Should I Keep My Old Annuity?

Is an annuity you purchased 5, 10, or 15 years ago worth keeping? Many retirees enter retirement with more savings than they need. If you’re not sure you need your old annuity or whole life policy, you’re not alone.

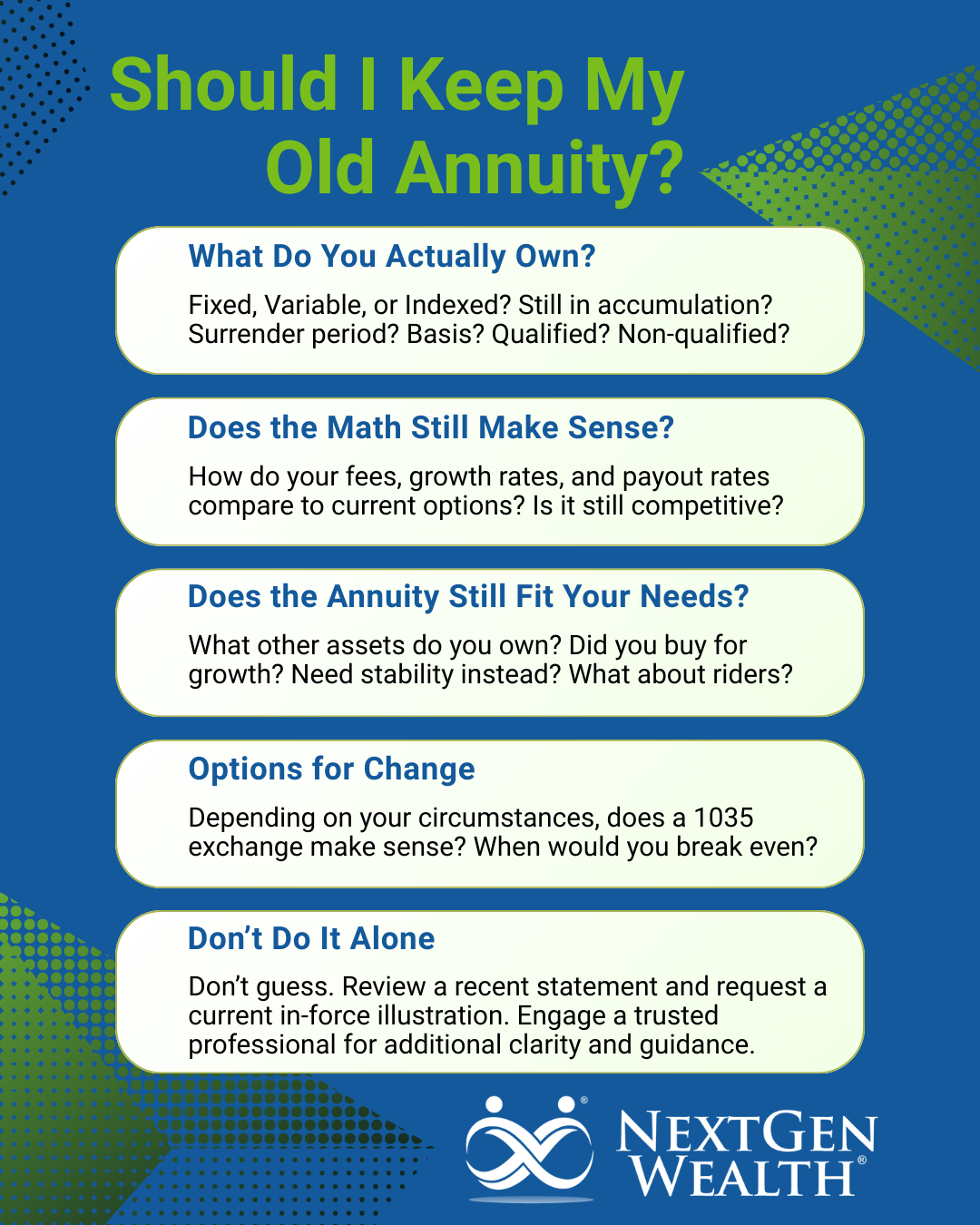

It’s important to evaluate whether your old annuity contract still serves a purpose in your portfolio or if it's dragging down your retirement plan. We want to move beyond the "annuities are good or bad" debate and discover what’s best for your specific situation.

