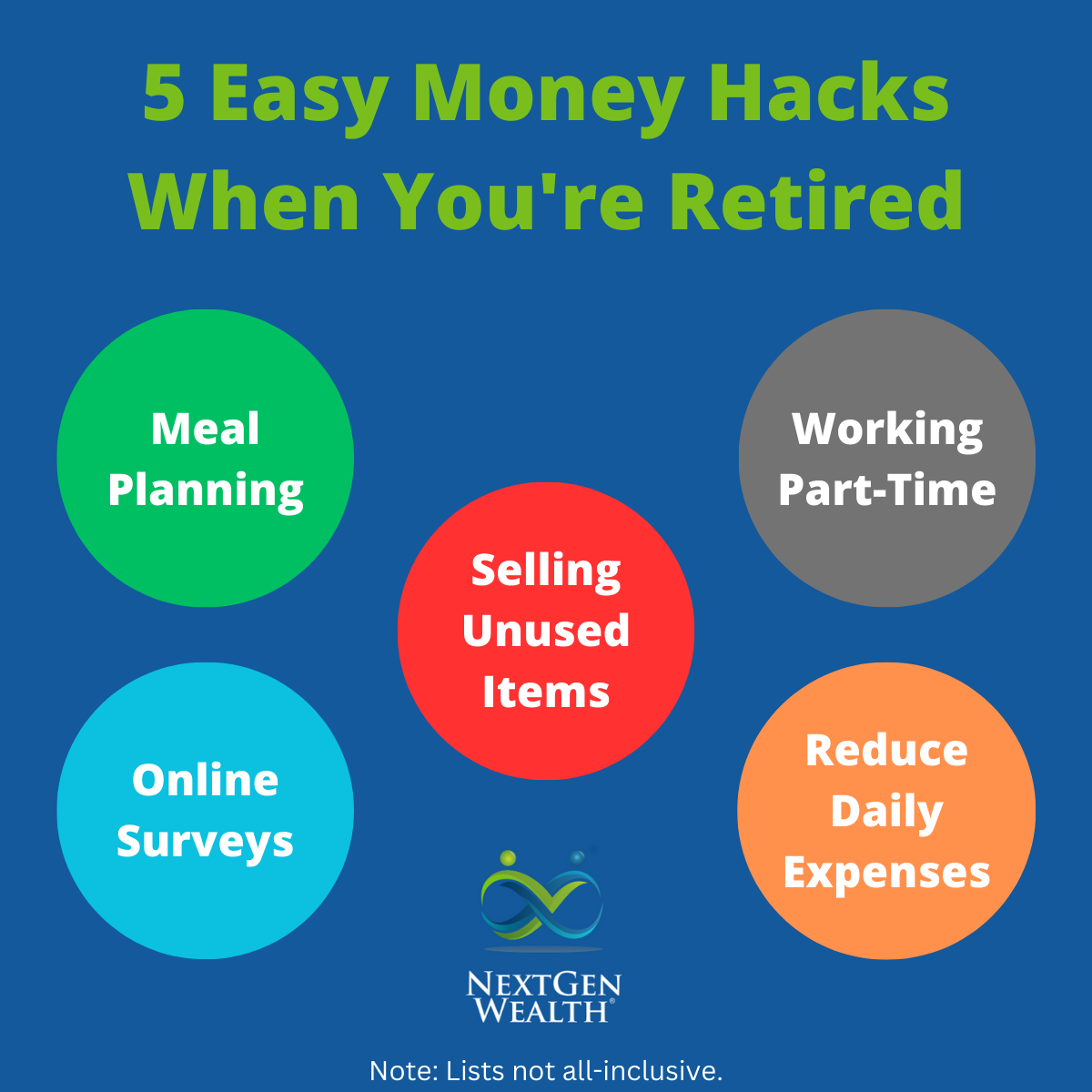

5 Easy Money Hacks When You're Retired

This post was last updated on May 26, 2023, to reflect all updated information and best serve your needs.

Retirement doesn’t mean you’ll no longer need or want to bring in any additional income. This is far from the truth for many people who’ve found ways to generate additional income after reaching retirement.

Even if you have a full schedule of activities planned in retirement, you can still find ways to bring in money – even when you’re busy. You may even end up making enough money to take multiple dream vacations and enjoy your post-work life to the fullest.

Balancing Retirement and Making Money

Before you start trying to bring in additional income in retirement, you need to make sure you’re not just trading one career for another – unless that’s what you want. Take into consideration your health, time with family, personal time, and how much income you actually need in retirement.

Retirement is a time to enjoy the fruits of your labor and celebrate your achievements during your working years. You’ve earned the ability to live your life the way you want and relax a bit. Try not to stress too much about money if you can help it, and don’t overload yourself.

