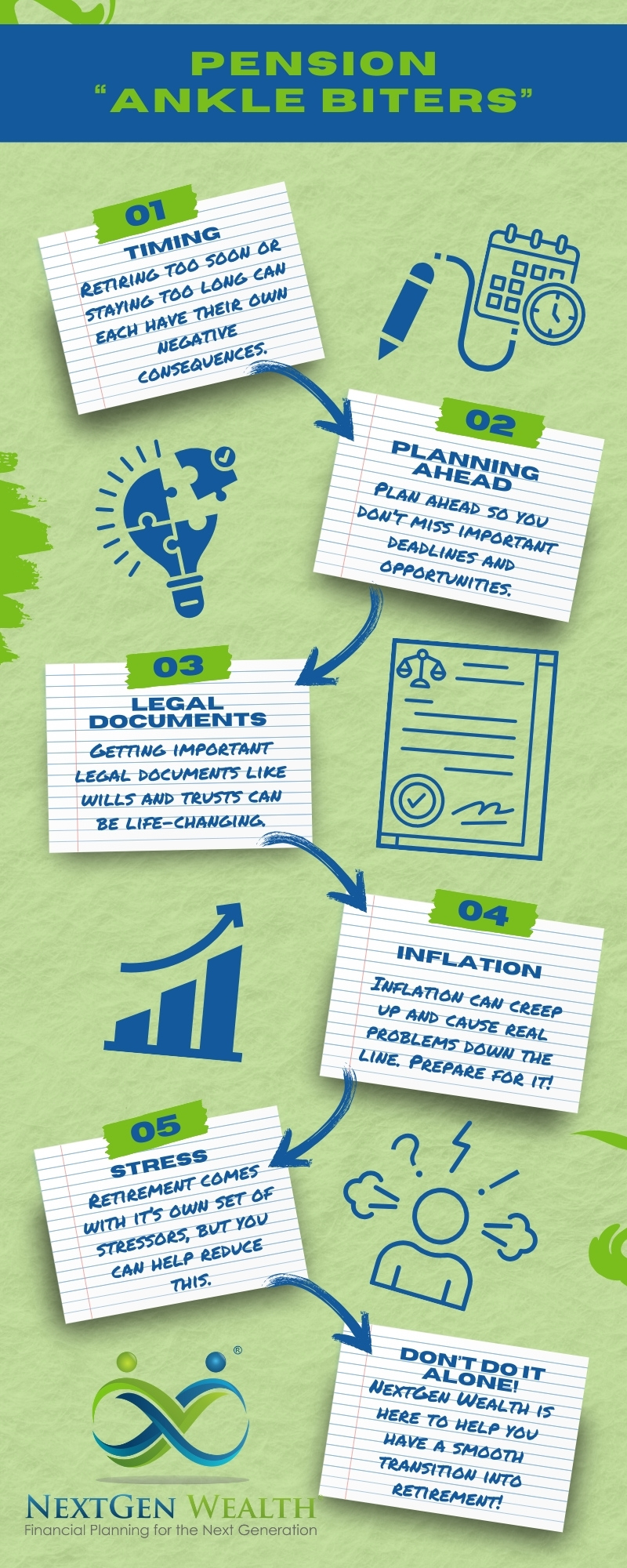

Avoiding Pension Ankle-Biters

There are lots of small, yet important things to creep up on you as you approach retirement. However, these “ankle biters” can turn into a big collective problem if you don’t pay attention. Don’t let the tiny details derail your retirement plans!

We’ll discuss some of the finer details that often get missed or confused. You’ll feel so much better knowing you’ve covered all your bases.

Table of Contents

Identifying Your Retirement Threats

Let’s get the scary stuff out of the way: inflation, taxes, timing, death, and other stressors. We often think a lot about saving for retirement, but have you thought about how to avoid these major threats?

As uncomfortable as it may be to think about, what does your financial life look like if you find yourself alone? What if you pass before your spouse? Making sure everyone is covered should something happen to one of you is very important.

You’ll also want to consider survivorship options on your pension as well as life insurance. Not to mention, keeping your relationships healthy is also a huge factor.

Need help navigating your retirement income options? Get your retirement income plan today!

Inflation

Inflation is a (usually) small, yet insidious threat to your retirement. Although inflation may not directly affect your pension payout, it can diminish the buying power of your pension. In most cases, your pension will be a set amount and won’t necessarily adjust for inflation. If your pension offers a cost-of-living adjustment (COLA), this is a major benefit.

It’s very important for you to plan for inflation in retirement. More than likely, your pension won’t adjust for inflation through cost-of-living adjustments (COLA). As costs rise over time, you need to have a plan to keep your buying power strong.

Taxes

Similarly, taxes can eat into how far your pension dollars go. You may need to look into some tax-saving strategies in retirement. It’s also really important to understand how your pension income is (or is not) taxed.

For instance, Missouri has some exemptions for pension income. Kansas has its own rules on this as well. Bottom line, plan to pay at least some taxes on your pension income.

Need help navigating your retirement income options? Get your retirement income plan today!

Timing and Your Pension Payout Optimization

We’ve covered this before, but it’s worth noting some of the “small” stuff here. Minor differences in your pension payout over your lifetime can make a big difference.

Understanding Creditable Service vs. Vesting

Some terms can be similar, and this can be confusing. In general, creditable service has certain criteria you must meet. For instance, you may need to work a certain number of hours per week for the time to count.

