This post was last updated on 20 June, 2023, to reflect all updated information and best serve your needs.

Money touches everything in our lives, but it doesn’t need to be the focal point of everything we do. Scrutinizing your money habits is a good thing, but you don’t want to constantly worry about each tiny detail of your spending. A full understanding of your money is good, so you don’t get carried away either – just don’t go overboard.

We want to strike a healthy balance between awareness and core financial principles. As with anything, anything done to excess can be harmful. Money obsession is no different.

Signs You’re Obsessed with Money

For many people, even though money is a regular part of daily life, they don’t think about it constantly. You might regularly check your bank account or bills for discrepancies, but not multiple times in a day.

For the money-obsessed, however, much of their daily life revolves around money and its impact on their life. You should be aware of possible warning signs you may be too invested in your money habits.

Haggling Over Small Expenses

Unless you’re really struggling to make ends meet, you probably don’t need to worry about saving every penny possible. Does it make sense to drive all the way across town to save five or ten cents? Probably not.

While these savings might add up, obsessing over them all the time will only lead to anxiety and worry. If you find yourself scrutinizing the smallest amount and regretting those purchases later, you might need to reassess your relationship with money.

Denying Basic Essentials

No matter what, we all have needs. Toiletries, food, water, and shelter are all crucial expenses for your survival. While you shouldn’t be wasting cash on frivolous expenses, you also shouldn’t be forgoing essential items because of the cost.

If you avoid paying for basic necessities even though you could afford them, this could be trouble. Skipping meals or trying to save on small items like toothbrushes and floss can be a sign of a money-based disorder.

In this case, the expenses don’t even have to be small. For many people, forgoing health insurance is a way to cut down on monthly costs. After all, if you’re relatively healthy, why pay for something you’re not using?

Unfortunately, you never know what the future holds, and one trip to the emergency room can set you back hundreds or even thousands of dollars. It may seem like a smart move right now, but you’re trading short-term benefits for a long-term loss.

Avoiding Social Interactions

For many of us, throwing around a couple grand to go out every weekend is financially irresponsible. However, going out to eat or having dinner with a friend or partner is a great way to relax and have fun. If you find yourself avoiding these interactions because of the dollar value associated with them, you might need to make some adjustments. Consider creating a specific budget category so you don’t miss out, but don’t feel you’re overspending either.

The real danger is when you’re avoiding these social situations because you’re afraid or uncomfortable parting with a few dollars. If you can afford dinner and a movie but still choose to stay home, this could be a warning sign.

Transition from Saving to Spending (Some) Money

Saving money regularly is a good habit to have. As a matter of fact, it’s probably what gave you the financial ability to retire in the first place. However, once you’ve reached retirement, it’s okay to dial back the focus on saving. It’s now time to transition toward using the money – which is why you saved it in the first place. Right?

You shouldn’t just go crazy on spending sprees, but it’s okay and expected for you to spend some of the cash you worked so hard to save.

Replacing Cheap Items Regularly

Ever heard the saying, “you get what you pay for”? For the money-obsessed, the quality of a particular product is not as critical as the price. In most situations, a cheaper alternative is seen as a better value, even if it doesn’t last as long.

If you find yourself having to replace the same products regularly because they keep breaking or wearing down, it’s far better to upgrade to a higher-quality version. Even though it costs more initially, you’ll save money in the long run.

On the flip side, reusing products well after they’re worn out is another sign of money obsession. For example, saving single-use packaging or reusing disposable products because you don’t want to pay for new ones can become detrimental over time.

Again, think about how much you’re saving compared to the value or convenience of buying a replacement. Is a few quarters or dollars really worth the hassle?

