Your Ultimate Health Savings Account Guide

Are you familiar with a Health Savings Account (HSA)? If you’re like most people, you’ve heard the term but you’re probably not sure what it is or if it makes sense for you.

If that’s the case, then it’s your lucky day because we’re going to dig into exactly what a Health Savings Account is and, most importantly, why I absolutely love them. So with that, let’s check out a few statistics that just might surprise you.

Did you know that 63% of Americans can't even shell out $500 for emergency expenses?

A 2015 survey conducted by Bankrate reveals that only 37% out of the 1000 participants interviewed have the financial ability to pay for an unexpected expense. Stuff like having your car fixed, taking your dog to the vet, or even getting your refrigerator back up and running are typical problems that fall under this expenditure.

And, while the numbers have probably changed since then (for the better, let’s hope), it gives us a glimpse at the state of a lot of people’s financial capacities. And it’s not looking good, apparently.

Which leads me to my next few questions. What if there was a medical emergency? What’s the best way to make sure you’ll have the funds for medical expenses? And, what if there was an account that offered tax-deductible contributions, tax-free growth and tax-free withdrawals? In others words, the triple threat of tax savings.

Enter: the Health Savings Account.

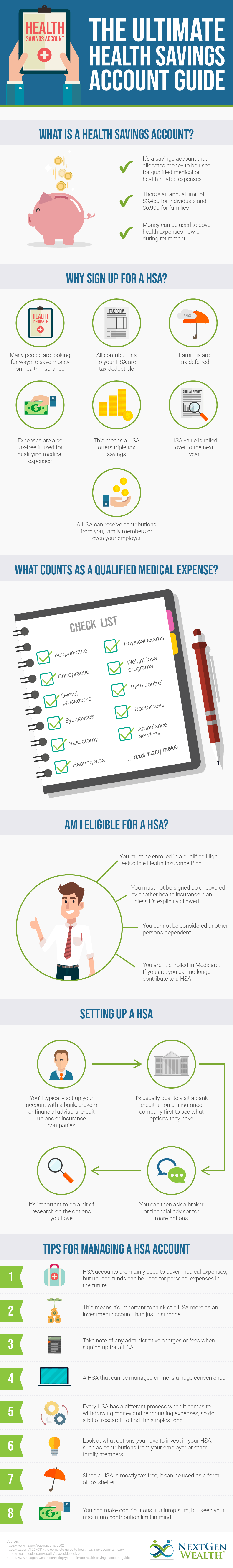

What is a Health Savings Account?

Think of a Health Savings Account (HSA) as a health-expense focused-401k. However, instead of saving for retirement, the money you allocate to it can be used anytime, tax-free, for qualified medical or health-related expenses. Like a 401k, it also has an annual limit which for 2020 is $3,550 for individual and $7,100 for families.

Here are just a few of the incredible things about an HSA:

- Contributions are tax-deductible

- Earnings grow tax-free

- The money can be used to cover healthcare expenses now or in retirement on a tax-free basis

So, how do you get access to a Health Savings Account? Well, you have to be enrolled in what’s a called a high deductible health insurance policy (HDHP) either offered through your employer or one you purchase on your own. We’ll get into exactly what an HDHP is in just a minute.

Let’s first take a look at the benefits of a Health Savings Account.

Benefits of a Health Savings Account

Brings down health insurance costs

Since an HSA is a tax-free savings account for medical expenses, you’re going to save a lot of money on taxes. It even gives the added flexibility of allowing the use of HSA funds to pay for other qualified health expense like eye and dental care (which usually aren’t covered by health insurance). As a bonus, it can also be used to pay deductibles on your health insurance and long-term care insurance policies as well.

Tax-free growth

The earnings that accumulate from your HSA grow tax-free as long as they’re used for qualifying medical expenses.

There is no use-it-or-lose-it like a Flexible Spending Account

HSA monies are rolled over into the next year, unlike a flexible spending account (FSA). As long as it sits in there unused, it will continue to enjoy tax-free growth.

