What is a Donor Advised Fund?

This guest post was last updated on June 21, 2023, to reflect all updated information and best serve your needs.

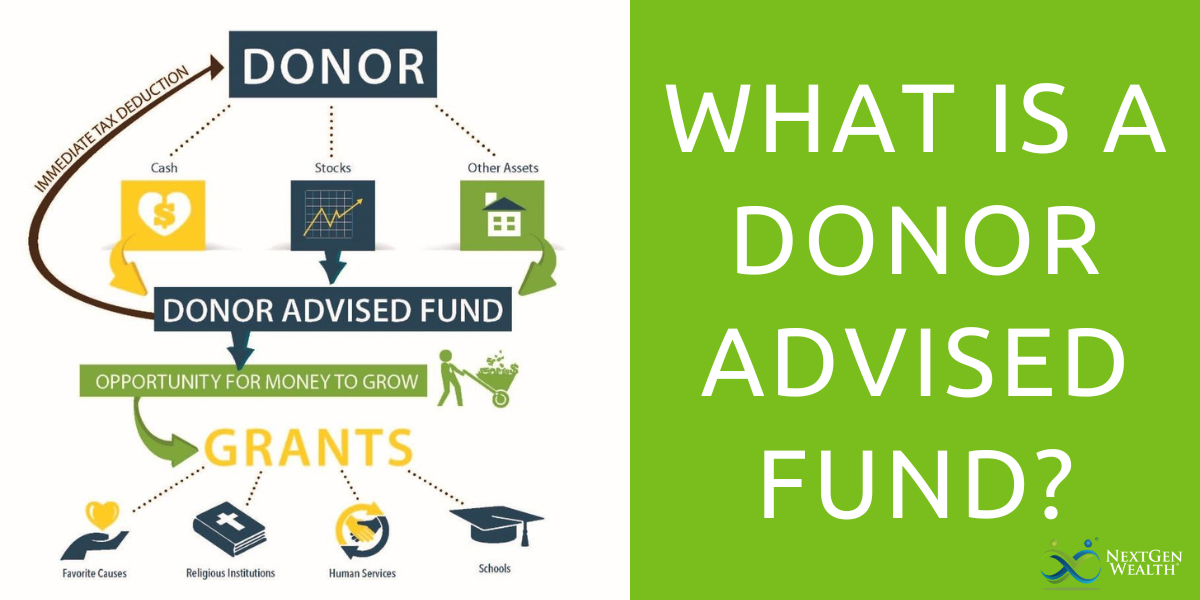

A Donor Advised Fund (DAF) is like a charitable-giving savings account, helping you maximize your tax benefits while making a bigger impact on your favorite charitable causes.

Illustrated below, the IRS defines a Donor Advised Fund as: “A separately identified fund or account that is maintained and operated by a section 501(c)(3) organization, which is called a sponsoring organization. Each account is composed of contributions made by individual donors. Once the donor makes the contribution, the organization has legal control over it. However, the donor, or the donor's representative, retains advisory privileges with respect to the distribution of funds and the investment of assets in the account.”

In many ways, a Donor Advised Fund is just like having a private foundation – only better. With a DAF, donors become organized and strategic in their giving and receive tax benefits while their investment grows to help them better support the charities they care about.

Benefits of Donor Advised Funds

There are many benefits to using a Donor Advised Fund. DAFs simplify charitable giving recordkeeping for people who give to multiple nonprofit organizations.

Donors enjoy the simplicity of contributing to their fund and then making grants from it to their favorite charities. During tax time, there’s no hassle with collecting receipts.

Donors have all their giving records in one place. Each quarter, the fundholder receives a statement that documents all activity (gifts, grants, investments) on their fund.

Donor Advised Funds can be effective tax planning vehicles. Donors can contribute to their fund at any time and receive an immediate tax deduction, then be strategic with their grantmaking to nonprofits.

DAFs are a great way to enjoy the tax benefits today while supporting charity at some point in the future. Many people make a year-end gift to their fund during high earning years as a tax planning strategy.

Donor Advised Funds and Charitable Bunching

Since the increase of the standard deduction, many people are using a Donor Advised Fund and “charitable bunching” strategy. This tax strategy has been featured in the New York Times and The Wall Street Journal.

The standard deduction (how much can be subtracted from your taxable income without itemizing) for 2023 is $13,850 for individuals and $27,700 for married couples. Many people with a history of charitable giving have found themselves in an unfamiliar situation and, for the first time, are not able to itemize; reducing the tax benefits of their current way of giving to charity.