It’s important to know exactly what counts and what doesn’t. Your creditable service has a direct impact on your pension payout.

Vesting or vested service simply means you’ve had enough creditable service to be “vested” in your retirement plan. In other words, you’ll get some type of benefits even if you leave your employer. Of course, this is subject to the terms of your retirement plan.

Retiring Too Soon

Depending on your retirement plan, waiting even one month can make a significant difference. For instance, you could miss out big time if you miscalculated your years of creditable service by a month or two.

Risks of Retiring Before Reaching Full Eligibility

There’s also a lot of risk in thinking retiring six months to a year early isn’t a big deal. It might not be a huge deal now, but once you look at these benefits over your lifetime, it can really add up.

For instance, a difference of $100/month might seem insignificant. However, if you live another 25 years, that’s $30,000 less you’ll receive in retirement. This isn’t to say you must stay forever, but these seemingly small changes can significantly impact you.

Also, many pension payout calculations have higher percentages once you reach certain creditable service thresholds. For example, if you had 29 years of service, your percentage of your salary paid in retirement might be 50%, and after 30 years of service it might increase to 55%. Once again, this doesn’t seem like a big change, but over the course of your retirement, this could be huge.

Working Past Maximum Creditable Service

On the other hand, working past your maximum creditable service for retirement could be a mistake too. This may not be a big deal if you like what you do. However, if your job is keeping you from living the life you’ve been planning, it’s probably not worth it.

The Concept of Maximum Creditable Service

Hitting your maximum creditable service is a nice goal but may not be worth it if you’re not enjoying work. Furthermore, if you don’t need the extra money, the trade-off might not make sense. If you need the extra payout, you really need to understand exactly how much you’re staying for.

If you’re close to a pay raise which will give you a significant bump in retirement, you might consider staying longer. However, most pension plans use an average range of your salary. Working an extra six months to a year might not make a substantial difference when averaged out over several years.

Potential Consequences and Benefits of Exceeding Maximum Service

The biggest downside to working past your maximum creditable service is the diminished return for your efforts. Once you’ve maxed the percentage of salary and/or topped out your salary, there’s not much benefit to your pension payout.

One other thing to consider is the ability to work while drawing a pension. If you have a side-business or could do some part-time consulting in retirement, you could potentially make more in retirement by switching to a different part-time job. This wouldn’t be a great option if you’re just ready to be done work entirely.

However, don’t discount how much waiting to start withdrawing from your investment portfolio can be. If your living expenses are covered an extra year or two through you working longer, you’ll save additional money in your retirement accounts and spend less in retirement.

Legal and Documentation Issues

Many of us are great at helping others but not as great at taking care of ourselves. If this is you, it’s best to start gathering all your paperwork now. Don’t wait to get all your retirement paperwork straight.

There may be several different decisions you’ll need to make in writing as you prepare to retire. Make sure you’re paying attention to all the important deadlines so you don’t miss anything. You don’t want to miss a benefit just because you missed a filing date.

Planning Early to Dodge Issues

Planning early is the best antidote to many common pitfalls. You want to give yourself plenty of time to read and research all the pension options and benefits you have available. This also gives you plenty of time to consult with tax, legal, and financial planning professionals.

Many processes can take some time. For instance, NextGen Wealth reviews many different items during our COLLAB Financial Planning Process™. This isn’t a super lengthy process, but in-depth analysis and quality advice do take a little time.

Building Up Your Defenses

Many folks have done a wonderful job of building up their offense – saving and investing for retirement. However, the small things in our defense often catch us off-guard. These are things like forgetting to update paperwork, not carrying enough insurance, or not optimizing for taxes.

In other words, you’ve got to make sure you’re taking care of all the “what-ifs” you hope will never happen. Unfortunately, sometimes bad things happen to good people. You want to make sure your family is covered no matter what.

Survivorship Options and Life Insurance

It might be easy to dismiss a survivorship option on your pension. These can often seem expensive or unnecessary. This may be true in some cases, but it’s always worth looking into.

If you were to pass suddenly, there needs to be a game plan. It’s not fun to think about, but you’ll feel more confident in retirement knowing everything is covered. If you’re able to live off your investment income, you might not need to worry about this at all.

Bottom line, retirees who have guaranteed monthly income are much happier. You need a plan to ensure your loved ones are covered.

Diversification: Spreading Your Risks to Avoid Ankle-Biters

Although it might seem trivial, having a properly diversified portfolio can help you weather the storms. Many retirees have company stock or other overweight holdings, which can create unnecessary risk. It might not take much adjustment to provide a safe and secure return.

Coping with the Emotional Transition to Retirement

Don’t underestimate the potential stress and anxiety you might feel in retirement. Even if you solve the financial worries, there are many other stressors you’ll need to deal with. You’ll need to redefine your days, manage your health, and possibly build new relationships with friends and family.

This is part of why planning early for retirement is so important. You want to transition smoothly – not abruptly. You’ll need to lean into your relationships, hobbies, and other interests to keep your mental well-being in tip-top shape.

Need help navigating your retirement income options? Get your retirement income plan today!

NextGen Wealth: Your Personalized Ankle-Biter Defense

This may be your first transition into retirement, but not ours. NextGen Wealth has been helping navigate the transition into retirement for many years. We’ve been crafting smooth transitions into retirement for a long time.

Don’t make the most important decisions of your retirement without professional guidance. Contact us today to see if we’re a good fit for each other on your retirement journey!