Should I Keep My Employer Life and Health Insurance Policies When I Retire?

You’ll encounter many important decisions as you transition into retirement. Almost none are as important as your access to quality healthcare. Your life insurance needs will probably change too.

If you’re trying to retire early, or at least before you’re eligible for Medicare, you’ll have to weigh your healthcare options carefully. You’ll want to make the best decision for you to preserve your health, wealth, and legacy.

Table of Contents

Weighing the Pros and Cons of Employer Health Insurance

We covered this in our last article on pensioner health care. However, it’s worth discussing again because you’ll likely make these decisions simultaneously.

Understanding Retiree Healthcare Benefits

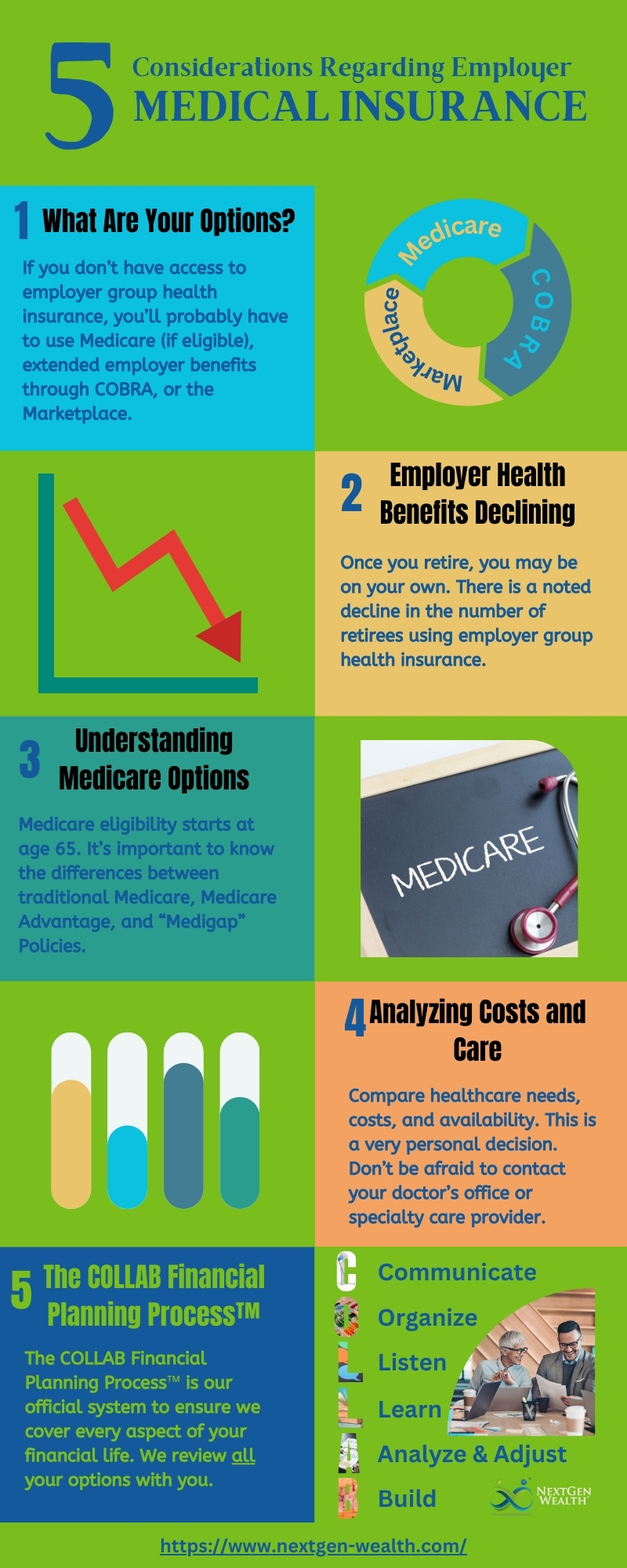

Unless you have a pension, you may not have any health insurance offered at all. Once you retire, you may be on your own as there is a noted decline in the number of retirees using employer-group health insurance.

This means you’ll probably have to use Medicare (if eligible), extended employer benefits through COBRA, or the Marketplace. While these are good options, they all have different providers and costs associated with them.

You’ll need to look carefully to see what post-retirement coverage is available from your current employer. Also, just because it’s available doesn’t mean it’s automatically better. Shopping around is a good idea – especially if you require specialty care.

Evaluating Medicare Options

We’ve covered Medicare before, but the main thing to know is when you become eligible and when your initial enrollment period starts. Unless there’s a disability involved, standard Medicare eligibility starts at age 65, and your initial enrollment period begins at age 64 and 9 months.

