Top 5 Things You Need to Know About Medicare Open Enrollment

Your medical care is one of the most important decisions you need to make as a retiree. Getting these top 5 Medicare considerations right could keep you from making a huge mistake. Medicare is a major part of the retiree healthcare equation.

Planning around Medicare is essential for your financial planner or advisor to consider too. Your decisions on medical care can have significant impacts on your retirement expenses.

What is Open Enrollment?

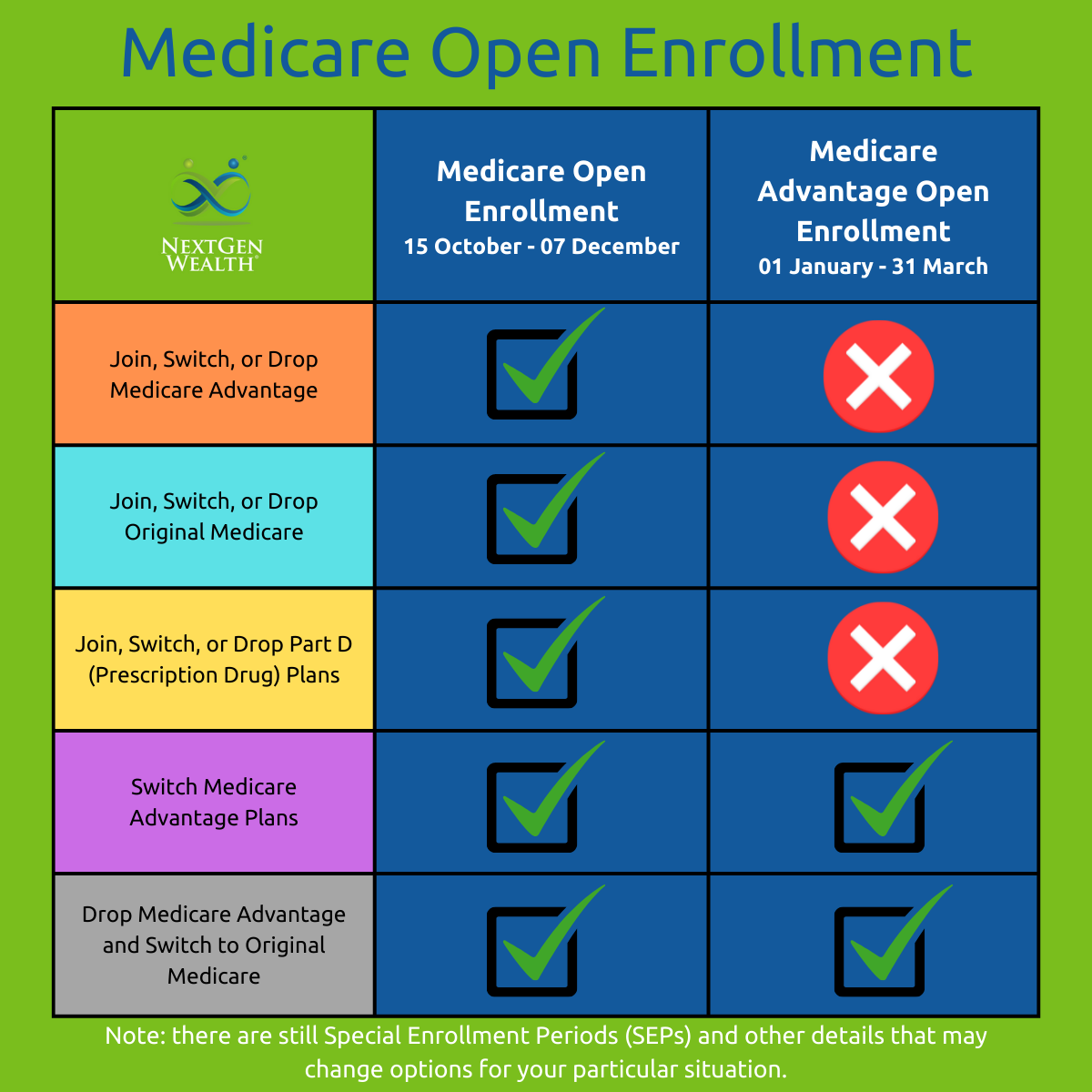

Open enrollment is simply the period when you can make changes to your Medicare coverage. Technically, there are two open enrollment periods – Open Enrollment and Medicare Advantage Open Enrollment. There are also Special Enrollment Periods (SEPs), but these are unique and separate from open enrollment.

Open Enrollment

During open enrollment, you can choose to enroll in a Medicare Advantage plan or switch to “Original Medicare” (Part B) coverage. Open enrollment is from October 15th to December 7th each year. This seems like a long time, but it goes by quicker than you think.

Medicare Advantage Open Enrollment

Medicare Advantage open enrollment is from January 1st to March 31st each year. During this open enrollment period you can still switch between plans or switch back to Original Medicare if you’re currently enrolled in a Medicare Advantage plan. You cannot switch to a Medicare Advantage plan, switch between Original Medicare drug plans, or enroll in an Original Medicare drug plan.