Table of Contents

Step 1: The Audit – What Do You Actually Own?

Annuities come in a few basic forms: Fixed, Variable, or Indexed. The type of annuity you have will determine whether it’s still appropriate for you. It’s also possible an annuity was never appropriate, but that’s a separate conversation. It’s also possible that your current annuity remains the best option for you and your family.

Most often, variable and indexed annuities are riskier and used partly for growth, whereas a fixed annuity is typically meant to preserve capital. Of course, these are secondary to the primary reason for annuities: insuring against outliving your money.

The Basis Check: Qualified versus Non-Qualified

You’ll also want to understand your current basis. Your basis is the total cost you’ve paid for the annuity contract with any adjustments. Annuities are purchased with either qualified (pre-tax 401k/IRA funds) or non-qualified (after-tax) dollars.

The qualified status affects the taxes you’ll owe regardless of what you decide to do with your annuity. Tax planning is very important in retirement, so you’ll want to know the tax implications of any decision. You don’t want to create a tax headache if you don’t have to.

The Fee X-Ray: Understanding Annuity Costs

All annuities have a variety of fees included in their costs. These include Mortality and Expense (M&E) charges, administrative fees, and rider costs for optional coverage such as death benefits or long-term care. You’ll need to read the fine print to understand all the fees and how they’re calculated.

It’s important to understand how much of your money goes toward fees and commissions compared to the financial benefits to you. All investment products have costs associated with them. However, some are more expensive than others.

The "Golden Handcuffs" of Older Contracts

Some older annuity contracts, issued when interest rates were higher, may have better guaranteed minimum interest rates. Even if fees are high, the long-term growth and stability of these higher rates may be more beneficial than the costs of switching to a different annuity.

Annuity payouts are affected similarly to corporate bond rates. This is because insurance companies often invest in highly rated corporate bonds and mortgage loans – both of which are affected by interest rates. This means an older annuity may have better rates than what you can buy today.

Mortality Credits

Mortality credits are one of the more morbid yet useful features of lifetime annuities. In short, once you place your money in an annuity, it is pooled with other annuitants' funds. For those who survive, their share of the assets increases.

In other words, an old annuity becomes more mathematically valuable the longer you live. You also take the risk of never recovering your investment in the annuity, but there’s no way around this tradeoff. You just need to understand the risks involved.

Tax-Deferred Growth

An annuity can also be a way to defer taxes until later. The benefit of deferring taxes is keeping the tax shield intact on non-qualified gains. Annuities are taxed using an exclusion ratio, meaning you’re generally only taxed on the calculated gains from your investment.

The taxation of annuities and their impact on required minimum distributions (RMDs) can be somewhat complex. Be sure to consult with your tax professional before making any major changes.

Reasons to Exit: When the Math No Longer Adds Up

There are cases when it’s best to exit an annuity. However, it’s tricky or sometimes impossible. If you purchased an immediate annuity (payments start right away) or already started receiving payments (entered payout phase), your options will be very limited.

For our discussion, we’ll assume you’re in the accumulation or growth phase of a deferred annuity.

Higher Costs and Payout Rates

As with any financial instrument, costs and payout rates change over time. If you purchased an annuity during a time when corporate bond rates were low, your payout rate could be lower than what’s offered today.

You may also have additional costs and fees you no longer want or need. For instance, if you have a fully funded retirement account and no longer have kids at home, a death benefit rider might no longer be needed.

The catch is the costs involved in switching or surrendering your policy.

