Why the PBGC is Important to Your Pension

Earning a pension is a feat all to itself. Maintaining the security of your pension becomes even more important once you enter retirement. Luckily, there are programs like the Pension Benefit Guaranty Corporation (PBGC) looking out for your pension as well.

Earning a pension is a feat all to itself. Maintaining the security of your pension becomes even more important once you enter retirement. Luckily, there are programs like the Pension Benefit Guaranty Corporation (PBGC) looking out for your pension as well.

Although the name can be misleading, the PBGC is ran by the federal government to ensure retirement security for pensioners. There are laws governing what benefits you might receive if your covered pension fails. This could be another consideration for whether you should take a lump sum instead of a pension.

Pension Benefit Guaranty Corporation (PBGC)

The Pension Benefit Guaranty Corporation (PBGC) was created in 1974 under ERISA. In the simplest form, the PBGC is a government-controlled insurance company to ensure workers receive their pension incomes (or at least a portion) regardless of the long-term success of their private employer.

Why It’s Important

The PBGC is the safety net for employees who earned a pension, but their employer couldn’t hold up their end of the deal. If a pension fails due to business failure or other factors, the PBGC will pay vested benefits to the employee.

One critical bit of information, the PBGC may not pay all benefits. They have a maximum monthly guarantee amount for single and multiemployer plans. Keep in mind, these are maximum legal limits and not necessarily what you would get paid.

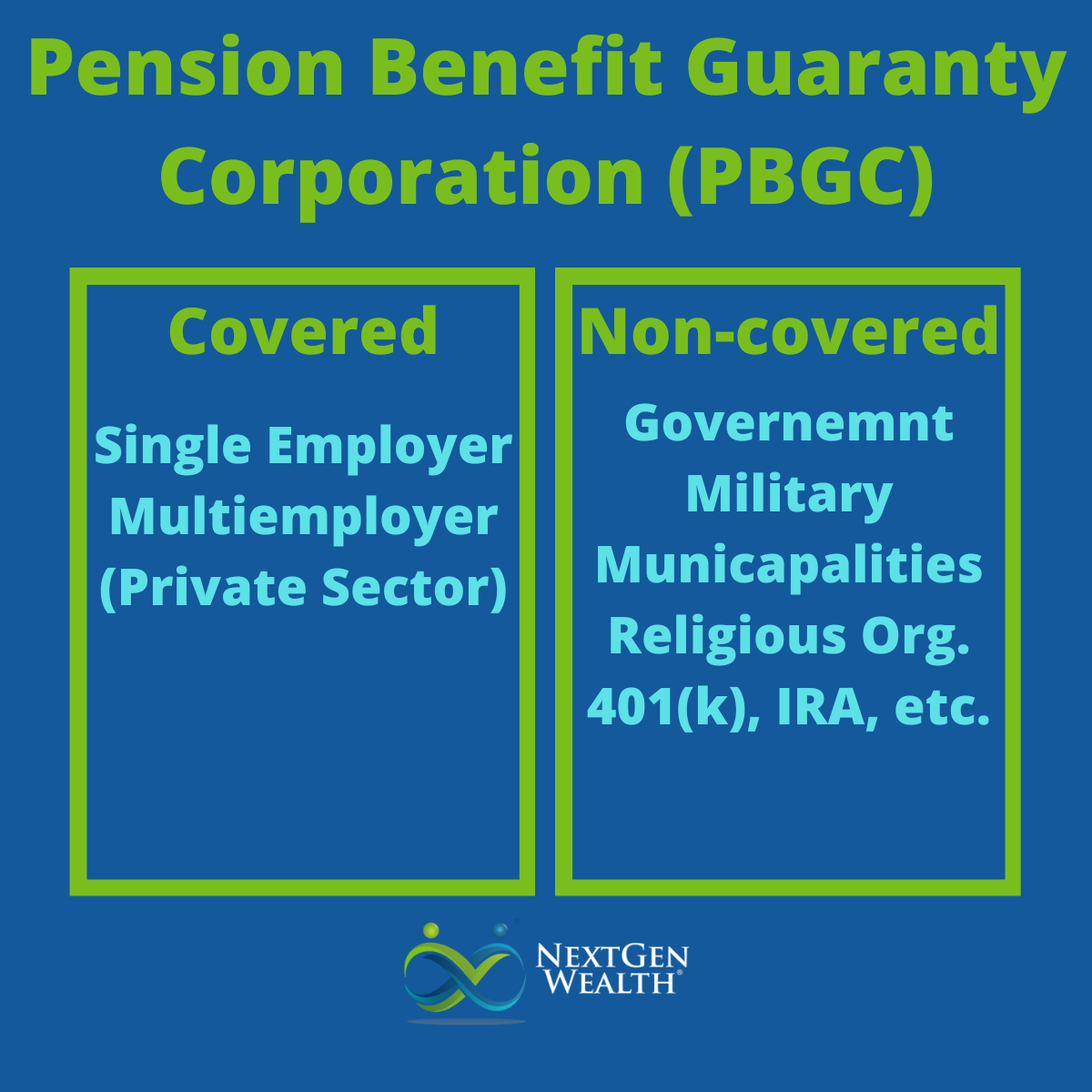

Plans Covered by the PBGC

According to the latest PBGC data tables, there are 25,069 pension plans insured by the PBGC (2019). The majority are single-employer plans which cover a single company. There are 1,375 multi-employer plans.