With a Donor Advised Fund and a bunching strategy, donors are able to bunch their charitable contributions. In the example below, every third year the donor contributes to a DAF with an amount equal to what they would normally contribute over a three year time frame.

In the year they donate to the DAF, the donor will itemize their deductions when filing their tax return. In the two years in between, the donor can still make contributions from their DAF and and claim the standard deduction.

This method allows donors to continue to support the charities and causes they care about while maximizing the tax benefit of their charitable contributions.

If you are interested in bunching with a Donor Advised Fund, meet with your financial advisor to decide if this strategy meets your needs.

Donor Advised Funds and Appreciated Stocks

A Donor Advised Fund offers an opportunity to maximize the power of your charitable contributions with gifts of non-cash assets. By donating appreciated securities, such as stocks, bonds, and mutual funds directly to a DAF (instead of selling the security and donating the cash) you can reap considerable tax advantages and make the most charitable dollars available to grant to the charities you care about.

By donating long‐term appreciated securities with unrealized gains directly to a DAF, donors are able to take a tax deduction up to 30% off their adjusted gross income for the full fair market value of the securities. However, you can carry any excess contributions forward for up to 5 years.

And because the securities are donated rather than sold, capital gains taxes do not apply to the capital gains made on the security. With a DAF as the receiving charitable entity, the donor simplifies the transaction, by not having to do multiple transactions with multiple charities.

The chart illustrates how a donor can maximize their charitable giving dollars while receiving maximum tax advantages when donating long‐term appreciated securities to a Donor Advised Fund.

Make Charitable Giving a Family Tradition

A Donor Advised Fund provides families the opportunity to involve future generations in philanthropy. Many families feel that the tradition of charitable giving is a great gift to leave children and grandchildren.

By partnering with a DAF, it elevates the permanence and security; knowing someone is there to help look after their interests forever. Donors are able to identify family members or friends they’d like to involve in their giving in the future and the DAF follows their wishes.

Estate Planning with Donor Advised Funds

There are numerous ways to use a Donor Advised Fund in your estate planning. DAFs can accept any type of asset based on the hosting charity’s gift acceptance policy.

Donors can make a gift from their estate (including real estate) to endow their fund, they can name their fund in their bequest, and they can name their fund as a beneficiary of their life insurance policy or retirement assets.

In addition, if donors have created a Charitable Remainder Unitrust or Charitable Gift Annuity they can designate their DAF as the remainder beneficiary.

Donor Advised Funds offer an option for donors to be diverse in their legacy grantmaking. Instead of naming one charity as a beneficiary of their assets, they can name multiple charities as the beneficiaries of their fund. They can also name their children as successor advisors or guide grantmaking through a simple letter of intent.

DAFs can become endowed funds and create a lasting legacy for years to come. Many times, an endowed fund ends up producing more cumulative grant dollars than if a donor were to leave a lump sum to a charity.

This illustration below shows the growth of a $100,000 gift put into an endowed fund. By year 50, the fund has the opportunity to produce cumulative grants totaling $326,000. This assumes a 4.5% annual payout and a 6% rate of return.

Unlike a gift provided to a nonprofit in one lump sum, an annual gift from an endowed fund provides support that the charity can count on for years to come. This helps organizations plan for the future and develop programs that are sustainable.

Similarly, an endowed Scholarship Fund helps deserving students follow their educational dreams and can radically transform the economic standing of families in the community.

Partnering with a Community Foundation for a Donor Advised Fund

Donor Advised Funds are offered by many sponsoring organizations. However, many people like partnering with local organizations who understand the needs of the community.

When you partner with a Community Foundation for your Donor Advised Fund you benefit from shared resources and join a network of generous individuals who are using their funds to make larger, more intentional charitable contributions.

Plus, fundholders are invited to attend fun and educational events that offer donors an exclusive look at nonprofits who are making an impact in their community

This information in this article is not intended as tax, legal, or financial advice. Gift results may vary. Consult your personal financial advisor for information about your specific situation.

Phil Hanson is the President and CEO of Truman Heartland Community Foundation. Truman Heartland Community Foundation (THCF) is a 501(c)(3) public charity committed to improving the communities in and around Eastern Jackson County through cooperation with community members and donors. A trusted philanthropic leader since 1982, Truman Heartland Community Foundation partners with more than 700 fundholders to make a positive impact in Eastern Jackson County and surrounding communities through charitable giving. In 2019 alone, Truman Heartland fundholders granted $4.8 million to charities. A large portion of these grants were awarded through DAFs.

THCF serves the region with assets of more than $54 million and annual grants surpassing $4.8 million. For more information on charitable giving, visit www.thcf.org or call Truman Heartland at 816.836.8189.