It’s also possible for you to continue working and be on Medicare. A rising number of employers cover Medicare-eligible employees and retirees using Medicare Advantage plans.

Traditional Medicare, Medicare Advantage, and Medigap Policies

Once again, there are a lot of different choices when it comes to Medicare. You have the option of traditional Medicare (Parts A, B, and D), Medicare Advantage (Part C), or adding a Medicare supplement (Medigap) policy.

You’ll definitely want to look at all your healthcare needs, costs, and availability. This is a personal decision, so you’ll need to do your research. Also, don’t hesitate to contact your doctor’s office or specialty care provider regarding your options.

Considering Alternatives and Marketplace Options

As mentioned, you may need to use the Marketplace as an option. If you’re retiring before you’re eligible for Medicare, you may need insurance from the Marketplace or extended benefits through COBRA.

Once again, you’ll have to weigh the options and providers in your area.

Evaluating Your Employer Life Insurance

You’ll likely have some type of group life insurance policy. You need to understand your policy, portability, and conversion options. Most likely, this will be in the form of a group term-life insurance policy.

Employers often default to a standard $50,000 death benefit or a multiple of your annual salary. You may have the option to purchase additional coverage through your employer provided plan. It’s important to note the taxable nature of employer group life insurance above $50,000.

It’s also possible you won’t even need life insurance anymore. More on this later.

Portability Versus Conversion

If you still need life insurance, then you have two potential options with your employer plan – portability or conversion. These both can provide extended coverage but in different ways. Actually, there’s a third option, dropping coverage if it’s not needed.

Group Life Insurance Portability Explained

Portability just means you can take the life insurance policy with you. You’ll have to pay the premiums on the policy, but you can keep the same coverage. However, this might not be cost-effective and might not be enough coverage.

It may be cheaper to purchase a different policy altogether. However, you’ll probably need a medical screening for new or additional coverage. If you keep the same plan, the basic terms and coverage should remain the same without the need for a medical exam.

However, term life insurance will get more expensive over time. Usually, group term policies will increase every five years or within particular “age bands” over time. More than likely, term coverage will eventually become too expensive.

The best strategy here would be to build up enough assets so you don’t need life insurance anymore. By definition, if you can live off your retirement accounts, you’re financially independent. You would no longer need life insurance to cover the loss of income due to premature death.

Group Life Insurance Conversion Explained

You may also have the option to convert your policy into a different insurance policy. This is normally some type of “permanent” life insurance option, such as Whole Life or Universal Life. These types of policies are typically more expensive, but the premiums won’t increase over time.

Once again, you may not need any life insurance coverage at all. We wouldn’t want you paying for a life insurance policy you don’t need.

Crafting a Comprehensive Retirement Life Insurance Strategy

Overall, you’ll want to get to a “Goldilocks” level of life insurance – not too much and not too little. Life insurance policies always have costs and fees associated. Actually, it’s legally required for them to charge you for a specific amount of “pure insurance” coverage.

You’ll want to make sure anyone who depends on your income is covered should you pass away suddenly. There may be other options you should explore, such as a survivorship on your pension (if applicable). A survivorship isn’t life insurance, but it can protect your spouse against losing all your pension income should you pass away.

Once again, depending on your other income sources like investment income or Social Security, your need for life insurance can, and will, decrease over time.

Moving into Estate Planning

Once we start looking at end-of-life considerations, you’ll also need to think through your estate plan. None of these things can be decided in a vacuum. Decisions during each phase of retirement planning affect the other decisions you must make.

As a part of our COLLAB Financial Planning Process™, we review this with you and make recommendations to estate planning attorneys as needed. As an added benefit, we can create basic estate planning documents for our clients through a third-party attorney. This is just another benefit included in the suite of services we provide.

Bringing it all Together

At the end of the day, you should take a hard look at the different insurance options from your employer. These benefits are very useful to you in retirement and are often affordable too. However, your situation is unique and subject to change.

We highly recommend doing an annual review of your benefits and costs. There’s nothing wrong with shopping around or looking for added benefits and plan features. It’s possible some options will improve, and others will be less beneficial.

Don’t Wait, Start Planning Now!

Simply put, the sooner you start looking at all your options, the better. You don’t want to wait until your last week (or month) at work to start your research. You can reach out to former colleagues to get some lessons learned from them too.

Retirement is a team sport, so don’t try to make this decision all on your own. There are lots of resources to help you along the way.

We’ve walked through this decision with many of our clients before. At NextGen Wealth, it’s one of the many areas we help guide you to the best choice for your family. Contact us today to see how we can help you on your own retirement journey.