for a hand-up in a time of need. As a matter of fact, helping others makes people feel good – by asking for help someone else gets the satisfaction of getting to help.

Sell or Downsize Vehicles

If you have an “extra” vehicle or boat for recreational purposes, then you might want to look at letting those go first. Although these are tied to fun and memories with family, hard times require hard choices. Temporarily letting non-essential vehicles and playthings go might be the best choice.

Personal Loan

If your bank or credit union offers personal loans, this could be a solution. Depending on your credit history, you could get an affordable loan to cover your needs. This would be preferrable to using a credit card or other high-interest loan like a payday loan or similar service.

Second Mortgage or Refinancing

If you own a home, you could tap into some of your home equity. This has some obvious risks involved with raising your payment or long-term cost of your home. This may also result in prolonging your pay off date for your mortgage.

However, you might find you can switch to a 15-year mortgage, pull cash out, and still have a similar payment and pay off date. Depending on when your original home purchase was, you might be able to get a lower interest rate which would offset the cash you pull out during the refinance.

Loan from Your 401k

We mentioned loans from your 401k as an option, but this is still not preferred. Loans are limited to 50% of your account balance up to a maximum of $50,000. For instance, if your 401k has a balance of $90,000, you can take a maximum loan amount of $45,000. Normally, the loan must be paid back within five years or when you are no longer a participant in the retirement plan (e.g., you terminate your employment).

Any outstanding loan balance upon plan termination will be treated as a withdrawal and subject to taxes and penalties. If you “fix” your problem with a loan instead of a hardship withdrawal and don’t pay it back on time, the end consequences are the same as a hardship withdrawal. It’s still not a great choice because you’ll miss out on growth of your money while the loan is outstanding.

Bankruptcy

Yes, bankruptcy is a serious financial issue to overcome. However, when looking through the lens of how to best protect your retirement, this could be preferable to withdrawing your life savings. You should absolutely seek professional advice from a bankruptcy attorney and financial planner before deciding on this course of action.

We’d rank bankruptcy at the very bottom of the list of possible solutions – right with hardship withdrawals. Bankruptcy doesn’t give you extra cash, it only restructures or reduces debt which may come with tax consequences attached.

Get Creative or Combine Options

There are numerous other ways to make things work before taking money from your retirement accounts. You may even find a combination of different things solves your problem easier anyway.

No matter what, leave no stone unturned before you commit to pursuing a hardship withdrawal.

The Consequences/Effects of Taking a Hardship Withdrawal

The biggest issue with taking a hardship withdrawal is giving up future, tax-deferred growth of the money withdrawn. This can significantly alter your ability to fund the retirement you have been hoping for. You might even have to work longer and delay retirement.

The tax hit and penalties are a close second. Just the 10% tax penalty for early withdrawal is a big enough problem all on its own.

Once you pull the money out, you can’t just put it back in. You can only contribute through your payroll deductions and there are limits to how much you can contribute each year. It might take years to recover what you pulled out.

Give Yourself Space and Make the Best Decision for You

The biggest takeaway we can give you is to create as much space as possible for you to make a decision. Take a step back, get lots of advice, and sleep on it before proceeding. Humans make better decisions with the benefit of rest and time.

Taking a hardship withdrawal should be viewed as a last resort when you truly don’t have any other options. If you’re reading this and you’re “in it” right now, we hope this helps you take a deep breath and get your bearing before moving forward. We wish you the best of luck!