Medical/healthcare expenses are tax-free

Here’s where your HSA money shines best---as long as you use it for qualified medical expenses (which is the whole purpose), the money is 100% tax-free

Tax-deductible

Like an IRA or 401k, the money you contribute to your HSA is 100% tax-deductible. So, if you pay 35% in federal and state taxes, you’re going to save over $2,000 a year if you’re contributing the maximum amount of $6,900 as a family to your HSA. Just think, that’s easily over $40,000 in tax savings in 20 years and that’s not even including the tax-free growth. Now you can see why I love Health Savings Accounts

Portability

HSA monies stay with you even if you leave your job or switch employers. You can always move your HSA from one provider to another

Flexibility

Your HSA may receive contributions from you, your employer or a family member. Also, employer HSA contributions are typically excluded from your gross income but they will count against your annual maximum contribution

Who is eligible to contribute to a Health Savings Account?

Let’s do a quick rundown of requirements for qualifying for HSAs:

- You must be enrolled in a qualified High Deductible Health Insurance Plan

- You must not be signed up/covered by another health insurance plan (except what is allowed under “Other Health Coverage”

- You are not considered another person’s dependent

- You are not enrolled in Medicare. Once enrolled in Medicare, you can no longer contribute to an HSA. At that point, you can only withdrawal from an HSA to pay for qualifying medical expenses which can include Medicare Supplements

So, how exactly does an HSA work?

Once you have an HSA set up, you can start making contributions immediately. You can actually start using these funds right away as they are vested upon deposit. If you have any (qualified) medical expenses, you can tap into your HSA funds and enjoy tax-free withdrawals.

However, if you withdrawal monies from an HSA for non-qualified expenses and you are less than 65 years old then you will pay taxes and a 20% penalty. At 65 and older, the 20% penalty is erased but you will still pay taxes. In other words, please don’t use this money to pay for non-qualifying expenses unless it is an absolute last resort – the tax-benefits are just too important.

Most HSAs issue a debit card for easy and convenient payments. If you prefer to receive a bill, you can pay for it over the phone using your debit card or simply get reimbursed with a receipt.

Contributions to an HSA must be made in cash which will most likely come from direct deposit through your paycheck or writing a check. Other forms of contributions like property or stock are not allowed. Contributions to an HSA can be made until April 15 of the next year.

Note that while you don’t have to pay taxes on distributions for qualified medical expenses, you still have to report the distribution on Form 8889.

How are HSA funds invested?

Monies put into HSA can be placed into different types of investments – which I would highly recommend. Fidelity, UMB and Vanguard, amongst most other providers, will offer a selection of investments to choose from (depending on your risk appetite or strategy) for your HSA monies.

Typically though, you have to have at least $1,000 to $2,000 in the account before they will allow you to invest the money.

When investing the funds in your HSA, I do recommend you either perform your own research to ensure you’re making the best investments or work with a financial advisor for their expertise.

Also, as mentioned earlier, these funds will grow 100% tax-free as long as they are used for qualified medical expenses.

When can I use my HSA?

As just mentioned, HSAs can be used tax-free as long as it’s for a qualified medical expense. For clarification purposes, Qualified Medical Expenses are the ones incurred by the following individuals:

- You and your spouse

- Dependents reflected on your tax return

Examples of Qualified Medical Expenses for an HSA

|

Acupuncture |

Treatment for alcoholism |

Ambulance services |

|

Chiropractors |

Supplies for contact lens |

Diagnostics |

|

Dental |

Doctor fees |

Eye surgery |

|

Eyeglasses |

Eye exams |

Maternity clothes |

|

Vasectomy |

Birth control pills |

Disable Dependent care services |

|

Hearing aids |

Lactation expenses |

Learning disability |

|

Physical exam |

Weight loss program |

Psychoanalysis |

For a more comprehensive list of includible medical expenses, you can check out the IRS’ page here.

