Should I Take Monthly Income from My Investments for Retirement?

Deciding how to spend down your life savings can be stressful. Working hard for decades to accumulate a nest egg is no easy feat. Spending money in retirement can be challenging because you don’t want to accidentally spend too much and mess things up.

Fortunately, you’re not the only one going through this, and you don’t have to do it alone. There are a multitude of options for what to do with the money you’ve worked hard for.

Assess Your Situation

The most important thing to do is figuring out how much you need to withdraw to live on. It’s quite possible you may not even need to use any of that money right now – or ever. I know many others might dismiss an abundance of money as a good problem to have, but it’s a real concern for many people.

At NextGen Wealth, many of the families we serve have been diligent savers and have more than enough for their comfortable, yet modest lifestyle. These are the “Millionaire Next Door” types of people – hard working, frugal, modest, and kind. Unless you saw their financial statements, you’d never know they had amassed a six or seven-figure nest egg.

This doesn’t mean everything is all smooth sailing. The plan you make today will need adjustments over time to take advantage of challenges and opportunities as they arise. Spending money you’ve accumulated over a lifetime can be hard to do sometimes.

How to Tell if You Need Additional Monthly Income

When you’re looking at your income and expenses, it’s hard to know exactly how much money you’ll make in retirement. Costs fluctuate, Social Security changes over time, and markets seem to do what they want. You’ll still want to accurately estimate what fixed expenses and income look like.

If you have income from a pension or Social Security, it’s possible those income sources cover your monthly expenses. If they don’t, then you’ll certainly need to withdraw from your retirement investments. You want to be able to spend funds using a safe withdrawal rate and have cash on hand when it’s needed.

If you won’t have enough money to live on, then you’ll need to make some adjustments. However, if you’ve saved plenty of money, then you may still need to adjust. Not spending enough can become an issue too.

When Underspending Becomes a Problem

It may seem odd, but not spending enough can become a problem. If you’re a frugal person, then spending more can seem like the opposite of what you should be doing. You need to save money, right?

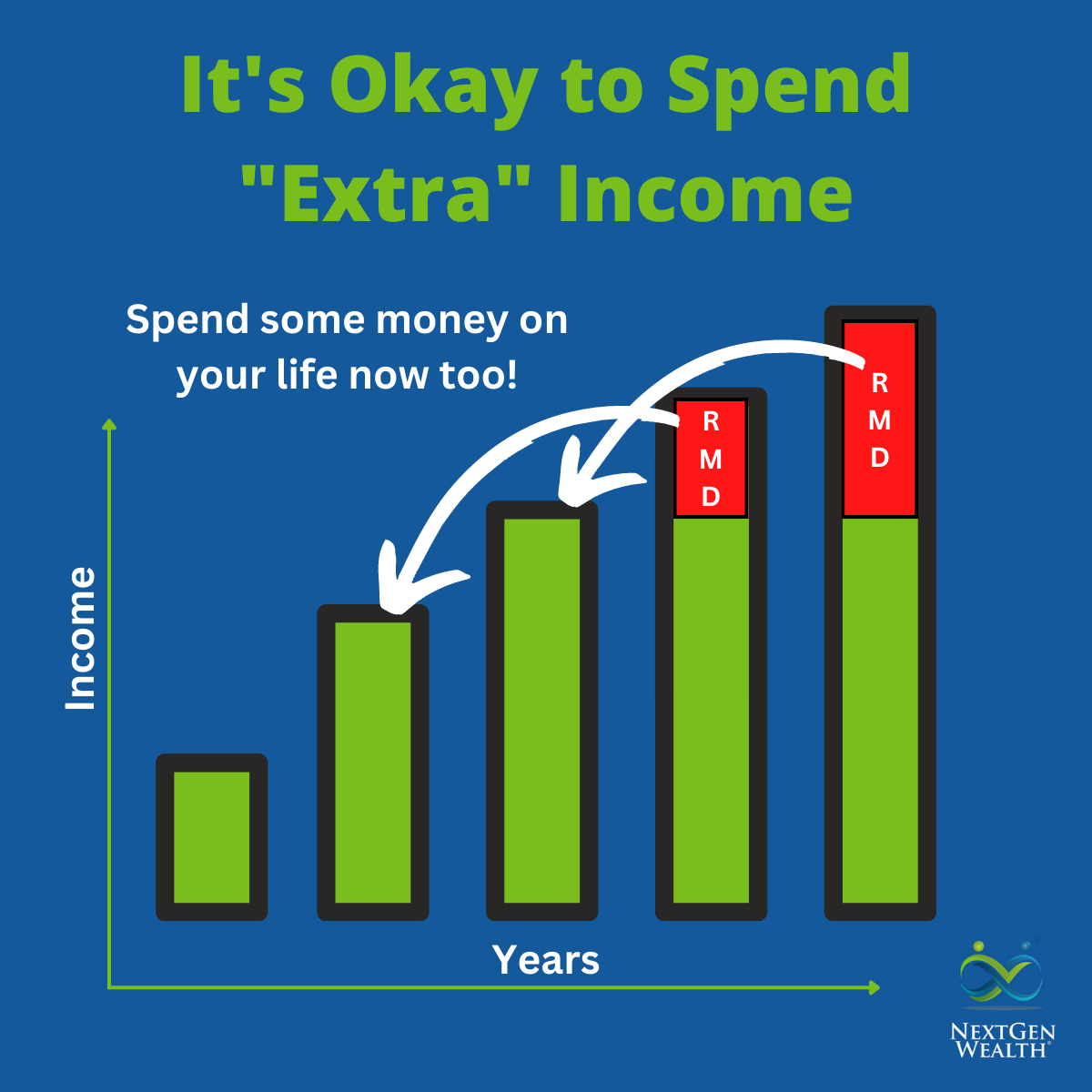

Underspending can cause unnecessary stress and cause you to miss out on opportunities. It can even cost you extra money in taxes later! That’s right, not spending enough money can cost you extra in taxes from Required Minimum Distributions (RMDs) and even estates taxes depending on the size and structure of your portfolio.

