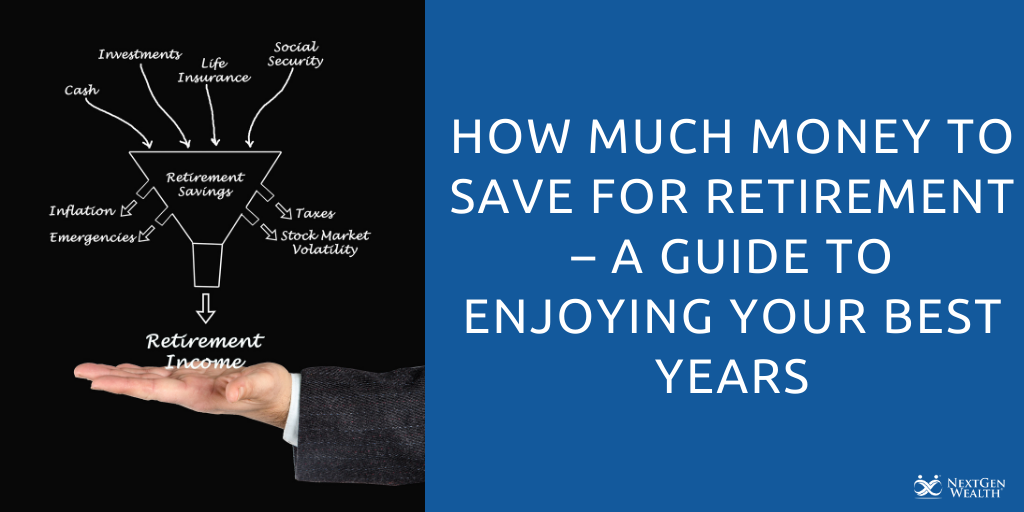

Annuities are often sold as "tax-advantaged," but what do taxes actually look like when you’re in retirement? It’s important to understand the "wait now, pay later" nature of tax-deferred growth and annuity taxation. Retirement isn’t the time to get caught off guard by tax surprises.

The name of the game is keeping more of your retirement check and not overpaying Uncle Sam. The first step in maximizing your tax strategy is understanding what you have and how your investments are taxed. This is an essential part of a comprehensive financial plan to make the most of your retirement savings.