Have a Medicare Gameplan

The first thing to consider is what your overall plan is for your healthcare. Without a thought-out plan, you could end up making changes you’ll regret later or missing the opportunity to make critical changes. You’ll want to consider what your current health care is, any anticipated changes to coverage, changes in income, and other factors.

At a minimum, you need to know what coverage you require and when you need to enroll to avoid late enrollment penalties. You’ll also need to consider your current health and anticipated changes in the future.

Coordinating Coverage with Your Spouse

If you’re married, you’ll want to consider all healthcare options available to both of you. Timing out who does what matters too. This team sport works best when you and your spouse are using the same playbook.

If your spouse is retiring soon, look at coverage changes you might want to make now. Planning out when you both want to retire can certainly affect your healthcare decisions. For instance, if you have prescription drug coverage through your spouse’s employer and they retire, you’ll need to get adequate prescription drug coverage.

Medicare Advantage or Medigap Coverage

You need to ensure full and adequate coverage. This is where weighing your options can be tedious (because of plan variations), but also critical to having adequate, yet economical, healthcare coverage.

Purchasing a Medicare Advantage or Medicare supplement (Medigap) plan may be needed to cover all your needs. Considering these carefully now will make sure you know if you need to switch plans during the open enrollment period.

This is going to vary a lot based on specialty care needs and your physical location. Regardless, you need to know what each plan covers and total costs for each. It’s a good idea to evaluate these coverages each year to make sure premiums haven’t gone up and look for any plans which might better serve your needs.

Anticipated Health Events or Specialty Care

Another vital thing to consider is whether you anticipate needing specialty care or have a major surgery on the horizon. For example, you might be anticipating a knee or hip replacement in the next year or two. You’ll want to make sure your out-of-pocket expenses are reasonable while also having access to the best specialists for your needs.

If you have Original Medicare, then you’ll really want to look at what your anticipated coinsurance costs are. This is a percentage (20% to be exact) of the overall bill after you’ve met the annual deductible. There’s no cap on the total out-of-pocket cost.

Alternatively, Medicare Advantage plans will require a fixed copayment. You’ll pay on a per procedure or visit basis after meeting your deductible. This could mean significantly less for you. However, it’s possible a Medigap policy may make Original Medicare cheaper in your situation.

Regardless, you’ll want to make sure you have access to your doctor of choice. Many physicians and their staff are willing to help discuss some of the payment pros, cons, and best practices. Don’t be afraid to ask their opinion on cost considerations.

You’ll want to make these decisions before open enrollment or at least before it ends. If switching between Medicare Advantage or Original Medicare is best for you, you need to know this for open enrollment.

Avoid Common Pitfalls

You want to be careful and avoid common Medicare pitfalls. Not the least of which is missing open enrollment or failing to enroll in a timely manner. Timing is key – especially in avoiding penalties.

Avoid Late Enrollment Penalties

For all parts of Medicare, there are penalties for not enrolling if you don’t have coverage elsewhere. You must know when you become eligible and ensure you maintain consistent coverage throughout retirement. If you are without required coverage for 63 days or more, then you will incur penalties.

Part A Penalty

The penalty for late enrollment in Part A is a premium increase of 10%. You pay this penalty for twice the number of years you didn’t sign up.

Part B Penalty

Like the Part A penalty, you’ll pay an additional 10% of your premium for the years you didn’t enroll. So, if you were late by a year, your premium increases by 10% for the following year.

Part D Penalty

If you don’t have prescription drug coverage and fail to enroll in a Part D plan, you’ll incur a penalty which stays with you for the entire time you have Part D coverage, so basically for life! This penalty increases every month you fail to enroll by 1%. If you fail to enroll for 15 months, then you’ll pay 15% higher premiums. Bottom line, you want to pay attention to this one for sure.

Regardless of what the penalty is, you can avoid this with proper planning and foresight.

Ensure Access to Physicians with Your Best Interests at Heart

Balancing affordability with quality of care is important. This is where financial planning can be helpful. You don’t want to save a little money at the expense of your health. We can make some adjustments to make the right care for you happen.

Medicare Advantage plans only cover in-network providers. It doesn’t matter how much money you save on premiums if the best doctor for you isn’t in the network of providers available to you. You want access to caring doctors who will put your best interest at the forefront of your care – not saving costs at your expense.

How NextGen Wealth Can Help

At NextGen Wealth, we’re committed to helping you live your best life in retirement. Health care is instrumental in your overall wellbeing. Costs are something we can help solve for, but only you can decide what’s best for your health.

We employ prudent financial planning strategies to ensure your medical costs don’t rise unnecessarily. We’ll also help you get the real impact of different options to make these important decisions.

We always start with what’s best for you and then work from there. Knowing the impact and tradeoffs of each decision is important to making an informed choice. You shouldn’t have to choose your medical care based solely on costs either.

Additional Medicare Resources

When looking at Medicare on the horizon, there are some great resources provided by the Centers for Medicare & Medicaid Services' (CMS) at Medicare.gov. They have guides including the basics and getting started, when you can sign up, and how to save on costs.

No matter what, medical care is always going to be important. Medicare is a major factor for most retirees. Make sure you’re getting the most out of your benefits!