Avoid Probate with These Two Free Methods Anyone Can Use

Probate can be quite a headache. Fear not! There are two not-so-secret secret weapons in your estate-planning arsenal, known as Transfer-on-Death (TOD) and Payable-on-Death (POD) designations.

These simple, yet overlooked methods are an easy and free way to avoid losing time and money to probate. Don’t burden your loved ones with complicated and confusing processes to claim their inheritance.

TOD and POD Designations

Estate planning is important for everyone, regardless of your age or wealth. Whether you want to think about it or not, we’ll all pass someday. You may as well be prepared – your family will thank you.

TOD and POD designations are two free ways to avoid probate. These may take a little bit of time to set up, but a few minutes on the computer or phone could save your loved ones a ton of time and frustration. Being the executor of someone’s estate is no walk in the park – especially if things weren’t in order to begin with.

What is Probate?

Probate is the legal process of transferring assets from a deceased person's estate to their heirs. However, there’s also room (usually about 4-6 months) in the process for creditors to come and claim any money they’re still owed. There’s also the chance for people to contest the will (if you have one).

Probate can be confusing, time-consuming, and expensive. It might take months or sometimes well over a year to settle your estate through probate – especially if your estate is complex. There are all kinds fees and your heirs will have to hire an estate attorney for any estate larger than $40,000 in Missouri.

In other words, it can get messy pretty quickly.

How Do TOD and POD Designations Work?

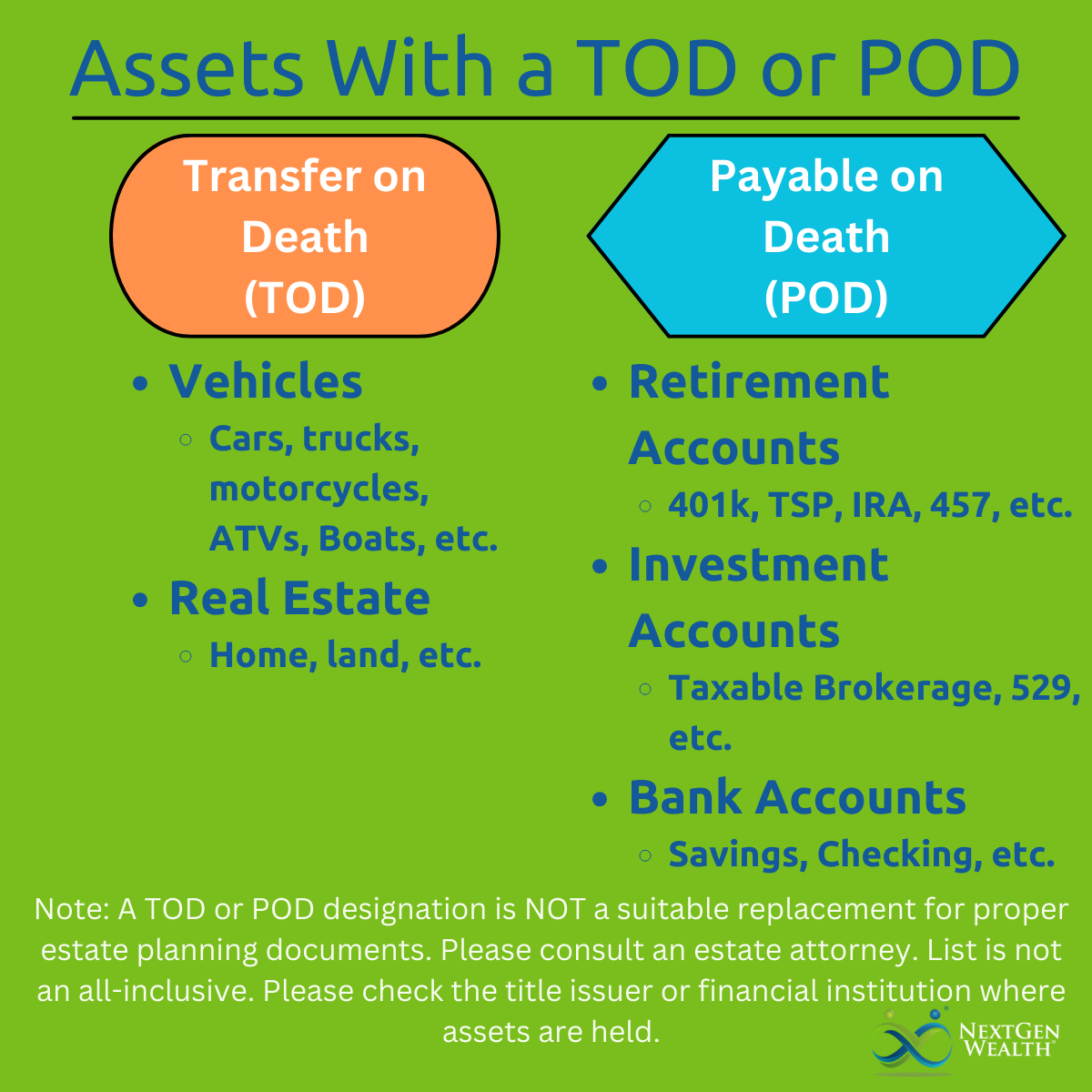

TOD and POD designations can help to avoid probate by transferring assets directly to the beneficiaries named on the title, deed, or account. When an asset or account has proper beneficiary designations or uses a TOD or POD designation, the assets pass to your heir without needing to go through probate at all. Both methods are very similar, but there are some differences between states, types of assets, and account types.

