Is a Survivor Benefit on My Pension Worth It?

Thinking through your pension decisions and transitioning into retirement is hard enough. Adding in planning for your premature death is even more stressful. However, there’s no replacement for peace of mind knowing your family is covered no matter what.

Adding a survivor benefit to your pension isn’t a decision to be taken lightly. There are often many variations and levels of coverage to consider too. Make sure you take your time to think through this decision by looking at your whole financial picture.

Table of Contents

- Understanding Survivor Benefits

- How Survivor Benefits Impact Pension Payouts

- Eligibility Criteria and Qualifications

- Financial Implications

- Tax Considerations for Survivor Benefits

- Weighing the Risks and Benefits

- Survivor Benefits as a Form of Insurance

- Aligning Survivor Benefits with Legacy Goals

- Evaluating the Role of Other Financial Assets

- Consulting with Financial Professionals

Understanding Survivor Benefits

First, let’s talk about what a survivor benefit on your pension is and how it works. In short, a survivor benefit, commonly called a Joint and Survivor Pension, pays your pension, in part or in full, to your designated beneficiary (usually your spouse) should you pass away before they do—otherwise, your pension stops when you die.

There are generally several different options to choose from, giving you some flexibility. Typically, your survivor benefit will be a percentage of your pension payout ranging from 50% all the way up to 100%. Many plans, including Evergy and the Public School and Education Employee Retirement Systems of Missouri (PSRS/PEERS) pension plans, offer 50%, 75%, and 100% survivor benefit options .

How Survivor Benefits Impact Pension Payouts

It’s important to understand these benefit options come at a cost. You may end up with a lower monthly payout compared to other pension payout options. As with anything, you can’t make this decision without considering other factors.

You’ll need to consider whether your spouse or other beneficiary actually needs the income if you pass away too soon. You might be able to designate a different beneficiary than your spouse, but there may be different costs associated with choosing a non-spouse beneficiary. Also, in the case of certain beneficiaries, you need to be careful to avoid causing other issues like the loss of Social Security benefits for a child with a disability.

Eligibility Criteria and Qualifications

For the most part, eligibility is based on your employer’s specific plan, if they offer a survivorship option at all. Some plans may require a health screening. This may also have an impact on your eligibility and costs for the joint and survivor options.

Many plans assume your spouse will be your designated beneficiary of the joint and survivor option. Pay close attention to any changes to benefits and specific eligibility for designating a beneficiary other than your spouse.

Financial Implications

The most notable impact on your overall financial picture is reducing the risk of losing household income upon your death. Lost income can also be handled with other tools like life insurance. You’ll need to look at all options and make the decision for you and your family.

The survivor benefit may not be enough to totally replace life insurance. However, it may reduce how much life insurance you need. More on this in a moment.

Assessing the Monetary Value of Survivor Benefits

Without knowing all the details of the remainder of your life and your spouse’s life, it’s impossible to know the actual dollar value of your joint and survivor pension option. However, we can start by looking at the short-term impacts it will have and then think about the long-term potential benefits and risk reduction it provides.

Impact on Monthly Pensions

There is an impact on your monthly payout. You’ll incur costs to pay for the joint and survivor option. This is usually paid for by a reduction in your monthly pension payment to you.

