2026 Retirement Plan Contribution Limits

This post was last updated on 16 February, 2026, to reflect all updated information and best serve your needs.

Planning for your retirement is the key to fully enjoying the fruits of your labor. Whether you have an IRA (individual retirement account), a 401(k), or other retirement account, you'll want to get the most out of it by maximizing your contributions. Understanding the IRS contribution limits will help you maximize your savings.

Most retirement accounts are tax-advantaged, meaning they are subject to special tax rules. They are a great way to secure your income. The tax advantages are great for people saving for retirement, but the IRS has enforced contribution limits - they still need to generate tax revenue.

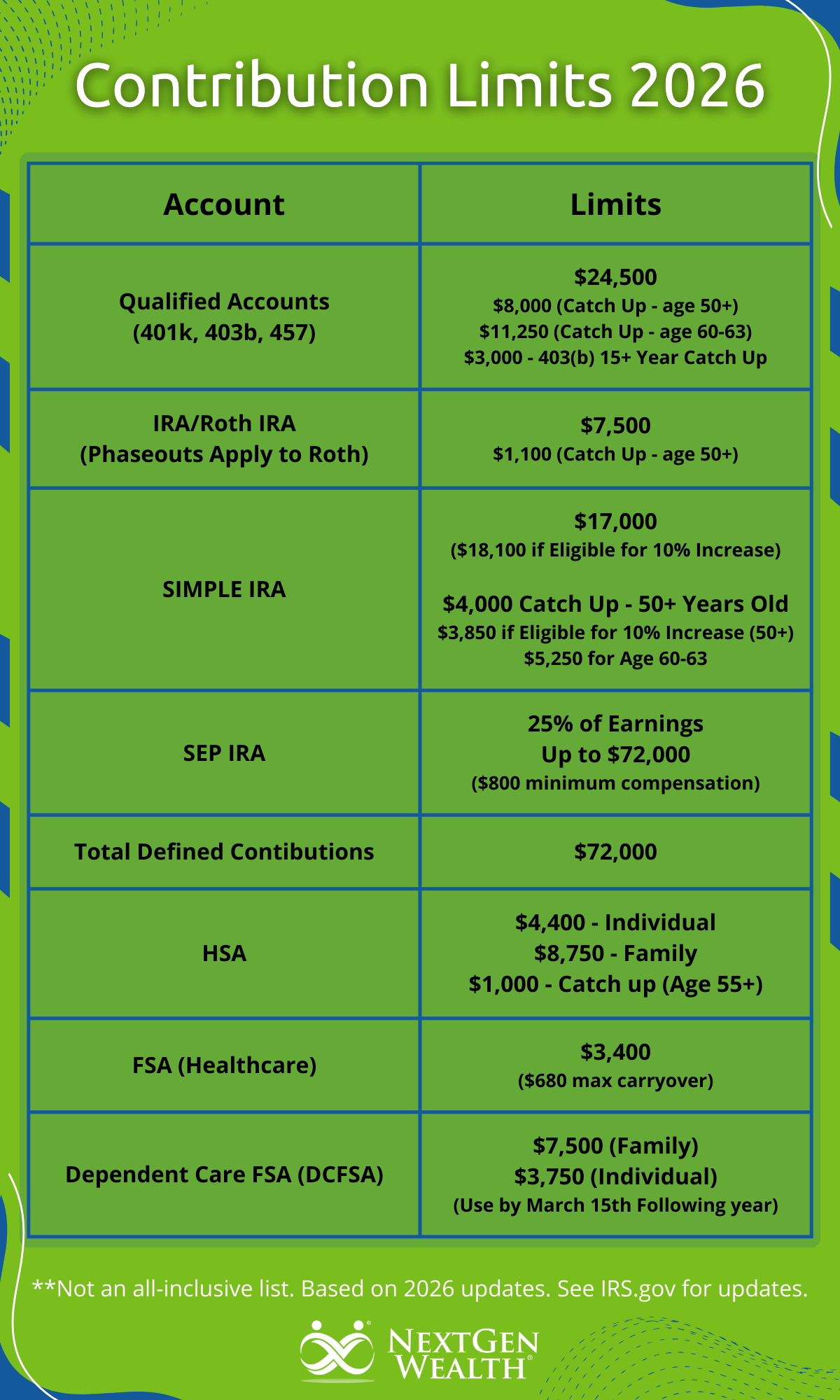

Every year, the IRS updates contribution limits to account for inflation. Staying up to date with all information regarding retirement accounts can be the difference between pinching pennies and living large. Let’s take a look at various retirement plan contribution limits for 2026.