Transfer-on-Death (TOD)

Transfer-on-Death (TOD) designations are used for assets such as real estate and vehicles. This varies from state to state. In Missouri, you can designate a TOD beneficiary when you apply for your vehicle title with the Department of Revenue. If you didn’t name a TOD when you first applied, you can complete a new title application and designate one.

As long as there’s a TOD beneficiary, there’s not much additional documentation needed other than proof of death and the proper title application forms. Missouri does list some exceptions for spouses and unmarried minor children (under 18). However, it’s always best to have everything titled and designated properly from the start.

House Deeds May Be Different

For the deed of your house, you may also register a TOD designation on the deed. However, you’ll have to have this notarized. This is probably something you’d need to go through a title company and pay fees to do. However, if you’ve titled the property jointly with your spouse, this may not be necessary.

Payable-on-Death (POD)

Payable-on-Death (POD) designations are used for financial accounts such as bank accounts, retirement accounts, and brokerage accounts. These may be easier to update than a TOD on a title or deed. When you make a POD designation, you name the person who will receive the asset when you die. The asset will then transfer to the beneficiary directly, without going through probate.

The process for designating POD beneficiaries will be different for different account types and different financial institutions. For most banks and brokerage firms, you can update the beneficiary online. However, some accounts like the federal Thrift Savings Plan (TSP) may require a witness to update the beneficiary designations.

Exceptions to TOD and POD Designations

One key distinction is jointly titled assets. If you have someone else listed as a joint owner, you may not need a TOD or POD designation. For many married couples, you likely have important assets like your house or vehicles titled jointly. However, this isn’t always the case.

Also, not everyone will want to title everything jointly. It’s a personal decision. You might have an asset you want to go to another heir in the family line.

Benefits of TOD and POD Designations

Avoiding probate is the biggest benefit of TOD and POD designations. They are a free and easy way to avoid probate. This will significantly speed up the process of transferring ownership and get everything titled in the new owner’s name.

TOD and POD designations help you maintain privacy. The details of your TOD and POD designations are not made public. Alternatively, court records, including probate, are public information. Avoiding probate with a TOD or POD designation can help to protect your privacy.

TOD And POD designations can give you some flexibility too. You can change your TOD and POD designations at any time, as long as you’re still alive. Keep in mind, there may be some time and fees associated with retitling vehicles or real estate.

Drawbacks of TOD and POD Designations

There are many benefits of having proper TOD and POD designations. However, there’s always some drawbacks and nuance to any situation.

Not all assets can be transferred through TOD or POD designations. If the asset doesn’t have a title, deed, or account number, it can’t have a TOD or POD designation. There may be some important family heirlooms like firearms or other collectibles you might want to go to specific people. A TOD or POD can’t do this.

Will and TOD/POD Don’t Match

The beneficiary of a TOD or POD designation may not be the same person who is named in your will. If this happens, you may end up inadvertently creating confusion over who gets what. Also, if you got married, divorced, or had a child after designating a TOD or POD beneficiary, you may have forgotten to update this.

At NextGen Wealth, we check for TOD and POD designations during our COLLAB™ Financial Planning Process. However, you can double check your own designations as well. It’s critical for your will and other estate planning documents to match your beneficiary designations and vice versa.

Bottom line, if there’s a dispute over the ownership of an asset, TOD and POD designations may not be enough to resolve it.

Lack of Control Upon Transfer

Another key drawback of a TOD, POD, or other beneficiary designation is the lack of control once transferred. If you named a minor child as the beneficiary, this could create some issues. Other estate planning tools such as properly formed trusts may be necessary.

Final Thoughts and Action Items

Overall, TOD and POD designations are a great way to simplify the probate process and give your loved ones’ peace of mind knowing your assets will be transferred to them quickly and easily. However, this isn’t a substitute for proper estate planning.

You’ll still want to get the basic estate planning documents like an up-to-date will. In some cases, a trust may be needed for your particular situation. Contact your estate attorney to ensure you have everything covered.

If you’re wanting to get more serious about planning out your financial future, be sure to reach out to get your free 15-minute consultation and see if NextGen Wealth is a good fit for you. We can look at your whole financial picture and make recommendations for an estate attorney as needed.

No matter what, make today the day you get serious about your estate planning documents and designations. Reach out if you want us to help guide you through the process as one of our clients.