A Quick Note on Life Expectancy Factors

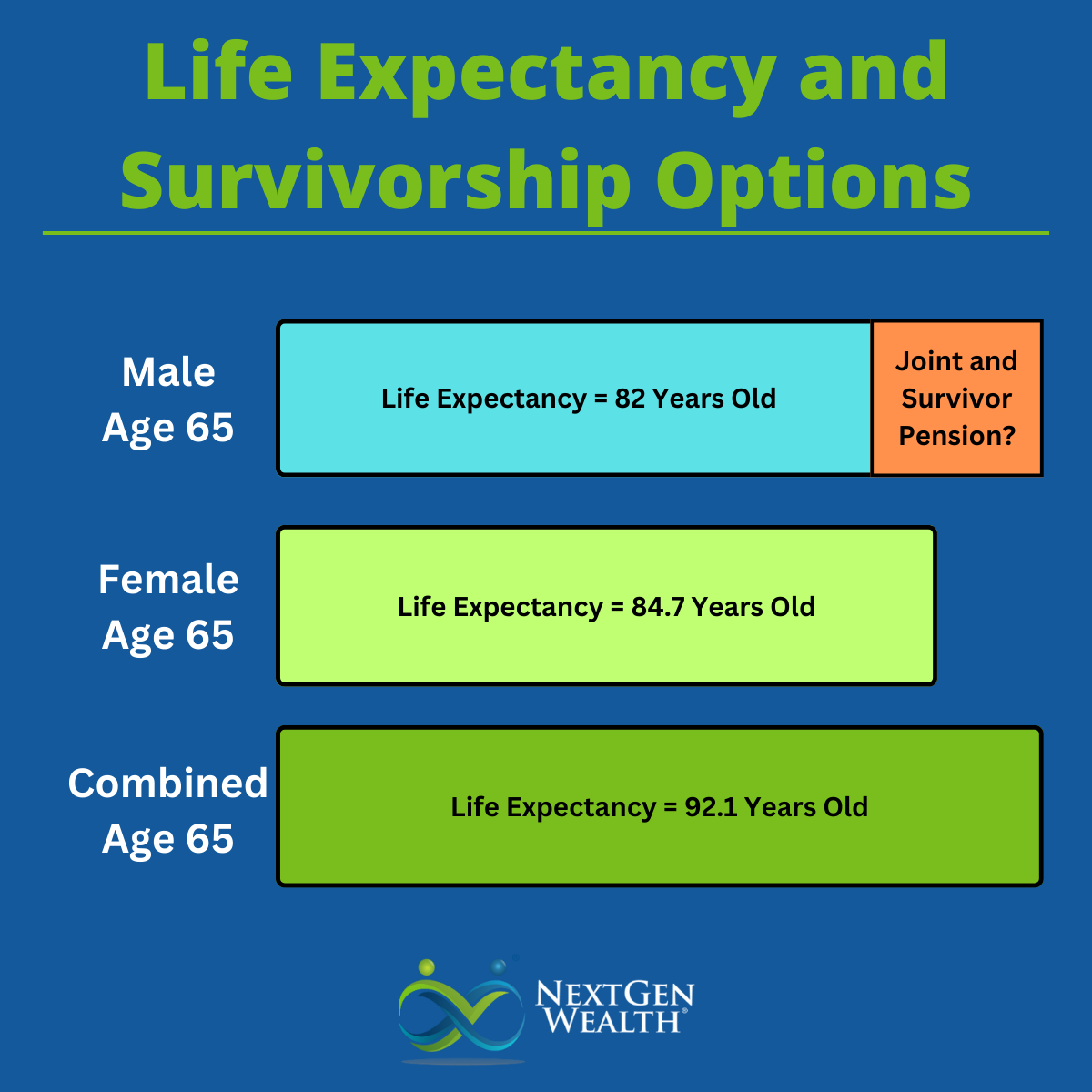

It might seem odd for a joint and survivor option to cost more – especially if your life expectancy is higher than your spouse’s. However, a couple’s combined life expectancy is much higher than either spouse on their own.

At age 65, a male is expected to live to 82 years of age, a female is expected to live to 84.7 years of age, but for a couple (both aged 65), your combined life expectancy is 92.1 years (27.1 years life expectancy at age 65). Using these types of statistics, you can start to see why the pension plan needs more money to pay for this option.

In other words, together you’ll have to fund retirement even longer. This means you may need your pension to provide income to you or your spouse much longer, which increases the amount of money needed to fund those extra years. This added cost is calculated by the plan’s actuaries and then passed on to you.

Tax Considerations for Survivor Benefits

Most pension benefits are taxed at the federal and state levels. However, some states, like Missouri, allow exemptions for some or all of your pension benefits. In most cases, these same rules and exemptions should apply to your beneficiary.

This is important because having a guaranteed income is a great thing. However, having continuous taxable income could limit the benefits of certain tax-saving strategies such as Roth conversions. Everyone’s situation will be different, though.

Weighing the Risks and Benefits

Overall, you’ll need to weigh the pros and cons of your situation and make the best decision you can. Nobody knows how long we’ll live, so we plan for the scenarios we can. The name of the game is to ensure your family is provided for – no matter what happens.

Ultimately, a joint and survivor pension payout option is just another tool for you to consider.

Analyzing the Long-Term Financial Security

You’ll want to look at you pension income, other income streams like Social Security, and other tools at your disposal such as life insurance – with your full pension and with the survivor benefit. This isn’t a fun exercise, but you should run through potential “what if” scenarios.

It’s also important to take any health conditions or specific care needs into account. Does it make more sense to pay down the mortgage (reduce expenses) and skip the survivor benefit? Are there other assets or income streams for your spouse to live on?

Survivor Benefits as a Form of Insurance

We briefly mentioned life insurance earlier. We want to point out the differences between life insurance and a survivor benefit on your pension. They are functionally two different things but could serve similar functions.

Part of deciding between the two is taxation. In general, life insurance proceeds are a tax-free benefit. Pension payouts are not. However, life insurance often comes in a lump sum (although not always).

If your spouse isn’t very comfortable managing large sums of money, handing them a huge life insurance payout at one of the most stressful times of their life may not be very helpful. Would the monthly payment from your pension be better for your spouse?

Aligning Survivor Benefits with Legacy Goals

Another consideration is what, if anything, you want to leave behind. If you want to leave your remaining assets to other heirs or a charity, having the higher paycheck and then paying for life insurance might seem like the best option. However, depending on the type of insurance and health status, you may end up paying high premiums.

You’ll want to speak with your financial planner, tax professional, and/or an estate attorney to implement your legacy gifting.

Evaluating the Role of Other Financial Assets

Other assets such as your 401k, primary residence, rental properties, annuities, or other investment assets all come into play. Each asset and income stream has its own benefits, which could affect one another. You’ll want to make sure they all come together for a cohesive retirement income plan to best serve you.

Consulting with Financial Professionals

Getting professional help is always a good idea. We’re a little biased about the importance of seeking expert advice, but we see the positive impacts of financial planning every day. We do what we do because we believe in the power of intentional planning to achieve your goals.

Whether you work with NextGen Wealth, or another financial planner, we can’t overstate the value of financial planning, tax planning, and estate planning.