Your Investments and the Coronavirus; What Should You Be Doing

This post was originally published during the COVID-19 pandemic and was last updated on June 21, 2023, to reflect all updated information and best serve your needs.

Recent outbreaks of the coronavirus (a.k.a., COVID-19) outside of China raised concerns about health and safety. These increased concerns have sent stocks quickly lower over the last few trading days.

While we don’t know how many people the virus will infect, the length of this viral cycle, or what influence it will ultimately have on the economy, we do know you probably have some questions about how it could affect your investments.

Investing During a Pandemic or Epidemic

Regardless of the outcome, there are some key things to consider. We want to share three investment-related themes to keep in mind during an outbreak.

Don’t Make a Knee-Jerk Reaction

First, don’t give in to the urge to take immediate action. We know this can be hard. The news stories about the virus can be downright scary but remember, market prices react immediately to both good and bad information. And the news isn’t always right.

You want to avoid selling out of the market to avoid locking in losses. You would have needed to sell before it was reported on the news. We’re not sure about you, but our crystal ball broke many years ago. So, any action we would be taking would be an absolute guess.

On the other hand, if you’re wanting to take advantage and continue to make money, you just continue investing as usual. We’re not saying to “buy the dip” either. Just keep putting money in, rebalance as necessary, and watch your long-term wealth grow.

We Plan for This

At NextGen Wealth, we plan for things like this. We ensure your money is invested in a properly diversified portfolio to withstand short-term swings in the market. We’re focused on the long-term viability of your portfolio – not just what’s currently on the news.

Zoom Out for Perspective

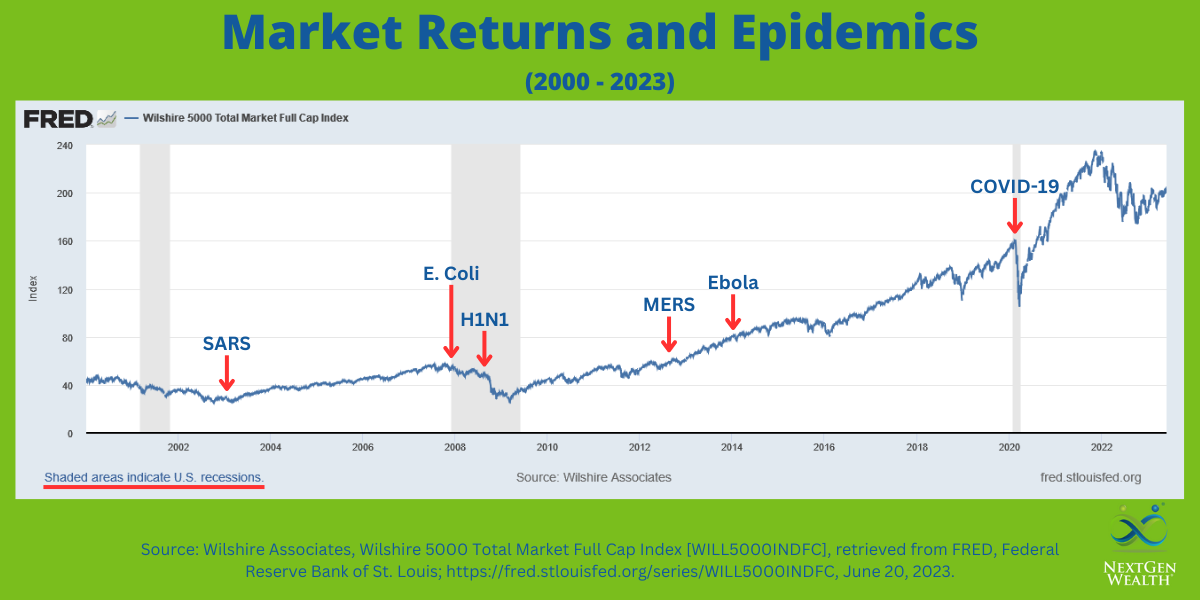

Second, we need to keep perspective. This isn’t the first new virus we’ve seen, and it certainly won’t be the last. SARS, MERS, H1N1, and others have all come and gone. While these were unpredictable and sometimes fatal, the market reactions don’t have to be fatal to your future.

There are always different variables such as how quickly the disease will it spread and if/when there will be a cure or vaccine. There are also reasonable concerns about how the global economy will react and how this might impact your investments.

It’s important to remember, we figured out how to overcome past viruses and markets have done the same. Again, we know it's easier said than done.

A Short History Lesson

In fact, when looking back, markets have pretty short memories regarding epidemics. They initially react to the uncertainty with fear and panic. However, viruses get contained and markets recover.

Market returns generally have been up in the 6 to 12-month periods following the outbreak of a virus or disease. While this is a rather small sample set, keeping focused on the long-term helps us keep a level head during all kinds of storms – easier said than done sometimes.

Take a look at some of the most widespread epidemics since the year 2000. You’ll see when you zoom out a bit, the markets were hardly affected. The COVID-19 pandemic did have a significant impact, but markets recovered quickly and have kept on trending upward.

Avoid Fraud

The third and final thing we want to share is to be on the lookout for fraud. The Securities and Exchange Commission has issued a public warning about fraudulent investment claims. Fraudsters are attempting to prey on our natural emotions of fear and greed during this period of uncertainty (what's wrong with people?).

There have been reports of social media posts and online ads promising a huge profit by investing in companies which have supposedly found a cure for the coronavirus. We’re sure we sound like a broken record on this topic, but there are no sure things or get-rich-quick strategies when it comes to investing.

If it sounds too good to be true, it is.

Avoiding Fraud

The best way to avoid these types of investment scams is to have a solid investment strategy in place. You wouldn’t wait until you’re at the airport to book your tickets, right? Your investment journey is no different.

Once you “get on the plane” there may be turbulence, but you have to stay the course and trust the pilot and equipment. Your investment portfolio is the same. There are tried and true tactics for investing in down markets and recessions.

Human Beings are Resilient

We’re more resilient than we give ourselves credit for. Although things may be scary right now, we’ll get through this (and prosper). One statistic you don’t hear much about in the news is the number of people who have recovered from disease. According to information tracked by John Hopkins University, 99% of all cases in the United States have fully recovered from the virus.

Catching COVID-19 doesn’t mean you’ll pass away. In fact, the odds are in favor of your immune system fighting it off.

Stay the Course

Our advice remains the same, stick to your long-term plan and tune out the noise. We invest your money so your success isn’t dependent on lucky guesses or get-rich-quick schemes. We use time-tested investment strategies and prepare financial plans to account for events like these.

Please, stay positive and focus on your family and your health. If you have any questions about your investments, need to inform us of family or work-related changes, or want to discuss your financial planning needs, please reach out. We’re here to help you reach your goals in life – regardless of what's happening in the world.