The PBGC covers private sector employer defined benefit pension plans. In other words, if you don’t work for some form of government and you have a pension, then you are likely covered.

The PBGC doesn’t cover all pension plans. For example, government, religious institutions, and military pensions aren’t covered. You can search to see if your retirement plan is covered by the PBGC. This will give you basic information including whether the plan is a single-employer or multiemployer plan.

Single-Employer vs Multiemployer

As mentioned, there are two separate insurance programs ran by the PBGC; Single-Employer and Multiemployer.

Single Employer

The Single-Employer is what it sounds like – individual companies. If you’re in the Kansas City area, you might recognize names on this list like Ford, Sprint, Hallmark, or Dairy Farmers of America. This insurance program is funded by insurance premiums, investments, and funds from failed pension plans.

Multiemployer

Once again, the name says a lot. Multiemployer plans cover unions. There are over 10 million people currently covered by a multiemployer plan. The largest plans administered out of Kansas City are the Boilermaker-Blacksmith National Pension, Carpenter’s District Council of Kansas City, and Operating Engineer’s Local 101 plans.

Multiemployer plans are funded by insurance premiums and investment income. Employers pay premiums based on the number of covered employees. Recent legislation on the Special Financial Assistance (SFA) Program supplies additional funding too.

Special Financial Assistance (SFA) Program

The SFA is an additional funding source for multiemployer plans. The program was created to bolster underfunded pension plans. The SFA also addressed 18 multiemployer plans which previously cut benefits to remain solvent.

In a nutshell, the SFA creates another avenue for multiemployer pension plans to apply for funds and remain solvent. In theory this keeps more pensions funded for longer. Will that last forever?

Maybe, maybe not. However, most multiemployer plans are adequately funded.

Evaluating Pension Risk Factors

You might be wondering, “What does all this have to do with my pension?” Simply put, no matter whether you choose a lump sum or monthly pension benefits, there’s some risk involved.

Risk in Your Pension

The biggest risk of keeping your pension and receiving annuitized payments (getting a check each month) is the possible default of your pension plan. There’s no way to know for sure what the future holds. However, companies must let you know if their pension is underfunded.

In addition, companies offering a defined benefit plan are required to send an annual funding notice to you. This should give you the big picture data on how the fund is doing. It should also tell you how much benefit will be paid by the PBGC in the case of plan failure.

Type of Employer

The type of employer offering the pension makes a difference. This includes if it is a private or government pension. The PBGC does not cover military, government, or religious institutions’ pensions.

Private Sector Pensions

The financial stability of your employer is a factor to consider. Even large companies fail from time to time. If the company goes bankrupt, the PBGC would have to take over the pension (if covered).

Government Funded Pensions

The size of the city/county/state government could matter too. A larger tax base means more options to correct things if needed. However, this might not always be the case.

As an example, the Kansas Public Employees Retirement System (KPERS) is currently underfunded. The KPERS has slowly made progress and legislative changes to properly fund pensions. If this happened to a smaller city or county pension fund, they might not have the tax base to fully recover.

Are State and Local Government Pensions Safe?

The answer is probably yes. Even if a pension is currently underfunded, that doesn’t always mean it’s not sustainable. Some research has been done on pension viability even if currently underfunded.

Ultimately, we don’t know exactly what the future holds. For most pensions, they need to be prepared to adjust as needed. They should continue to seek out competent actuaries to ensure plans are solvent well into the future.

What’s an Actuary?

An actuary uses math, statistics, and economic data to help solve complex problems. For pensions, they make periodic “best guesses” on how much money is needed to fully pay benefits. They answer other questions as well, but pension funding is the main piece we’re concerned with for this discussion.

The quippy definition from the Academy of Actuaries sums it up nicely, “Actuaries put a price tag on risk.”

Living on a PBGC Provided Benefit

The last thing we want to consider (both literally and figuratively) is if you can live off the estimated PBGC benefit amount. Your annual funding notice should give you this number. It will likely be less benefit than your current estimated benefit.

This is also a key factor to think about failure of a pension plan not covered by the PBGC. We don’t need to get scared about it but having a secondary plan is always wise.

Final Takeaways

The PBGC is a form of insurance for private pensions in the U.S. It’s an important organization we hope you never have to rely on. The key questions you need to answer are:

1. Are you covered by a pension?

2. Is your pension covered by the PBGC?

3. Is your pension in danger of becoming insolvent?

4. In case of insolvency, can you live off the PBGC estimated payout?

Hopefully you have a better understanding of what the PBGC is and how much you should care about it. As always, be sure to consult your financial planner before making any major decisions.