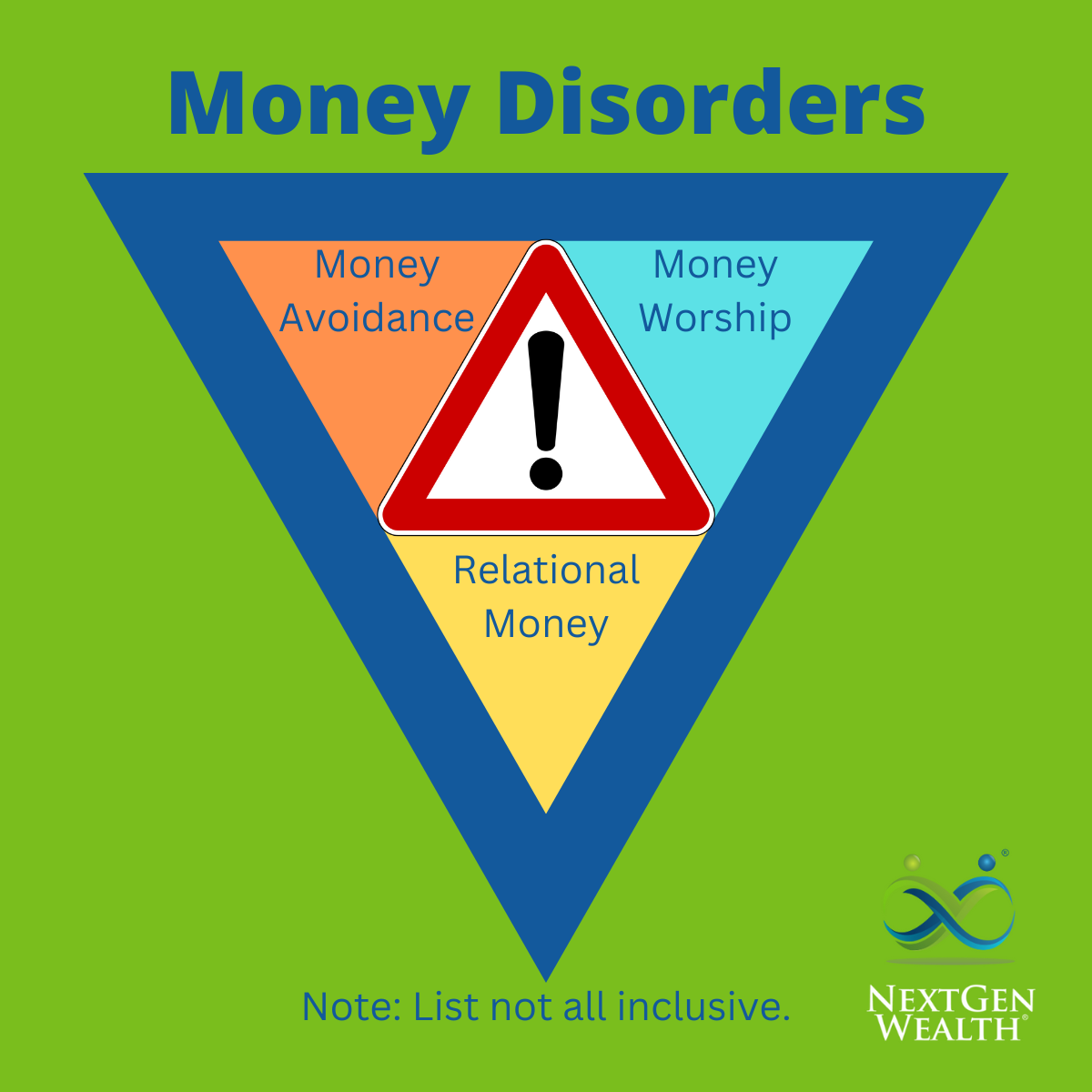

Types of Money Disorders

While we’ve discussed some of the broad strokes of money obsession, some real psychological factors can be at play. Typically speaking, if you are obsessed with money, you likely suffer from one of three different disorders. Let’s dive deeper into each one so you can see how they can impact your life.

Money Aversion

The concept of having or spending money is too painful, so you try to avoid it as much as possible. Rather than facing your financial troubles or bills, you ignore them until they start to take over your life.

