Traditional 403(b) or Roth IRA?

This post was last updated on February 19, 2026, to reflect all updated information and best serve your needs.

A 403(b) plan or tax-sheltered annuity (TSA) is a retirement account for public schools, colleges and universities, churches, and non-profit organizations. While the account works similarly to other retirement plans, like a 401 (k), there are some differences.

It’s crucial to understand the ins and outs of your 403b plan. In addition to your 403b, you can also contribute to a Roth IRA. We’ll dive into these plans and help you decide between a traditional 403(b) and a Roth IRA.

Table of Contents

What is a 403(b) Plan?

The nickname 403(b) comes from the IRS tax code that establishes this type of account. Your 403b is a great way to save for retirement in a tax-advantaged account.

Contribution Limits

In 2026, your normal contribution limit (through salary deferrals) is $24,500 into your 403(b). If you’re over age 50, you can contribute an additional catch-up of $8,000 each year. If you're age 60-63, you can contribute up to an additional $11,250. 403b accounts also have an additional “15-year” catch-up contribution of up to $3,000 (more on this later).

Employer-Matching Contributions

While many employers do offer matching contributions to your 403(b), it’s not a guarantee. However, if they do, you could potentially save even more for retirement. Regardless, the most you could potentially save (in 2026) is a total of $72,000 (including employer matching) per year into your 403(b).

As you can see, the fundamentals of these plans are very similar to a standard 401(k). However, there are some specific advantages and disadvantages of a 403(b).

Benefits and Drawbacks of a 403(b) Plan Over a 401(k)

If you have the option of contributing to a 401(k) or 403(b), it’s critical to understand how you can maximize your investment. Here's a quick breakdown of the top benefits of a 403(b) compared to a 401(k).

The 15-Year Catch-Up for 403(b) Accounts

If you’re over 50, you can put away “catch-up” contributions every year until you retire. If allowed by the 403(b) plan, an employee who’s worked at least 15 years at the same employer can contribute up to another $3,000 annually. The lifetime total of this catch-up is $15,000.

To qualify, you must have worked at the same eligible employer for 15 years. Best of all, you don’t have to be age 50 or older to start contributing using the 15-year catch-up.

Immediate Vesting

If you’re not familiar with the term vesting, it refers to the point at which employer contributions become the property of an employee. Usually, companies will draft specific requirements for vesting to occur. For example, you might have to work several years before you own all of the money in the account.

Delayed vesting encourages you to stick around for longer. If the money is vested immediately, you could leave and keep your employer's matching contributions. Employers may hold off on vesting, so you don’t just take the money and run.

However, in a 403(b) plan, all contributions, including employer contributions, are immediately vested. With a 401(k) or other qualified plan, employers don’t have to allow for immediate vesting.

Lower Account Costs

You might pay less in administrative fees because some accounts aren’t regulated by the Employee Retirement Income Security Act (ERISA). This reduces the paperwork and other “testing” costs. However, this could be a benefit or a drawback, as we’ll discuss later.

Drawbacks of 403(b) Accounts

Although there are some potential benefits of 403b accounts versus other retirement accounts, there are some potential drawbacks.

Lack of Investment Options

403(b) plan investment options are limited to mutual funds or annuities with fixed or variable contracts. However, if your only option is a 403(b), it’s far better than nothing at all. Investment options vary by employer, but you should still be able to build a diversified portfolio to meet your needs.

Lack of Oversight

As we mentioned, some traditional 403b accounts aren’t regulated by the Employee Retirement Income Security Act (ERISA). Most 403b accounts are subject to ERISA, but public educational organizations and churches are exempt from ERISA. However, they can elect to meet the guidelines.

This means some educational institutions and churches might not follow all of the same rules as other retirement accounts. This may mean your costs will be lower, but your account isn’t protected the same way either. The biggest difference is that the non-ERISA 403 (b) isn’t subject to “non-discrimination” testing to determine whether executives and managers receive disproportionately higher benefits and contributions.

In other words, regular employees might not get the exact same contributions as other employees. Also, your employer could terminate the plan without warning, leaving you with no recourse.

Withdrawal Penalties

As with 401(k) plans, you’ll get hit with a 10-percent excise tax if you take money out before turning 59-1/2. However, there are exceptions, such as leaving your job when you’re 55 or older or becoming disabled.

Overall, the downsides of a 403(b) aren’t very significant for most employees. It’s still a great way to save for retirement, with a few additional nuances.