Are there any disadvantages to having a Health Savings Account?

Here are several things to keep in mind if you’re thinking about opening an HSA:

- You have to participate in a high deductible health plan (HDHP). This means you will have higher out of pocket costs for most medical expenses. However, on a positive note, this also means you will have a much lower monthly premium when compared to the typical PPO or HMO plan. Understanding this concept is of extreme importance when determining if an HDHP is right for you. This is why I always recommend putting that monthly savings from an HDHP into your health savings account

- An HSA does not guarantee enough coverage for all types of medical expenses (e.g if your total medical expenses exceed what you have in your HSA)

- You will pay taxes and a 20% penalty for distributions before the age of 65 for non-qualified expenses. The 20% penalty is waived at 65 or older

- Some HSAs may charge a monthly maintenance or transaction fee

Who are Health Savings Accounts best for?

There’s no one-size-fits-all solution when it comes to financial matters, especially when it comes to medical expenses. But to answer that question, HSA’s are probably best for people who have minimum to medium healthcare expenses or frequently spend their own cash when paying for the types of qualified expenses mentioned above.

If you read the full list on the IRS’s page, you’ll realize that it pretty much covers the most common health expenditures (even wigs are included).

The benefits of tax-deductibility on contributions, tax-free withdrawals for medical expenses, and tax-free earnings on growth make this the most tax-advantaged account available today.

There’s no other account that offers triple tax savings. Once again, it could potentially save you tens of thousands if not hundreds of thousands in taxes over your lifetime. And, once again, why I love them.

Plus the rollover-ability and portability are just icing on the cake.

How else can a Health Savings Accounts be used?

As you can probably tell by now, a lot of people will use an HSA as a form of a tax shelter. Aside from acting as a well, you can dip into for medical expenses, it can also serve as a long-term savings tool since HSA earnings accumulate tax-free when untouched.

However, you might want to look at other options if you’re someone (or have someone) who requires frequent (and more expensive) health care needs. What you have in your HSA simply might not be enough to cover it.

You’ll also want to make sure you’re able to meet the high-deductible potential of the healthcare policy before committing to an HSA. So, if you have unpredictable cash flow an HSA might not be a good fit (unless you can fund it in a lump sum).

How an HSA can help fund your retirement

While most will see an HSA’s benefits from a “now” standpoint (since it’s meant to fund your annual medical expenses), it’s really the long-term benefits that make HAS’s more appealing. And, I have to say that I couldn’t agree more.

Think about it: If you don’t need to spend it this year, for example, it will get rolled over next year and continue to grow tax-free. Now, the annual limits may seem small to some, but add these up over the years and sprinkle in a magical dash of compound interest and you’ll have quite a nice nest egg for medical expenses in retirement.

For example, a 40-year old couple could start maxing their yearly HSA contributions until they retire at 65. Using a 7 percent rate of return, they could be looking at a potential balance of around $466,000 at age 65. And, believe it or not, that probably still won’t be enough medical expenses in retirement.

How an HSA can help you with Long-term care expenses

On a limited basis, the funds in your HSA can be used to pay the premiums for a long-term care insurance policy. That’s option #1. The second option is not to utilize it for insurance premiums but instead continue to invest it and let compound interest continue to work.

Say that 40-yr old couple decides to max their annual HSA contributions until age 65. Using the same example above, we see that they’ll have around $466,000 in their account.

If they go with option 1, they can use this money to buy a qualified long-term care insurance policy and pay the annual premiums. That in and of itself is already an excellent reason to get an HSA.

But if they go with option 2 and still get that 7% return, they’ll end up with nearly $1.3 million dollars if they hold off until age 80. Pretty amazing if I do say so myself.

Important notes about taxation on Health Savings Accounts

As mentioned earlier, HSA distributions can be used to fund expenses other than medical or health reasons. The main rule to remember is that if you’re under 65, you’ll have to pay taxes and a penalty of 20%.

