How to Get Money from Your Retirement Accounts Early

One of the key functions of retirement accounts is they “lock up” your money until you’re ready to retire. What happens if you need to access your money sooner? There are several reasons, and options, to gain access to your retirement funds early.

One of the key functions of retirement accounts is they “lock up” your money until you’re ready to retire. What happens if you need to access your money sooner? There are several reasons, and options, to gain access to your retirement funds early.

As with anything, you need to understand the consequences of pulling money out of your retirement accounts – early or otherwise. There may be options which may be better suited to your situation. Just make sure you know what you’re getting yourself into.

Why You Might Want to Access Your Money Early

First, let’s discuss why you’d want to access your retirement funds early. There are some very legitimate reasons why you might want to tap into those retirement funds early. However, you don’t want to jump straight to pulling money from your retirement nest egg.

Early Retirement

Are you planning to retire early? If so, then it makes sense you’d want to use the money you saved for, well, retirement. However, if you’re not age 59-1/2 yet, you could be subject to the 10% early withdrawal penalty – not good.

You have some options to pull money out for retirement early. One common strategy is to pull out Roth IRA contributions. When you pull money out of Roth IRAs the contributions first. If you know how much you’ve contributed, you can pull out those funds without penalty or taxes (because it’s after-tax money).

All earnings and dividends will be subject to the 10% early withdrawal tax if you’re not age 59-1/2 or older. For other retirement accounts such as a 401k, it doesn’t matter which contributions are pulled out first because you’ll pay income tax on those withdrawals regardless.

Need help navigating your retirement income options? Get your free retirement income plan today!

Major Life Changes

It’s possible you may be facing some significant life changes like buying a house, having children, or even getting a divorce. These large transitions in your financial life require some adjustments – and cash. Whether the situation is temporary or permanent, you’ll want to look at all your options carefully.

Hardships

Unfortunately, bad things still happen to good people from time to time. Whether you’re being forced to retire early, lost a job, or had a death or disability occur, you may need to access funds. There are specific instances when you can take a hardship withdrawal.

We’re not big fans of hardship withdrawals, but if you’re out of options, it is what it is. If you’re up against losing your home or not having food to eat, you might need to use an option like this. You still need to be aware of how this affects you.

Pitfalls of Early Withdrawals

Even if you have a legitimate reason to withdraw retirement money early, it still has an impact on your finances. You need to be aware of the damage an early withdrawal may have on your future.

Lost Earnings and Penalties

Pulling money out of retirement investments can be bad. If you’ve ever heard the phrase, it’s not about timing the market, it’s about time in the market, you’ll understand why. Missing just a few of the best days in the stock market can have significant negative effects.

If you pull your money out, the earnings stop. Even worse, if you pull the money out when there’s been a large downward swing in the market, you’ll lock in losses.

On top of that, if you’re not at least 59-1/2, you’ll be subject to the 10% early withdrawal penalty. This is a real issue.

Limited Ability to Recontribute

In many cases, once you pull the money out, you can’t recontribute without counting against your annual contribution limits. You can’t “put the toothpaste back in the tube” so to speak. There are some additional exceptions added by SECURE 2.0. These include early withdrawals for childbirth or adoption expenses.

Bad Habit Forming

Retirement accounts are for retirement. This is how we need to continue to think about your tax deferred retirement accounts like your 401k or IRA. If you get in the habit of taking early withdrawals or loans, you’ll be less effective at saving for retirement.

You run the risk of forming bad habits and misusing the money you meant to be for later. It’s kind of like stealing from your future self.

How to Access Retirement Accounts Without Penalties

Those pitfalls aside, there are ways to access your funds early. Once you’ve thought things over and decided to pull money out early, you still need to be aware of how to avoid penalties.

Need help navigating your retirement income options? Get your free retirement income plan today!