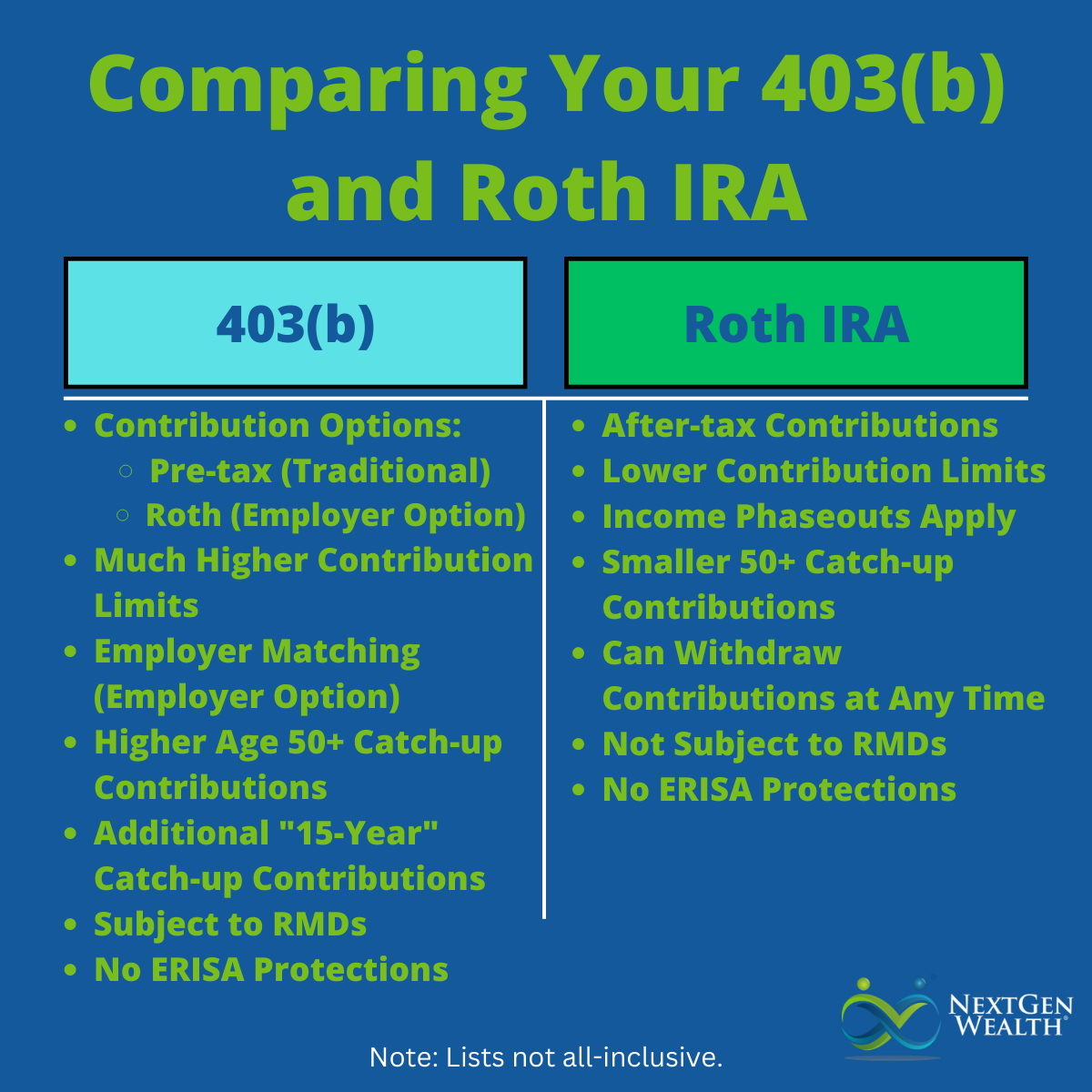

Comparing a Traditional 403(b) and a Roth IRA

Even if you have a 403b, you can still contribute to an IRA or Roth IRA on your own (subject to annual contribution limits). We recommend setting up a Roth IRA, even if you don’t need one right now, because it starts the clock on one of the 5-year rules.

Although it’s somewhat of an apples-to-oranges comparison, we’re going to talk about whether you should use your Roth IRA versus your traditional 403b. In short, we see this as a “both/and” type of scenario – not an “either/or” scenario.

Tax Payment

One of the primary advantages of contributing to a traditional 403(b) over a Roth IRA is the ability to deduct contributions from your income on your taxes. This could be particularly useful if you have a higher income or need to lower your taxable income.

You’ll have to pay taxes on the money you withdraw in retirement. In other words, you’ll get a deduction now and pay taxes later. Your “income” in retirement is taxed at the ordinary income tax rate you have when you withdraw it. So, if you’re in a higher tax bracket now (e.g., 22% or higher), you may be able to pay less in taxes later.

Required Minimum Distributions

However, you’ll eventually be subject to required minimum distributions (RMDs), which could force you into a higher tax bracket in retirement or cause other issues.

With a Roth IRA, contributions are made with after-tax money. So, withdrawals are not taxed or counted in your adjusted gross income (AGI) in retirement. This can have significant benefits. Also, Roth IRAs are not subject to RMDs.

You still have to meet the requirements for penalty-free Roth IRA withdrawals. You need to be at least 59-1/2 and have had the account open for at least 5 tax years. Alternatively, you could qualify to make withdrawals for specific life events, such as buying a house, or for financial hardships, such as paying for a medical emergency.

IRA Contribution Limits

For a Roth IRA, you can contribute up to $7,500, plus an extra $1,100 if you're age 50 and older. Roth IRAs also have income restrictions. In 2026, contributions are phased out between income of $153,000 and $168,000 ($242,000 to $252,000 married filing jointly).

If you make more than $168,000 ($252,000 married filing jointly), you can’t contribute directly into a Roth IRA. However, you may still be able to do a backdoor Roth conversion. Alternatively, if your employer offers a Roth 403 (b) option, you could contribute to it as well.

Which One is Right for You?

There’s nothing wrong with having both a Roth IRA and a 403(b) simultaneously. As a matter of fact, it’s probably best to have a Roth IRA in addition to your traditional 403b, regardless. This allows you to save more money for retirement and opens up options for tax-saving strategies.

Whether you choose one account or both, keeping your savings rate high never hurts. Just make sure you don't exceed the annual deferral limit. Having both accounts provides flexibility and lets you take advantage of the different tax benefits available to you.