Here’s a quick reference guide to help you figure out if a distribution is taxable:

- Under 65-years old — ALL non-medical related distributions will be subject to income tax and penalty

- 65 or older — ALL non-medical related distributions will be subject to income taxes (but NO penalty)

- All ages — ALL medical-related distributions won’t be taxed. Seems like the best strategy to me

Frequently asked questions about Health Savings Accounts

What are the contribution limits of an HSA?

For 2020:

- Single - $3,550 (2020)

- Family - $7,100 (2020)

Are there catch-up contributions allowed for people 55 and older?

For participants aged 55 and above, they are allowed to contribute an extra $1,000 into their HSA annually

If I’m 65 years old, am I allowed to request for a non-qualified medical distribution and not take any penalties?

Per our table above, you won’t take a penalty for a non-medical distribution---however, it will still be subject to income tax.

What happens to the funds of an HSA-holder who passes away?

If you named your spouse as the beneficiary, it will then be in their name. If you are single and have no spouse as beneficiary, the savings account will no longer be treated as an HSA and will be tagged within the federal gross income of the named beneficiary or estate.

What are the most common HSA fees and charges?

Some of the most typical ones are (may vary from one HSA to another):

- Monthly maintenance fee

- Set up fee

- Debit card fee

- Overdraft charge

- Printed check charge

- Investment management fees

Can I make my contributions in a lump sum?

Sure, but check with your HSA provider to make sure they allow it. Note that it should still not exceed the allowed annual maximum contribution limits.

Which one is better, HSA or FSA?

The ability to not lose the funds even when left unused along with triple tax savings makes the HSA a much better pick over Flexible Spending Accounts. However, you can still contribute to an HSA and Dependent Care FSA if you have childcare expenses.

Quick table of differences between an HSA and FSA

| HSA | FSA | |

| Is it portable? | Yes---the participant gets to keep their HSA funds even after changing employers | No---employer will forfeit your contributions if you leave the job |

| Can I change how much I contribute? | Yes---amounts being allocated can be updated within the year | No---the chosen amount elected by the participant cannot be changed within the year |

| Does it earn interest? | Yes---and it's tax-free | No---it does not accrue interest |

| Can I make withdrawals? | Yes--- tax-free for qualified medical expense (will be taxed and penalized if distribution is not for health reasons) | Yes--- tax-free for qualified medical expenses |

| Can I rollover my previous year's balance? | Yes | No---unused contribution will be forfeited by the employer. |

| What is the contribution limit? |

|

|

| Who is eligible? | Individuals with a high deductible health insurance plan | Employees are eligible whether they have a HDHP or not. Note, however, that self-employed individuals are not included since this is an employer-owned plan |

Health Savings Account Next Steps

If you’ve read this far then it probably means you have some serious interest in setting up an HSA.

It’s not really surprising given the fact that HSAs provide a ton of benefits whether you use it within the year or not. Just having the financial cushion during emergency health-related situations is a solid reason to get one in place.

However, the biggest benefit is the incredible triple tax-savings:

- 100% tax-deductible contributions

- 100% tax-free earnings for qualified medical expenses

- 100% tax-free distributions for qualified medical expenses

As I said, there’s no other account out there that offers these benefits.

And should you have the fortunate or flexible situation wherein you don’t have or don’t need to spend your HSA regularly, then you’re looking at the best solution available for funding your healthcare and long-term care insurance needs in retirement. This is what I always recommend if you’re able.

By following certain rules, there are ways an HSA can help you increase your bottom line by tens if not hundreds of thousands of dollars in tax savings. The key is to know what these rules are and knowing how to properly manage your HSA account.

If you need any help at all or have questions, then feel free to reach out to us any time. We’re here to get you moving in the right direction and ensure you’re making the best financial decisions that will lead you to financial independence.

This is a post from Clint Haynes, a Certified Financial Planner® in Lee’s Summit, MO. He is also the founder and owner of NextGen Wealth. You can learn more about Clint at the website NextGen Wealth.