Table of Contents

401(k) Contribution Limits

401(k) plans are among the most common retirement accounts for employees today. Defined contribution plans have nearly replaced the standard, defined benefit pensions that once dominated retirement plans. Your 401(k) plan typically offers a good mix of investments, such as stocks and bonds. A traditional 401(k) is not taxed on its earnings until withdrawn during retirement. Roth 401(k) accounts, on the other hand, offer tax-free withdrawals (assuming you follow the rules for withdrawals).

In 2026, the amount an employee can contribute to their 401(k) will increase to $24,500.

Catch-Up Contributions

The “catch-up” contributions, for those 50 and over, are $8,000. If you're age 60, 61, 62, or 63, you're eligible for a special catch-up contribution of $11,250.

Annual Contribution Limit

The total contribution limit from employers and employees combined is $72,000. However, catch-up contributions are in addition to regular contribution limts. If you're over 50 years old, the total contribution limit is $80,000 due to the addition of the $8,000 catch up amount. For age 60-63, it's possible you could have a total contribution of $83,250 for the year.

Since 401(k) contributions are made through direct salary deductions, speak with your employer about your contribution amount. You'll also want to make sure you're spreading your contributions across the entire year to make sure you get the full match.

Individual Retirement Accounts (IRA)

There are technically more than one type of IRAs. For self-employed individuals, you'll also have the ability to use a Savings Incentive Match PLan for Employees (SIMPLE IRA) or Simplified Employee Pension plan (SEP IRA).

Traditional and Roth IRA Limits

In 2026, the contribution limit for "regular" traditional and Roth IRAs is $7,500. The catch-up amount is $1,100 for those aged 50 years and older, bringing the total to $8,600. Keep in mind, you can contribute to an IRA whether you have a 401k or not.

However, you still have to be careful not to exceed your total annual contribution limit of $72,000 (plus catch-up contributions). Another useful feature of regular IRAs is that you can contribute after the end of the calendar year. You have until tax day, usually April 15th, to make contributions.

SIMPLE IRA

SIMPLE IRAs have the most misleading name of all retirement accounts because they are anything but simple. For small business owners and the self-employed, a SIMPLE IRA can still offer many benefits. Like a 401(k), both the employer and the employee contribute to the employee's SIMPLE IRA.

The annual contribution limit is $17,000 (or $18,100 with a 10% income-based increase). The catch-up amount is $4,000 ($3,850 for 10% increase-eligible employees) for ages 50+ or $5,250 for ages 60-63.

SIMPLE IRA 10% Increase Eligibility

There may be an additional 10% increase, depending on your income, so the catch-up could be as much as $3,850 (age 50+) or $5,250 (ages 60, 61, 62, or 63).

Other SIMPLE IRA Rules

When using a SIMPLE IRA, employers are not permitted to offer any other type of retirement account. If your employer offers a SIMPLE IRA retirement plan, you should discuss with your employer how much of your salary you wish to contribute to the retirement plan.

SEP IRA Contribution Limits

The SEP IRA is actually a much simpler self-employed option. Your contribution limit is the lesser of 25% of adjusted earnings or $72,000. SEP IRAs are typically employer-only contributions, but some plans allow for employee contributions.

Finding the Right Retirement Plan for You

The increased contribution limits for 2026 should help you maximize your retirement savings. It's best to discuss your contributions with a financial advisor to make sure you're on track. You'll want to prepare for your future while living comfortably today.

You'll want to make sure you save enough for retirement, so don't miss opportunities to save more.

Small Business Owners

If you're a business owner of any size, determining which retirement plan offers the greatest benefit to your employees is vital. You'll want to balance costs with strong incentives to keep your employees happy as well. Retaining your best employees and ensuring a bright future isn't just good business; it's fulfilling to know you've provided long-term stability.

Make sure to share the new contribution limits with your employees. They'll want to know the changes so they can prepare for retirement.

How NextGen Wealth Can Help

Whatever your financial situation, experience, or knowledge, NextGen Wealth is here to help. We have over a decade of experience helping our clients understand their financial situation and prepare for a brighter future.

Understanding your financial security doesn’t have to be confusing. We have the expertise to help you out wherever you are on your journey. Contact us today to get your no-obligation financial assessment and see if we're a good fit to work together.