How Do I Calculate My Liquid Net Worth?

This post was last updated on September 30, 2023, to reflect all updated information and best serve your needs.

How do you measure your personal financial health? If you were running a business, you’d pay close attention to its financial health, right? Elements like cash flow, debts, and total assets would be part of your normal routine.

One of the best ways to determine your personal financial health is to look at your total net worth. You don’t need to have an extremely high net worth like Warren Buffet, Jeff Bezos, or Bill Gates. However, keeping tabs on your net worth can give you a “pulse check” to see where you’re at.

What’s My Total Net Worth?

The wealthiest individuals have a net worth in the billions of dollars. However, Elon Musk doesn’t have billions in a savings account. In fact, most wealth of the ultra-rich is tied up in fixed assets like real estate, long-term investments, and corporate holdings.

In other words, their net worth is mostly “illiquid” or unusable. Yes, they could sell some shares of their company, but it’s sometimes risky to do so. Just selling a seemingly small portion can cause people to panic and sell – lowering the price of the stock.

However, these are included in their total net worth. This is different than liquid net worth, which we’ll discuss later.

How to Calculate Your Total Net Worth

The most straightforward formula for determining net worth is calculating the value of all of your assets and subtracting your liabilities (debts). First, you want to account for all of your assets, both fixed and liquid. Fixed assets can’t be turned into cash quickly (restricted stock, your primary residence, etc.). Liquid assets can be spent right away (cash, 401k balance, etc.).

For example, if your home is worth $400,000, you would have to put it on the market and find a buyer before you could use the money. Also, after taxes and fees, your cut will be somewhat lower. For the asset column, you should include everything, such as:

|

Car (Blue Book Value) |

$15,000 |

|

House (Recent Appraisal) |

$400,000 |

|

Savings |

$50,000 |

|

Retirement Accounts (401k, IRA) |

$525,000 |

|

Stocks and Bonds (Taxable) |

$200,000 |

|

Jewelry |

$10,000 |

|

Total: |

$1,200,000 |

If you have any other substantial assets, like collector’s items or other valuables, you can include them as well. Other belongings like clothes and furniture aren’t typically included.

Next, you want to look at your liabilities, including any money you owe on those assets. So, if you still have a balance on your car and a mortgage to pay off, you’ll have to count those against your net worth. All liabilities should be included, but you can bundle types of debt (i.e., credit cards).

|

Mortgage |

$200,000 |

|

Car Loan |

$5,000 |

|

Credit Cards |

$5,000 |

|

Student Loans |

$20,000 |

|

Total: |

$230,000 |

Based on these numbers, your current net worth would be $970,000 ($1,200,000- $230,000). If you owe more money than you have in assets, then you’d have a negative net worth.

Now let’s break down the difference between liquid and fixed assets.

What’s My Liquid Net Worth?

A liquid net worth on the other hand, is money you can use right away. This typically doesn’t include things like your house or car. You need those to live and operate on a regular basis.

Liquid assets are those you can use right away. The money in your savings account is a perfect example. You can go to the bank and withdraw it immediately.

Stocks and other short-term investments are also counted as liquid because the delay between selling them and receiving the cash is minimal. Retirement assets may be a little different depending on if you’re eligible to withdraw penalty free. If not, we’d say consider them as illiquid.

