Why We Look at Finding the Right College from the Wrong Perspective

Let’s face it; saving for your children’s college is quite the challenge. However, just as challenging is actually finding the right spot to send them off to college. There are so many choices with only so much money you can realistically spend without you and your child completely being indebted for the rest of your lives.

Sounds like a real pleasant experience, doesn’t it? Well, for most parents, it can really be a gigantic pain to find the right college for their children. Today, though, I’m going to explain how to make it a much more comfortable experience where everyone will understand and be happy.

The biggest issue I see with most parents today is that the child is the one driving where they want to go to college. While this might seem the right way to go about it, it isn’t. Certainly, their input is needed and what their aspirations are after college should be considered, but those should really be steps two and three.

The foundation for where you send them to college should start with what you and your child can afford… or the dreaded “b” word, budget. That’s right, neither you nor your child’s emotions should be driving that decision. What truly should be driving that decision first and foremost is how much you can afford.

Once you have an idea of your budget, then you can start looking at colleges that fit your budget. Plain and simple, the amount of money you want to spend and the amount of debt your child wants to incur should be the determining factor with where they want to go. Where they personally want to go from an emotional standpoint should be a distant second.

I’ll get into this a little bit later, but if you could show your child how much debt they would be carrying if they went with their emotional choice of college, they might not be so set on a certain school.So, how do you figure out what you can afford for college? It really comes down to a few different factors and, again, coming up with a budget. Here are a few of the factors to consider.

- 529 Savings

- Other assets earmarked for college

- Other family members willing to help

- Monthly cash flow from you and your spouse

- Parent loans (I don’t recommend)

- Savings from your child and work during college to pay for it

- Student loans

- Scholarships

- Need-based or merit-based aid

There are certainly other factors, but these are by far the most common. We have a nifty little spreadsheet we use with our clients that lays it out all on one page. Feel free to send me an email to request it.

When it comes to student loans, parents have differing opinions on how they were raised. A good rule of thumb to remember is that the child should never incur more student loan debt than what their salary would be in their first year. So, if their salary is going to be $45,000, then it’s best they come out of college with less than $45,000 in student loan debt. That’s why I say, show them how much debt they would incur if they went with their expensive, emotional choice of college and they might not be so keen about it anymore.

While the college savings and college search processes are complete entities in themselves, just know that your budget and what you can afford should be the driving force behind what college your child attends. I’ll reiterate it again; do your budget first and then go shopping. Your future self and your child’s future self will thank you later.

Feel free to reach out to us if you have any questions or would like to go through the formal college planning process. I would also encourage you to visit the net price calculators on the university’s websites where you believe there could be a good fit to get an idea of what the out of pocket would be to attend. Also, be sure to check out the World’s Simplest College Cost Calculator. While it’s not perfect, it’s definitely one of the better ones I’ve run across.

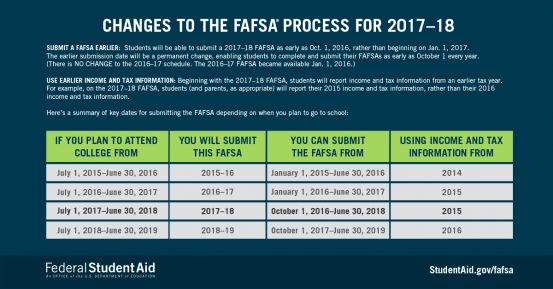

Finally, below are the FAFSA deadlines you should be aware of for 2017-18. Make sure to get that filled out before the deadline. Best of luck and, again, please feel free to contact me if you need help or have any questions.

This is a post from Clint Haynes, a Certified Financial Planner® in Lee’s Summit, MO. He is also the founder and owner of NextGen Wealth. You can learn more about Clint at the website NextGen Wealth.