How to Find The Right Financial Advisor For You

This post was last updated on January 19, 2026, to reflect all updated information and best serve your needs.

Retirees who work with a financial advisor are happier and more confident in their finances and in life. Many of us have concerns about money. So, it makes sense that getting expert help would increase happiness by reducing financial stress.

The right financial planner does so much more than just help you with a 401k rollover. A true expert takes the time to get to know you and craft a detailed, thought-out plan around your hopes and dreams. The process should center around you, not your money.

Table of Contents

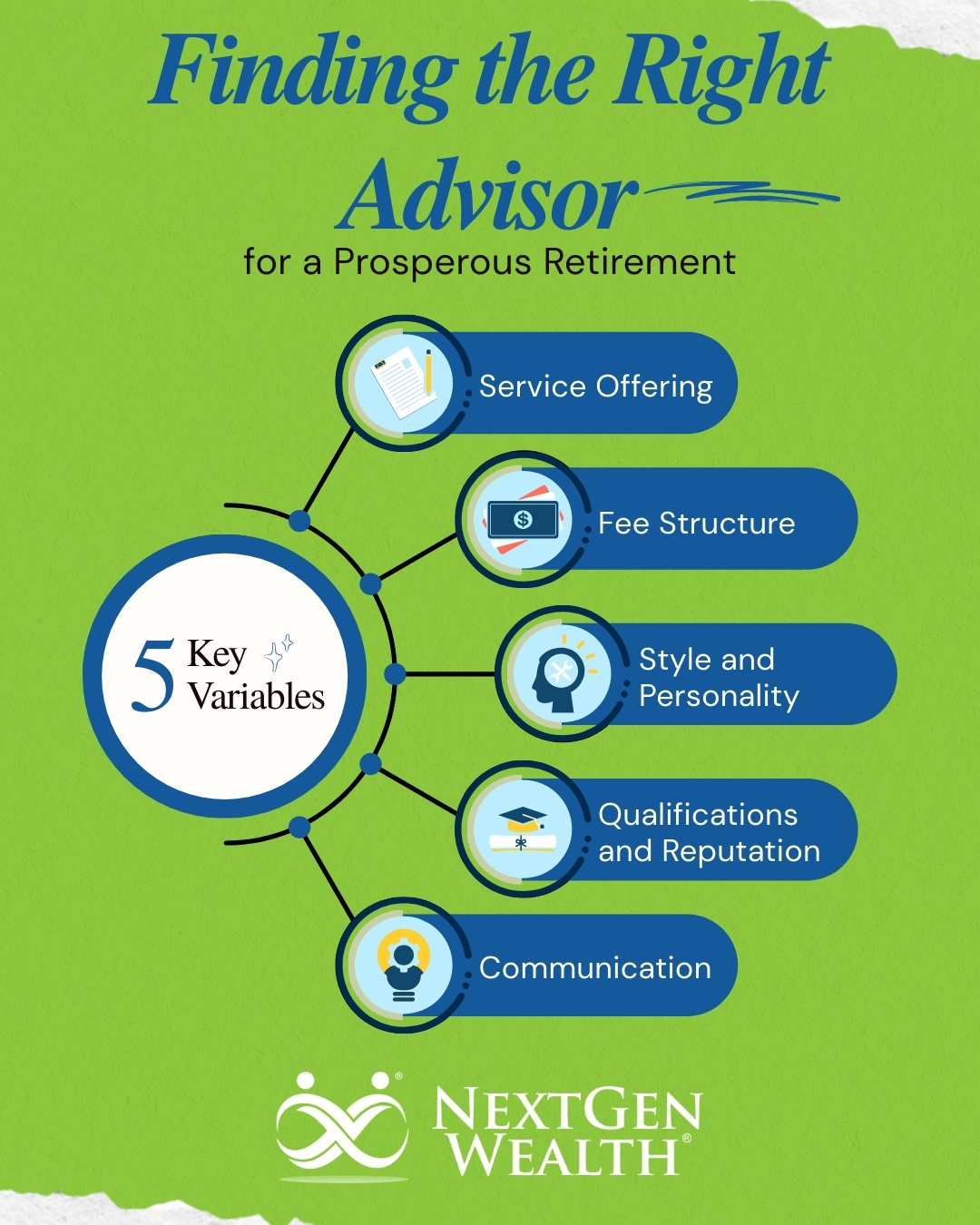

Top Considerations When Picking an Advisor

Investment managers and financial planners vary greatly in their personalities, service offerings, and fee structures (how they get paid). It’s important to get the big things right and then whittle down the choices to the planner who’s best for you.

Service Offering

The first thing you want to look at is the services offered by the financial professional you’re looking to work with. If you just want someone to invest some money for you, you can probably do it yourself or use a robo-advisor. If you’re looking for guidance as you transition into retirement, you’ll want a planner who offers much more than just investment advice.

As a matter of fact, the best planners to guide you into retirement probably won’t even talk much about your investment strategy at all.

Fee Structures

There are a variety of fee structures, but the two main categories are commission-based and fee-based. There are some key things you need to know about each.

Commission-Based Fee Models

You’ll probably want to avoid advisors who are compensated solely on commissions. This means they get compensated by the companies where they invest your money or by the insurance products they sell you. This isn’t illegal or anything, but it shifts the power away from you and toward the investment and insurance companies.

If you think about it, people tend to listen more to the people paying them. In a commission-based model, you pay the insurance or investment company. Then they pay the advisor a commission.