However, life happens, and you might need or want additional income.

Planning Out Your Meals

Meal planning or meal prepping may or not be new to you. In a fast-paced work environment, you might have only been able to just grab a quick bite here and there. Now, you can take your time, plan out your meals, and possibly save hundreds of dollars a month.

Maybe you’re wanting to explore cooking or barbecuing a little more seriously in retirement. What better way to perfect your favorite recipes than prepping healthy, tasty meals for yourself?

You could spend an afternoon preparing a week’s or even a month’s worth of meals so you wouldn’t have to worry about cooking for a while. Planning out your meals can help you ensure the proper nutrition you require. You can avoid the temptation of eating junk food by sticking to your meal plan.

Preparing your own meals at home is not only a big cost saver, it’s also much healthier to cook at home versus going out to eat all the time. We’re not saying you can’t treat yourself to a meal out every once in a while, but limiting those will make them more special and enjoyable as a treat.

Selling Your Unused Items Online

After a lifetime of taking vacations and purchasing various trinkets, some items you own may start to gather dust. It may be difficult to let go of some keepsakes, especially if they hold sentimental value. However, selling items online which no longer bring you joy or satisfaction is an effective way of bringing in extra cash.

Some of your items may even hold much more financial value than you might think. Art pieces, furniture, electronics, collectibles, and games are all items which may have a fairly high demand online depending on the condition. There are plenty of online marketplaces such as Facebook Marketplace and eBay.

People often prefer to buy used items over new items for a variety of reasons such as a cheaper price and helping the environment. You can take this a step further and start a small business venture by buying products at a discounted or wholesale price and selling them for a higher price.

It might even be fun to go to local yard sales and find some hidden gems to list online. Make sure to do the proper amount of research before purchasing products to sell in order to avoid getting burned by a bad purchase.

Work Part-Time at a Low-Stress Job

If you find yourself with a little extra free time, working a part-time, low-stress job is a great way to continue receiving income while in retirement. In fact, this is a great excuse to get out of the house and socialize with coworkers and customers.

You could even consider driving for a ride-sharing service such as Uber or Lyft or services taking people to medical care like OATS, working as a cashier in a grocery store, or be a tour guide or gift shop clerk at a local museum. You could even work from home as a freelance writer.

Even if you don’t really need the income, a “side-gig” might bring you joy and fulfillment.

Take Online Surveys

Online surveys are a simple way to generate extra income from the comfort of your home. There are plenty of online survey websites such as Survey Junkie, Swagbucks, and Branded Research which allow you to take short surveys for money or gift cards.

You may even be genuinely interested in some of the survey topics and find enjoyment in the process of filling them out. Some websites will pay better rates than others, but you can find the best websites by reading company reviews or through the process of trial and error.

Always do the proper research into the legitimacy of online survey websites to avoid getting scammed, and never share important personal information such as your insurance information or social security number.

Keep it Simple for Yourself

Some of these money hacks in retirement will require more time and energy than you’re willing to put in. Fortunately, there are plenty of simple, everyday things you can change to save more money.

- Drinking more water can save you more than you think. Just skipping one soda a day could save you thousands over the course of your retirement. It’s perfectly fine to enjoy a coffee, soda, or tea on occasion, but replacing these with water is better for your wallet and your health.

- Carpooling with friends and family could be helpful too. Maybe you have a friend in the neighborhood who wouldn’t mind sharing a ride to the grocery store or gym. If you’re going to the same place anyway, why not save some money on gas and wear and tear on your car.

- Gardening is an enjoyable activity while also saving you on your grocery bill. You’ll be able to produce your own fresh fruits and vegetables and know exactly where your food comes from. Even a small herb garden could save you a whole lot over the years.

Most gardens can be relatively low maintenance until it’s time to harvest. Some plants will grow back each year, or you can save their seeds, so you only need to invest in the seeds once. If you have limited space, focusing on the most expensive vegetables you like might be the best use of space and time. - Cancel unused subscriptions. All the free trials and other services can really start to add up over time. Maybe you can consolidate some subscriptions too. You might even look into discounts or ways to get these paid for through your credit card rewards or membership deals you have access to.

Small Changes Make a Big Impact

Overall, none of these things we talked about are going to save you if you’re not prepared for retirement. However, even a small amount of savings and maybe a modest annual income from a side hustle could make a big impact over the course of your retirement.

If you’re concerned about whether you’ll have enough money to retire or can’t decide if you’re ready to retire, we can help. Contact us today to see how NextGen Wealth can help you make a plan and stick to it so you can reduce stress and worry in retirement.