In most cases, money aversion comes from having too much debt or high bills without enough cash to cover it. Looking at your credit card bill causes too much anxiety, so you don’t look at it at all.

Another form of money aversion can be when you feel bad about having or earning money. In these instances, you believe money itself creates negative energy, so you don’t want anything to do with it. Often, those with low self-esteem can suffer from this disorder, as they believe they are not worthy enough to have excess money.

Money Worship

On the opposite end of the spectrum, we have individuals who love money more than is healthy. In many cases, these people want to accrue as much wealth as possible, with no end in sight. Additionally, those who worship money may be willing to go to great lengths, including exploiting themselves or others, to obtain even more cash.

Another form of money worship can be excessive overspending. The thrill of buying flashy or high-end products becomes addictive, so you obsess over getting more money to maintain a buyer’s high.

Finally, obsessive gambling can be a sign of money worship. The rush of winning a payout is so intoxicating you’ll continue to gamble to feel it over and over again. Even when your losses far outweigh your winnings, the excitement of gambling feels like too much to allow you to stop.

Relational Spending

With this disorder, the money itself is not as important as the relationship you have with others. For example, giving money to family members, even if you can’t afford to do so. You feel compelled to “help” by giving money (i.e., guilt), so you put yourself in a bad financial situation as a result.

Another example of relational spending can be lying to a spouse or family member about your money habits. The driving factor could be the thrill of not getting caught, or it could be a symptom of a toxic relationship where money affects how you interact with each other.

Finally, financial dependence can be a sign of relational spending and money obsession. Valuing your relationship to another person based on the money they can provide is a dangerous path leading to arguments, lies, and even emotional abuse.

The Dangers of a Money Obsession

Hopefully, understanding warning signs of money obsessions can give you an idea of when you need to get outside help with your finances. Let’s look at some of the dangers of unchecked money obsession or disorders.

Harmful to Your Health

If you avoid going to the doctor because you don’t want to pay for medicine or a copay, you could get even more ill. Eventually, you’ll have to go no matter what, but the issue may have festered into a much larger (and expensive) problem.

Beyond the typical aversion to hospitals and clinics, money obsession could cause you to buy cheaper products and food, which can lead to poorer health. If you’re only eating the most inexpensive meals possible, chances are you’ll be facing a variety of problems, including diabetes, high blood pressure, and obesity.

Harmful to Your Relationships

For most people, money can be a relatively touchy subject. Discussions about how much someone makes and what they spend their paycheck on are usually off-limits. For the money-obsessed, many conversations can center on money, which can lead to strained relationships.

If your money obsession is directly correlated to a particular person (i.e., significant other), you could be ruining your relationship by lying about money or withholding funds for personal reasons.

Added Stress

For those suffering from money aversion, their obsession can cause severe depression and/or anxiety. Worrying about your financial situation or scrutinizing every aspect of it will only lead to problems down the road. High amounts of stress can have damaging effects on your health, so money obsession could be more damaging than you realize.

Financial Insecurity

If your money obsession is causing you to buy things you don’t need, give money to friends when you don’t have it, or gamble too much, these habits will catch up with you eventually. Money obsession can lead to massive debt, which causes many problems. If your life is just one missed paycheck away from financial ruin, you need to figure out how to bring yourself back from the brink.

How to Get Over Your Obsession with Money

Depending on your situation, overcoming an obsession with money is easier said than done. In some cases, you may be able to change your mindset and start thinking of money more positively. In other instances, you may have to get professional help. Here are a few of our top suggestions.

Talk With a Friend or Partner

Because money is such a sensitive subject for many people, many people might avoid discussing the problem altogether. In most cases, talking to someone you trust about the situation can provide some fresh perspective. Also, opening up about it can help you alleviate the pressure and stress associated with money obsession.

Seek Counseling

If you’re suffering from compulsive behaviors (i.e., excessive gambling), then reaching out to a professional is probably the best solution. Fortunately, there are many hotlines and resources available to help you get back on track. Best of all, you can research them online and reach out whenever you feel comfortable.