Surrender Periods and Penalties

All annuities and most life insurance products have a surrender period. You can’t just back out of or modify the contract without paying a fee. Surrender periods are often very steep and last many years (usually 10 or more).

Once your surrender period ends, you can exchange your policy without penalty (liquidity). Then, you can decide if an annuity still fits your financial plan.

Mismatched Objectives

The primary reason to consider changing your annuity is that it no longer meets your needs. You may have bought it for growth at age 50, but at age 65, you need income or legacy planning. In most cases, this would happen through partial or full annuitization (payout) under the contract.

You may also have experienced significant life changes, such as a disability or a death. For instance, a widow’s needs and tax situation are much different from those of a married couple. Sometimes terrible things happen to good people.

It’s best to check your annuity contract to see whether there are any specific hardship rules. You may also have riders you didn’t know you were paying for. Regardless, it’s best to take some time to consider your options before rushing to a decision.

Sub-Account Performance

In some cases, you may have poor underlying investment options in variable annuities. Crediting can be complicated, so it’s important to understand how the investment portion performed compared to what was originally told to you. Often, performance is stated in broad ranges during sales pitches to leave room for “imagination” on growth potential.

There are significant financial incentives for insurance brokers to sell annuities. Most won’t outright lie to you, but they’re encouraged to tout the benefits and downplay the risks and costs. However, it’s difficult to know if the costs of exiting an annuity will outweigh these potential benefits of a new annuity.

The High-Net-Worth Pivot: 1035 Exchanges and Alternatives

If you decide your current annuity is no longer the best choice for you, you have some options. You may be able to modify or exchange your annuity for a different one. There are pros and cons to consider.

The Power of the 1035 Exchange

You could use a “1035 exchange” to switch to a different annuity. This would allow you to swap an old, potentially expensive annuity for a modern, lower-cost version without triggering a tax bill. However, this isn’t without costs or risks.

When you complete a 1035 exchange, only the taxation is affected. You’re still bound by other contractual agreements. You’re still subject to surrender charges and limited to the cash value of your current annuity. You’ll still be out the costs of insurance and other fees you’ve already paid.

Partial or Accelerated Annuitization

You might also have options in your annuity contract to complete a partial or accelerated payout. This may allow you to keep a portion of the contract for minimal income while moving the rest of your money to other assets.

Some annuities allow you to request accelerated payments. In some cases, there are stipulations for disease or disability. Each contract is unique, so you’ll need to read the fine print carefully.

Keep in mind that you’ll need to factor in taxes when you annuitize (begin taking payments). You’ll also eliminate the option for a 1035 exchange. Except in rare circumstances, once you annuitize, you typically can’t get out of the annuity contract.

Conclusion: Your 3-Question Decision Matrix

Before making your final decision, you really need to revisit whether annuities are right for you in the first place. Here are a few questions that may help you with your decision:

- Am I still in the surrender period?

- Is the guaranteed internal rate or benefit higher than what I can get in the open market today?

- Am I paying for riders, like death benefits or income floors, I no longer need because my other assets have grown sufficiently?

- What’s the tax cost and opportunity cost of surrendering versus the opportunity cost of staying?

- Do I have enough “safe” income for my retirement needs?

- What’s the “break-even” point of this decision?

Answering these questions and more will help you determine your overall retirement readiness. Before stepping into retirement, you’ll want to sort through many aspects of your personal and financial life. We suggest a comprehensive approach similar to our COLLAB™ Financial Planning Process we use with our clients.

Next Steps for You

Bottom line, we don’t want you to guess about your financial future. At a minimum, you should review a recent statement and request a current in-force illustration from your annuity provider. Better yet, get these documents reviewed by a competent financial planner who can help you see how your annuity fits within your overall financial picture and retirement goals.

At NextGen Wealth, we offer a no-obligation financial assessment to help you determine next steps and see if we’re a good fit to work together. Contact us today to get started on your retirement journey with clarity and confidence!