Fee-Based Advice Models

Fee-based advice models are exactly what they sound like – based on fees paid directly to the planner. There are different subcategories, such as flat-fee, retainer, and assets under management. These refer to how the fee is calculated, but the concept remains the same. You pay the advisor directly for the service they provide.

This shifts the power into your hands because you are the one paying the advisor, not some big company focused on profits. When you’re the only person writing a check to the advisor, this cleans up the relationship considerably. More importantly, it better aligns the planner's success with your success.

Style and Personality

This may seem trivial, but it’s actually very important for you to get along with your financial planner. You’ll likely be entering into a long-term relationship, so it’s important that you like each other. At NextGen Wealth, this is an extremely important part of our process.

We plan to work with clients for life, so we're very selective about who we work with. You should be too.

Qualifications and Reputation

Another key consideration is the level of education and experience of a financial advisor. There are 252 different credentials recognized by the Financial Industry Regulatory Authority (FINRA). How do you know which ones to look for?

Good Question. Most of them will not even be relevant to your personal situation. For the most part, financial planners and consumers view the Certified Financial Planner® (CFP®) designation as the gold standard. Financial planners often hold additional credentials for services and specialties they want to offer.

For instance, Clint Haynes, CFP®, the founder of NextGen Wealth, currently holds the CFP® designation and specializes in retirement transition.

Why the CFP® Designation?

You might not have heard of the CFP® designation, and that’s okay. Just know, it’s a good sign if an advisor has this credential. Many people consider this a requirement. The main things the CFP® marks tell you as a potential client is you are working with someone who:

- Completed a bachelor’s degree

- Completed a minimum financial education requirement

- Passed a grueling exam (~60% pass rate, full-day test)

- Has adequate experience in financial services

- Committed themselves to the CFP Board Code of Ethics

- Passed a background check

Let’s just say, if someone goes through the trouble to complete all those steps, they’re committed to being a respected financial planner. The CFP® Board regularly monitors for any infractions or complaints and requires continuing education to maintain the designation.

Background Checking

The FINRA BrokerCheck and SEC BrokerCheck sites are the “official” background check sites for financial advisors. FINRA and the SEC are the overarching bodies keeping track of all background information, as well as disciplinary information for financial professionals.

If an advisor has ever been in trouble before, it will show up here. These are must-check sites to see if there have been any issues in the past. These sites will show you every place they’ve worked in the industry, examinations they’ve passed, disclosures, disciplinary actions, and state licenses.

You'll also want to check the SEC site, where you may be able to find a more detailed history. The FINRA site links to the SEC site, but if you rely only on FINRA, some information may be incomplete. Some advisors are listed only on FINRA Broker Check, and others are listed on both.

For example, if you take a look at Clint Haynes, CFP® on the FINRA website, you’ll see there is a blank period from 2007-2013 and then one additional year in 2014. Everything else is on the SEC website, where you can see that Clint is still currently registered as an Investment Adviser with NextGen Wealth.

Clint Haynes, CFP®, is a Registered Investment Advisor with NextGen Wealth and is not associated with a broker-dealer.

Form ADV

A highly useful tool for vetting any firm is the Form ADV. There are two parts to the ADV, and we strongly suggest you read Part 2 carefully. If you’re on the SEC’s website, you can find both parts by clicking on the dark blue buttons labeled “View Latest Form ADV Filed” and “Part 2 Brochures” on the left under the firm’s name.

Part 1 of the ADV provides relatively superficial business information. The Part 2 Brochures provide details on the types of advisory services the firm offers and how it charges fees. It also provides a deeper look at the background of the company’s management.

Ask Questions!

You want to make sure you ask all your questions before moving forward. At NextGen Wealth, we take the time to make sure we’re a good fit for you, and you’re a good fit for us. We don’t rush this.

If you’re not sure what kinds of questions you should ask, we’ve provided a list of common questions to ask a potential advisor. These questions might not cover everything in your situation. We suggest writing down any questions you have as they come to you so you don’t forget to ask later.

Pricing

The price of a wealth management firm’s services matters, but don’t be tempted to base your decision only on how much it’s going to cost you. Use the tips mentioned above to evaluate potential firms. And when it comes to pricing, don’t simply ask, “Which one is cheaper?” but rather, “Which one offers the most value?”

You want to look for quality. A good financial planner will provide you with way more value than the fees you pay. At NextGen Wealth, we take great pride in the value we provide our clients.

Regardless, you should feel good about the fee you pay versus the value you receive. Focusing on value, expertise, and experience will make a big difference in your satisfaction.

Get Your Spouse on the Same Page

It’s very important to make sure you and your spouse are on the same page when it comes to working with a financial planner. If one spouse is comfortable speaking with and meeting with the financial planner, but the other isn't, it won't work very well.

You need to be truly united in your decision because this is going to be a long-term relationship. Eventually, it may be just one of you working with the planner (hopefully many years from now), so you’ll want to make sure your spouse can rely on your planner without hesitation. It’s vital that both of you are 100% comfortable with who you choose to work with.

Take Your Time

Last but not least, we urge you to take your time when deciding who to work with. Just as we take the time to fully understand and onboard our clients, you should take your time with an advisor as well. We understand there may be an immediate financial need, but rushing the process may cause more issues down the road.

You want to make sure you leave no stone unturned and feel comfortable and confident in your choice of financial planner. You deserve someone truly great in your corner as you move toward your goals. We wish you all the best!