Too Much? So What?

We know it seems like there’s no such thing as too much money, but you might end up with more money than you’ll need. Eventually Uncle Sam will take his cut through RMDs – maybe more than you want him to. If so, you’ll want to employ strategies like Roth conversions or Qualified Charitable Contributions (QCDs) to avoid extra taxes.

The more you have in qualified retirement accounts, the larger your RMDs will be. This can raise your taxes. Shifting some of your spending before you reach age 72 can reduce your RMDs and save on taxes.

If you don’t “right-size” your spending, you may even end up growing your nest egg instead of spending it down. We don’t want to spend too much either. Instead, we want to have spending that’s “just right” like Goldilocks likes her porridge.

Personal Problems with Underspending

Consider the following scenario of how underspending could cause personal issues. Your children and grandchildren are successful and moved a little farther way for career opportunities (or maybe you moved in retirement). They always hint they’d like you to come see them, but you haven’t visited (or at least not often) because it “costs so much” to travel to them.

The years go by, each of you wanting to see each other more often, but it’s just “not in the budget.” As more time passes, you become unable to travel and, eventually, your children and grandchildren receive an inheritance because you’ve been such a great saver. How upset would they be if you did, in fact, have plenty of money to visit them all those times - but didn’t?

We mention this not to make you feel guilty. We’re never sure what the future holds, so there’s no judgment regardless. After all, saving is what helped create your retirement nest egg in the first place. However, if spending more money now will save you on taxes and bring joy to you and your family, then maybe it’s okay to spend some money.

No Switch to Turn on Spending

Spending more money than you “need” to can be hard to do. You may be worried about assisted living costs later in life (even though you have long-term care coverage), economic downturns, or even inflation. These are real fears, so we don’t want to dismiss them.

Many of us never want to be a “burden” on family, so saving extra for end-of-life care is a big priority. However, once the essentials are covered and there’s still money left over, then money needs to be reassigned to a different purpose. Giving money a purpose instead of “just-in-case” can unlock many benefits and help you live a more fulfilling life.

We understand “flipping the switch” to spend more can be difficult. This is when having a detailed financial plan and being clear about what matters the most to you is vitally important. If the why is big enough, the how matters a lot less.

Spending Is Okay

No matter what you choose to do, spending money is okay. In our article on RMDs, we showed increased spending earlier in retirement can actually save a significant amount of taxes. It seems like the opposite would be true, but sometimes the laws and math don’t add up the way we expect.

Your savings are just the spending of the past converted into the spending of the future. The whole point of saving for the future was for you to spend it later. Don’t be afraid to put it to good use during your lifetime.

Once we zoom out and look at your total lifespan, it makes it easier to align spending with your best years and goals. You just need to decide what you haven’t been spending money on (but secretly want to).

Revisiting Old Dreams

If you’re looking at a healthy retirement income, let some of your old dreams come alive again. At the end of this thing called life, we don’t want to leave any regrets behind. You probably won’t regret having a little more fun.

We’re not talking about drastic life changes. This can be as simple as adding a bit extra per month toward traveling to visit family. Maybe you want to take a big family vacation together once a year? Or maybe it would be nice to track down a classic car like you used to drive in high school?

Money Makes Memories Possible

As the saying goes, money can’t buy happiness, but it sure does help. The most important thing to many of us is family. When our time here is up, the memories we make will remain.

We’re not saying to take the YOLO (you only live once), haphazard approach to spending the kids do nowadays. However, an extra fishing or shopping trip probably won’t hurt a thing. Our fondest memories of our relatives are centered around experiences together.

Creating experiences and opportunities to bond with family and friends can prove to be priceless. Wouldn’t it be nice to create some additional memories with those you care about most?

Know the Details

If you’re unsure if you’ll have enough in retirement, get the facts, and see where you stand. You might be surprised. If you have a net worth of $403,800 or more, you’re doing better than 75% of U.S. households. If you have a net worth of $1,220,200 or more, then you’re in the top decile of U.S. wealth – a higher net worth than 90% of U.S. households.

A high net worth doesn’t necessarily guarantee you’ll have a great retirement though. Your unique situation and goals matter most. You need to analyze your estimated spending now and throughout retirement.

However, not knowing exactly where you stand makes projecting for the future kind of impossible. You need a clear picture of where you’re going and how to get there. This isn’t a dress rehearsal; you’re center stage in your life’s story - we’re filming live.

How NextGen Wealth Can Help

Whether it’s helping decide the optimal Social Security withdrawal strategy or seeing if you can add Chiefs season tickets to the budget, we can help get all the math right for your retirement. We work with you to uncover the most important aspects of your dream retirement and unlock what’s possible.

Although we’re trained in all the nitty gritty financial details, you are what matters most. We take care of all the details so you can make decisions with confidence, not fear.

Bottom Line and Brass Tax

It’s okay to spend money with purpose and intention. If you’ll have enough money to live on, then the “extra” money is a valuable tool to maximize the one thing you’ll never get more of – time. If you’re scared or unsure, you’re not alone.

Make a plan, get clear about what matters, and make the most of life.