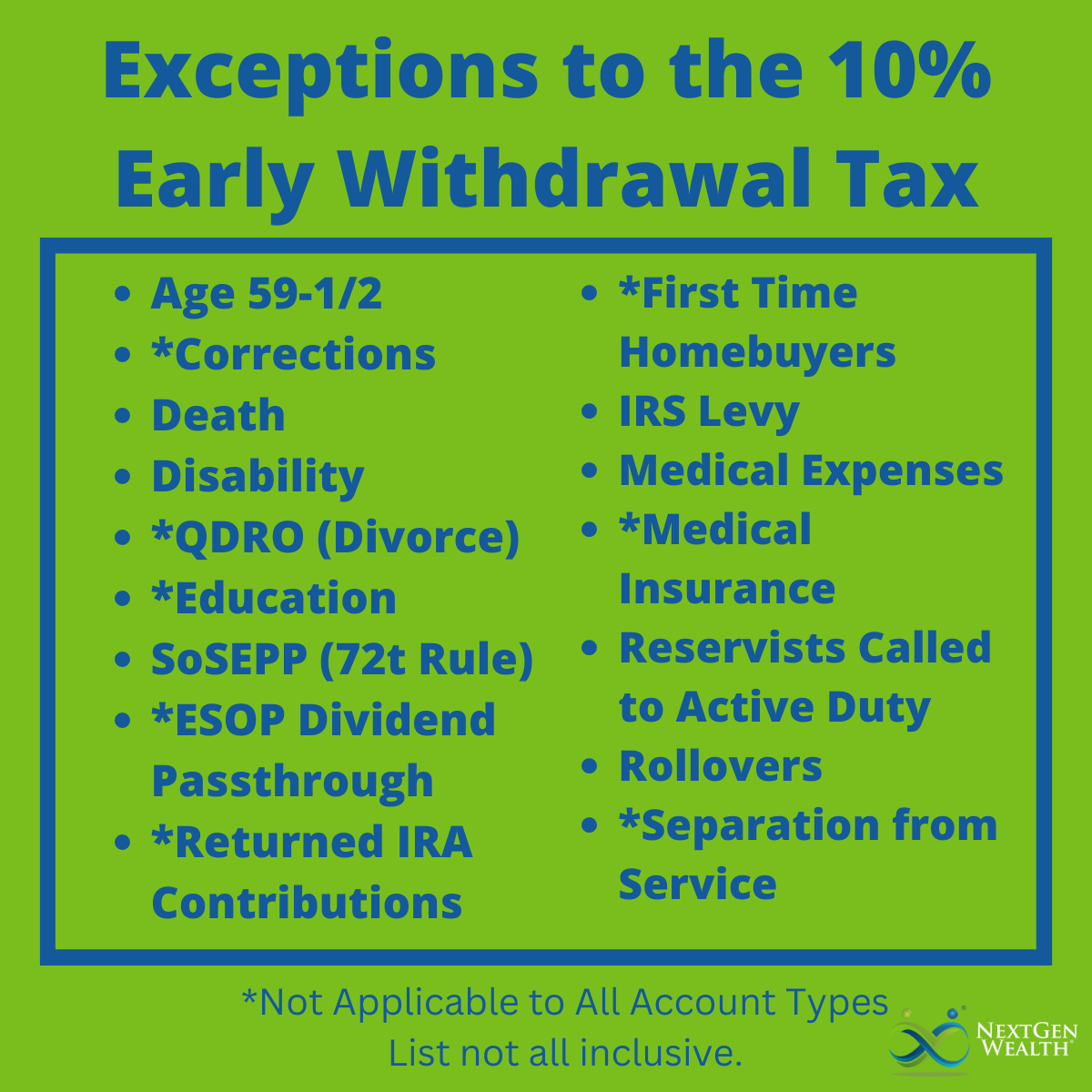

Wide Variety of Exceptions to the 10% Tax

The IRS makes several exceptions depending on your situation and account type. These can vary from having a baby to a death or disability.

Qualified vs Non-Qualified Accounts

Qualified employer plans such as a 401k or 457 will have different rules than an IRA will. For instance, an IRA or Roth IRA allow exceptions for education expenses, first-time home purchase, or paying for certain medical insurance, but a 401k or other qualified account does not.

It’s best to check with the IRS website, your financial advisor, and your plan sponsor (employer) to find out if you can withdraw penalty free. We suggest getting the proper reference to double-check on exceptions yourself. Don’t just take the word of whomever you reach in the call center – ask for where you can reference the information yourself.

Series of Substantially Equal Periodic Payments (SoSEPP)

A unique way to access your retirement funds early is through what’s called a Series of Substantially Equal Periodic Payments (SoSEPP) or “72(t)” withdrawal. In the simplest terms, the name pretty much says it all. You liquidate your retirement account through a series of equal payments.

This method is somewhat popular among early retirees. You can choose from three different methods to calculate the payment amounts: the RMD method, fixed amortization method, and the fixed annuitization method. We’re not going to detail these here, but they vary in the amounts you’ll need to withdraw.

The biggest thing to consider with 72(t) withdrawals is you have to continue to take the payments until the account is depleted or until 5 years after the first withdrawal and you’ve reached age 59-1/2. There are provisions to adjust which method you use, but you still have to continue withdrawals until then.

Top Considerations Before Early Withdrawal

Withdrawing from retirement accounts before you’re retired should be approached with caution. There may be several other options available before you start pilfering your retirement.

Other Avenues Which Could Be Better

Some potential options may include short term loans, emergency savings, cutting spending, downsizing, or taking on additional work. You really should look at other forms of assistance available to you.

There are protections for your retirement accounts to consider even if something as extreme as a bankruptcy is necessary. It would be a shame to liquidate your retirement accounts to pay off debts only to end up in bankruptcy anyway and have nothing in the end. If you’re facing bankruptcy, you definitely need to get professional advice before making any big money moves.

Need help navigating your retirement income options? Get your free retirement income plan today!

Get Professional Advice

We highly recommend you speak with your financial planner, accountant (CPA), other tax professional like an Enrolled Agent (EA), or attorney before pulling retirement funds early. At NextGen Wealth, we offer a free 15-minute consultation to see if we’re a fit. If you’re looking to access funds early because you’re ready to retire, we’d be glad to help walk you through the nuances of early retirement strategies and implementation.