Revising Our Example

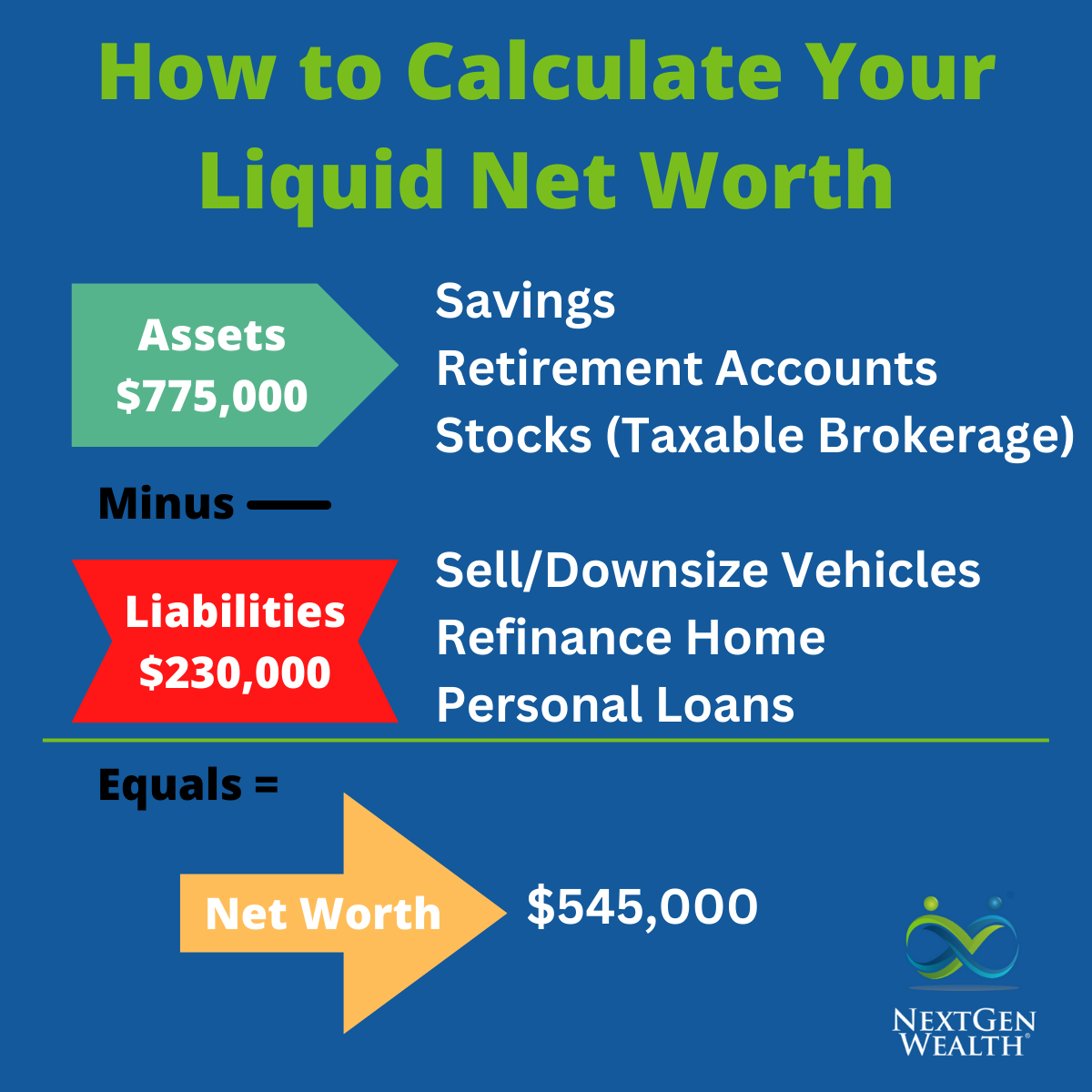

Using our example totals from above (assuming you’re able to withdraw retirement funds penalty free), your total liquid net worth would be $545,000 ($775,000 in liquid assets - $230,000 in liabilities = $545,000). In this case, we’d count your savings, retirement accounts, and stocks (taxable brokerage).

We wouldn’t count your jewelry because you might not be able to sell easily or get the full $10,000 in a pinch. If you had to sell to the pawnshop or online quickly, you probably wouldn’t get full value.

The Role of Debt on Your Net Worth

Additionally, we have to consider your debts. All liabilities are counted equally, even though assets are not. This is because, no matter what, you still owe the same amount.

More importantly, if you’re not working down the balance, debt can slowly erode your net worth. For instance, paying the minimums on your credit cards won’t be enough to pay them off. The balance will likely grow over time accruing at a high interest rate.

Bottom line, debt reduces your total assets available for use. If you had to sell everything today, you’d still have less money because you have to pay off your debts.

How To Improve Your Liquid Net Worth

Remember, net worth is just one variable. Your blood pressure might be a talking point at the doctor’s office, but it’s not generally the main point. However, when you have a negative net worth (or really high blood pressure) you’ve got to make some changes.

Just like your blood pressure can be improved with diet and exercise, your net worth can be improved too. Here are some ways to increase your liquid net worth.

Trim Your Debt

One of the best ways to boost your net worth is to reduce liabilities as much as possible. Some lower interest debts like a mortgage may not be as troublesome. However, higher interest debt like credit cards and some care loans can be problematic.

The main thing to think about here is the effect one has on the other. You may be hesitant to use your 401k balance to pay off your credit cards, but this doesn’t actually affect your net worth like you might think. It does reduce your debt service payments.

Example, if you take the example above and reduced your cash holding by $5,000 and paid off your credit cards, your net worth would still be exactly the same. The only difference is you have less debt and less cash.

Increase Your Savings

Ideally, you should have an emergency savings fund to help you get through any unforeseen expenses and crises. However, if your monthly earnings are already tight, it can seem virtually impossible to save more.

Start Small

Rather than eating out for lunch, put the $15 you would have spent into a savings account. You don’t have to be putting giant amounts away - little contributions will add up over time.

Create A Unique Savings Account

When your money is a little too accessible, it’s easy to dip into it on a whim. By putting money into a separate account or financial institution, you won’t be tempted as much.

Start Budgeting

If you’re not tracking your cash flow, how can you know what you can save? Fortunately, there are plenty of apps to make budgeting easier.

Start Earning Side Money

There are many different ways to earn a few extra dollars here and there. This doesn’t mean you have to go back to work. It might be as simple as getting paid for things you already enjoy doing like selling paintings on Etsy or giving piano lessons to people in the neighborhood.

Wrapping Up the Net Worth Discussion

Ultimately, net worth is a way to measure financial health. It’s not the only or even most important metric to look at. At NextGen Wealth, we look at every aspect of your financial picture and focus on helping you live the retirement of your dreams.

We walk you through our COLLAB Financial Planning Process™ and review common scenarios you may come across. Contact us today to see how we can help you plan your retirement journey.